Get the free Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty - m...

Show details

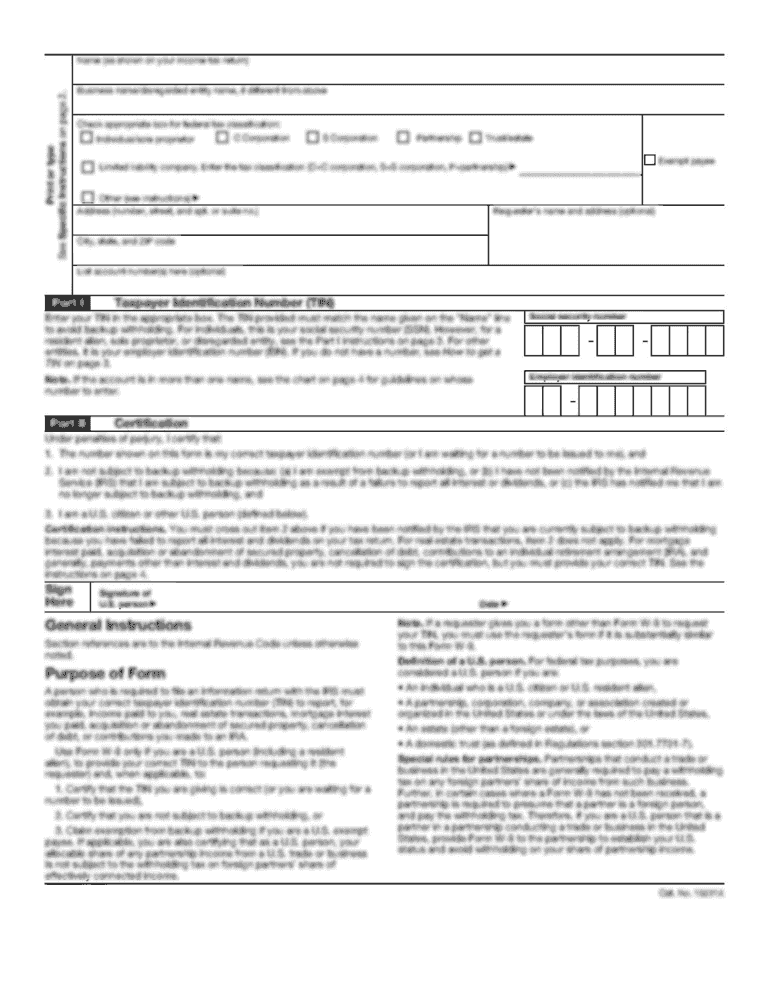

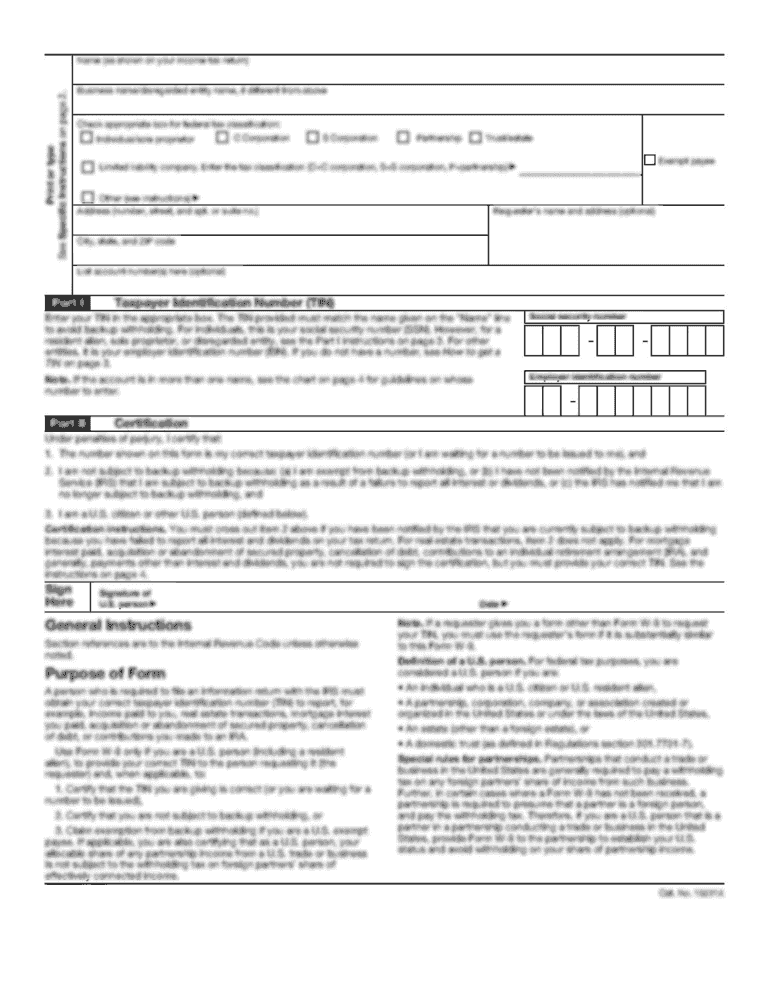

This form is used by the College of Medicine at Florida State University to collect information for compensating faculty, particularly in connection with student rotations and tax identification requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign compensation distribution form and

Edit your compensation distribution form and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your compensation distribution form and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit compensation distribution form and online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit compensation distribution form and. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out compensation distribution form and

How to fill out Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty

01

Download the Compensation Distribution Form from the designated website.

