Get the free Correspondent Banks vs. Intermediary Banks: What's the ...

Show details

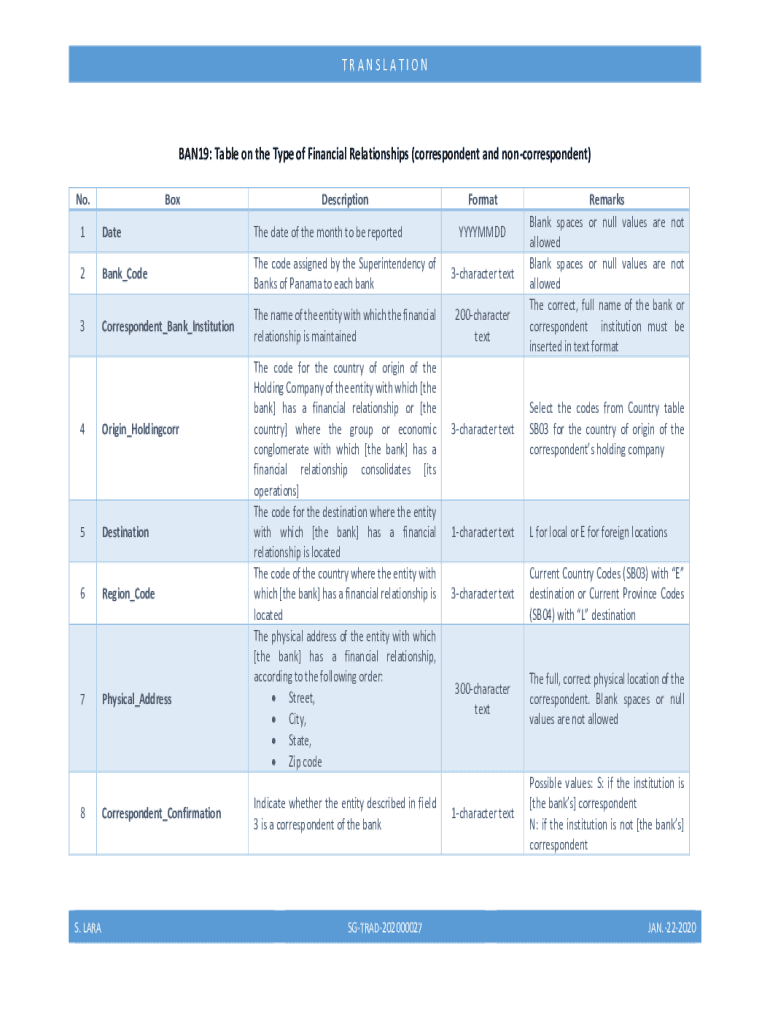

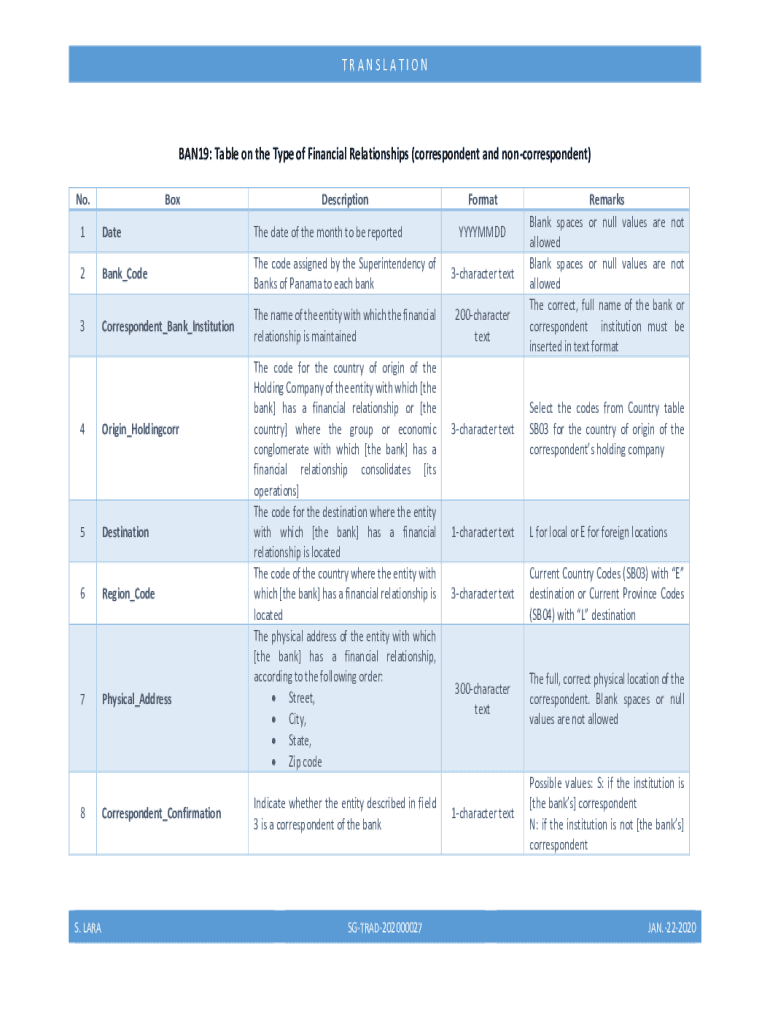

TRANSLATIONBAN19: Table on the Type of Financial Relationships (correspondent and noncorrespondent) No. BoxDescriptionFormat1DateThe date of the month to be reported2Bank_Goethe code assigned by the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign correspondent banks vs intermediary

Edit your correspondent banks vs intermediary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your correspondent banks vs intermediary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit correspondent banks vs intermediary online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit correspondent banks vs intermediary. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out correspondent banks vs intermediary

How to fill out correspondent banks vs intermediary

01

Understand the difference between correspondent banks and intermediaries. Correspondent banks are financial institutions that offer services to other banks, while intermediaries act as intermediaries in international financial transactions.

02

Determine the purpose of the transaction. If you are a bank looking to transfer funds to another bank in a foreign country, you would typically use a correspondent bank. If you are an individual or a business looking to make an international payment, you may consider using an intermediary.

03

Gather the necessary information. For correspondent banks, you will need to know the bank account details of the recipient bank, such as the account number, branch address, and SWIFT code. For intermediaries, you may need to provide additional information such as the purpose of the payment and any required documentation.

04

Fill out the required forms. Correspondent banks usually provide standard forms for transferring funds, which you will need to complete with the relevant details. Intermediaries may have their own specific forms or online platforms for initiating international payments.

05

Review and confirm the transaction details. Before submitting the forms or initiating the payment, carefully review all the information provided to ensure accuracy.

06

Submit the forms or initiate the payment. Follow the specific instructions provided by the correspondent bank or intermediary to complete the transaction.

07

Monitor the progress of the transaction. Keep track of the payment status through the correspondent bank or intermediary's communication channels or online platforms.

08

Receive confirmation of the completed transaction. Once the funds have been successfully transferred, you should receive a confirmation notification from the correspondent bank or intermediary.

