Get the free Country-by-Country(CbC)South African Revenue ...

Show details

External Business Requirements Specification:Country by Country and Financial Data ReportingCore Business AreaAutomatic Exchange of

Information and Exchange

of Information on RequestOperational AreaTaxpayer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign country-by-countrycbcsouth african revenue

Edit your country-by-countrycbcsouth african revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your country-by-countrycbcsouth african revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit country-by-countrycbcsouth african revenue online

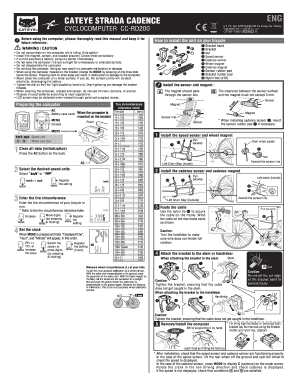

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit country-by-countrycbcsouth african revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out country-by-countrycbcsouth african revenue

How to fill out country-by-countrycbcsouth african revenue

01

Step 1: Obtain the necessary financial information relevant to the country-by-country reporting for the South African Revenue Service (SARS). This information usually includes details of income, taxes paid, and activities conducted in each jurisdiction.

02

Step 2: Organize the financial data in a structured and comprehensive manner. Ensure that all required fields and information are accurately filled out.

03

Step 3: Prepare the country-by-country report according to the specific guidelines and requirements set by SARS. This may involve using certain templates or formats provided by the tax authority.

04

Step 4: Submit the completed country-by-country report to SARS within the specified deadline. Ensure that all the necessary supporting documents and disclosures are included.

05

Step 5: Maintain proper documentation and records of the country-by-country report for future reference or potential audits.

06

Step 6: Review any feedback or queries from SARS regarding the submitted country-by-country report and promptly address any issues or concerns.

07

Step 7: Continuously stay updated with any changes or updates in the country-by-country reporting requirements in South Africa to ensure compliance in future reporting periods.

Who needs country-by-countrycbcsouth african revenue?

01

Multinational corporations operating in South Africa

02

Companies with significant global operations and cross-border transactions

03

Entities with a revenue above the specified threshold as determined by SARS

04

Organizations subject to country-by-country reporting regulations and guidelines

05

Tax professionals and advisors assisting clients with their tax compliance obligations

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my country-by-countrycbcsouth african revenue directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign country-by-countrycbcsouth african revenue and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send country-by-countrycbcsouth african revenue for eSignature?

country-by-countrycbcsouth african revenue is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I edit country-by-countrycbcsouth african revenue on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit country-by-countrycbcsouth african revenue.

What is country-by-countrycbcsouth african revenue?

Country-by-country CBC reporting is a requirement for multinational enterprises to report details of their revenue and taxes paid in each country they operate in.

Who is required to file country-by-countrycbcsouth african revenue?

Multinational enterprises with annual consolidated group revenue exceeding a certain threshold are required to file country-by-country CBC reports.

How to fill out country-by-countrycbcsouth african revenue?

Country-by-country CBC reports are typically filled out electronically using specific reporting templates provided by tax authorities.

What is the purpose of country-by-countrycbcsouth african revenue?

The purpose of country-by-country CBC reporting is to increase transparency and combat tax avoidance by multinational enterprises.

What information must be reported on country-by-countrycbcsouth african revenue?

Information such as revenue, taxes paid, number of employees, and business activities in each country of operation must be reported on country-by-country CBC reports.

Fill out your country-by-countrycbcsouth african revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Country-By-Countrycbcsouth African Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.