02

Fill in your personal information, including your name, address, and contact details.

03

Specify the total amount of compensation you are receiving.

04

Indicate the period of time that the compensation covers.

05

Provide any additional required information, such as your department or project title.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Download the Substitute IRS Form W-9 and fill in your taxpayer information.

09

Sign and date the W-9 form as indicated.

10

Submit both forms to the appropriate administrative office by the deadline.

Who needs Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty?

01

Any faculty member participating in a clerkship program who will receive compensation.

02

Administrative staff responsible for processing faculty payments.

03

Departments managing faculty compensation for clerkship programs.

Fill

form

: Try Risk Free

People Also Ask about

Why is W9 needed for payment?

The business owner needs this form to properly report certain payments to the IRS. This form requires your name, address, federal tax classification, SSN, and withholding requirements. The purpose of a W-9 IRS form is to ensure all parties are compliant with tax laws.

What is the difference between a W9 and a substitute W9?

Payors and withholding agents are allowed to use their own Forms W-9, which are not the official Internal Revenue Service (IRS) published Forms W-9. These forms are called substitute Forms W-9. In order to be sure that the substitute Form W-9 is reliable, a few items must be in place. Substantially similar content.

How do I fill out a W 9s form?

How to fill out a W9 form. Line 1. The payee's name. Line 2. Business name (if different from line 1). Line 3. The payee's federal tax classification. Line 4. Exception codes. Lines 5–6. The payee's mailing address. Part I. The payee's taxpayer identification number (TIN). Part II.

Why do I need to fill out a W9 for refund?

A form W-9 provides the landlord with your correct taxpayer identification number so that they can properly complete the Form 1099 required for interest earned on your security deposit.

What is required for reimbursement?

If your employee made a purchase using their own money, a receipt is necessary to trigger reimbursement; if the purchase was made with company funds—for example, with a corporate card—you still need a receipt for your business records.

What happens if I don't fill out a W9?

If you fail to present a completed W9, the payer is required by the IRS to withhold 24% of the payments you generated. This backup withholding serves as a precaution in collecting taxes. Many payers require a completed W9 form before processing payments. It could also result in payment delays.

Should I fill out a W9 for reimbursement?

You should report the reimbursement as income but then deduct it as a business expense and thus you won't have to pay income tax on it. The W9 is standard procedure and well-run companies won't pay money to anyone without their W9 in hand.

Why am I being asked to fill out a W9?

A W-9 is being asked for from someone who plans on filing a Form 1099 to report to you and IRS the amounts paid for services you performed as an independent contractor. The form gives your proper legal name and address as well as your social security number, all of which will be to ensure they properly same to the IRS.

Why do I need to fill out a W9 for reimbursement?

The IRS forces companies to require a W9 because the company wants to expense what they are paying. By requiring the W9 it ``encourages'' the recipient to report their income. I'm not sure if you are aware of this but many people don't report their income. The W9 creates a paper trail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty?

The Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty are documents used to report and manage the compensation of faculty involved in clerkship programs. The W-9 form collects taxpayer identification information while the Compensation Distribution Form details how compensation is allocated among various funding sources.

Who is required to file Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty?

Clerkship faculty who receive compensation for their services are required to file these forms. This includes any faculty members engaged in teaching or supervising clinical clerkships within a medical or educational institution.

How to fill out Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty?

To fill out the Compensation Distribution Form, faculty should enter their name, department, and the distribution of funds among the specified budget lines. For the W-9 form, the faculty member must provide their name, business name (if applicable), address, taxpayer identification number, and sign to certify the information provided is accurate.

What is the purpose of Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty?

The purpose of these forms is to ensure that the compensation is properly documented and reported for tax purposes, facilitating accurate processing of payments to faculty and compliance with federal tax regulations.

What information must be reported on Compensation Distribution Form and Substitute IRS Form W-9 for Clerkship Faculty?

The Compensation Distribution Form must report the faculty member’s details, compensation amount, and funding source allocation. The W-9 form requires the faculty member’s name, taxpayer identification number, address, and a signature verifying the accuracy of the provided information.

Fill out your compensation distribution form and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Compensation Distribution Form And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.