Who needs correspondent banks vs intermediary?

01

Banks: Banks that need to send or receive funds internationally often require the services of correspondent banks or intermediaries.

02

Individuals: Individuals who need to make international payments or transfer funds to another country may opt for using correspondent banks or intermediaries.

03

Businesses: Businesses engaged in international trade or cross-border transactions may utilize correspondent banks or intermediaries to facilitate their financial operations.

04

Financial Institutions: Non-bank financial institutions such as money transfer companies and payment service providers may rely on correspondent banks or intermediaries for their international fund transfers.

05

Importers and Exporters: Importers and exporters who conduct business across borders may choose to work with correspondent banks or intermediaries to handle their payment and settlement processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in correspondent banks vs intermediary without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing correspondent banks vs intermediary and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my correspondent banks vs intermediary in Gmail?

Create your eSignature using pdfFiller and then eSign your correspondent banks vs intermediary immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete correspondent banks vs intermediary on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your correspondent banks vs intermediary. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is correspondent banks vs intermediary?

Correspondent banks act as middlemen between two financial institutions, while intermediaries facilitate financial transactions between a buyer and seller.

Who is required to file correspondent banks vs intermediary?

Financial institutions such as banks, credit unions, and money services businesses are required to file correspondent banks vs intermediary.

How to fill out correspondent banks vs intermediary?

Fill out the required forms and provide detailed information about the transaction and parties involved.

What is the purpose of correspondent banks vs intermediary?

The purpose is to ensure transparency and compliance with anti-money laundering regulations.

What information must be reported on correspondent banks vs intermediary?

Information such as the names of the parties involved, transaction amounts, and the purpose of the transaction must be reported.

Fill out your correspondent banks vs intermediary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Correspondent Banks Vs Intermediary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.