Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

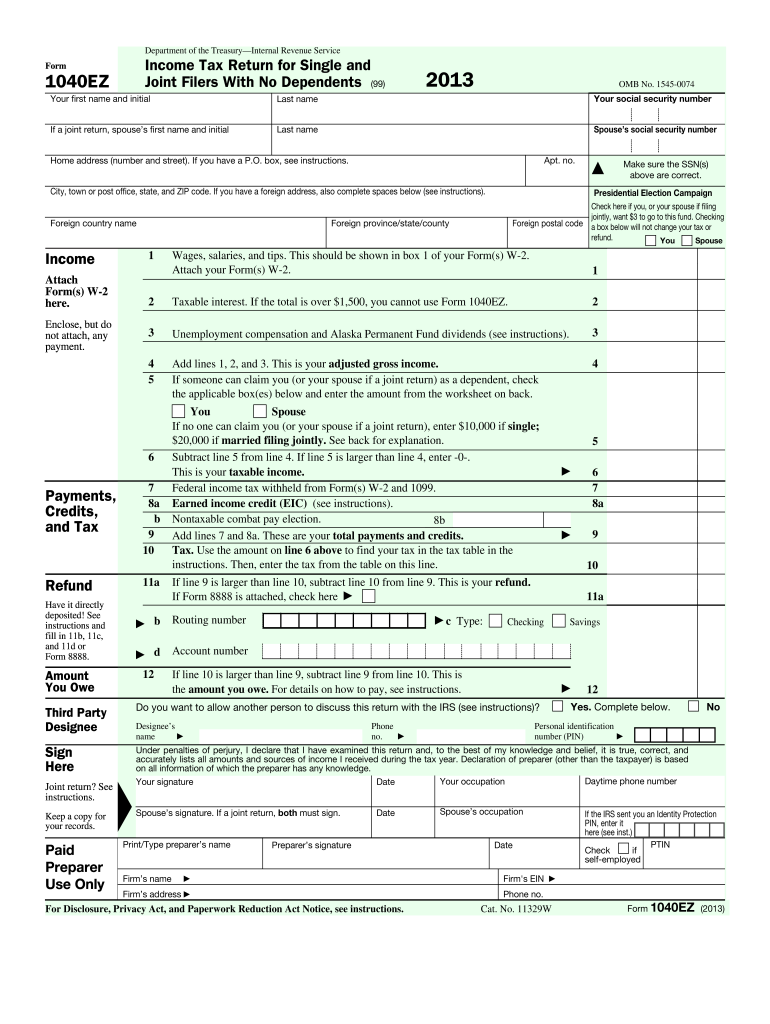

The 1040EZ form is a simplified version of the individual income tax return form, known as Form 1040, that is used by taxpayers who meet certain criteria and have a straightforward tax situation. It is the least complex of the various Form 1040 options and is typically used by individuals with no dependents, no itemized deductions, and taxable income under a certain threshold. The form is used to report wages, salaries, tips, and other income, as well as claim any applicable tax credits or deductions.

Who is required to file 1040ez form?

The 1040EZ form is typically used by individuals with no dependents who have an income below $100,000, and meet other specific criteria set by the Internal Revenue Service (IRS). Generally, those who meet the following conditions can file a 1040EZ form:

1. Single or married filing jointly.

2. Under the age of 65.

3. No dependents.

4. Earned income through wages, salaries, tips, taxable scholarships or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends.

5. Interest income less than $1,500.

6. No itemized deductions.

7. No income adjustments, such as student loan interest deduction or IRA contributions.

8. Certain credits, such as the Earned Income Tax Credit (EITC), may be claimed.

Keep in mind that the criteria for filing a 1040EZ form can change, so it's best to consult the latest guidelines from the IRS or a tax professional for your specific situation.

How to fill out 1040ez form?

Filling out a 1040EZ form is relatively simple if you meet the eligibility requirements. Here are the steps to fill out a 1040EZ form:

1. Gather your information: Collect all necessary documents such as W-2 forms, 1099 forms, and any other documents related to your income and deductions.

2. Personal Information: Provide your name, address, Social Security number, and any other necessary personal details.

3. Filing Status: Indicate your filing status, such as single, married filing jointly, married filing separately, or head of household.

4. Exemptions: Claim any exemptions you are entitled to, such as yourself, your spouse, and any dependents.

5. Income: Enter the income information from your W-2 forms and any other sources of income, such as interest or dividends. Calculate your total income.

6. Adjusted Gross Income (AGI): Subtract any adjustments to your income, such as student loan interest or IRA contributions, from your total income to calculate your AGI.

7. Taxable Income: Subtract deductions, such as the standard deduction or itemized deductions, from your AGI to calculate your taxable income.

8. Tax Calculation: Use the tax tables provided in the 1040EZ instructions to determine the tax amount based on your taxable income.

9. Payments and Credits: Enter any federal income tax withheld from your paychecks or any tax credits you are eligible for.

10. Refund or Amount Owed: Calculate the difference between your tax liability and the payments/credits. If you have overpaid, you will receive a refund. If you owe taxes, you will need to pay the remaining balance.

11. Sign and Date: Sign and date your completed 1040EZ form.

Remember to review your form carefully to ensure accuracy before submitting it. Additionally, consider consulting a tax professional or using tax software if you have complex tax situations or if you are unsure about filling out the form on your own.

What is the purpose of 1040ez form?

The purpose of the 1040EZ form is to provide a simplified version of the individual income tax return for taxpayers with straightforward tax situations. It is designed for taxpayers who have no dependents, have an annual income below a certain threshold, and meet other specific eligibility criteria. The form allows individuals to report their income, claim certain deductions, and calculate their federal income tax liability in a simplified manner.

What information must be reported on 1040ez form?

The information that must be reported on Form 1040EZ includes:

1. Personal Information: This includes your name, address, social security number (SSN), and filing status.

2. Income: You must report your total income for the year, which may include wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, and Alaska Permanent Fund dividends.

3. Adjusted Gross Income (AGI): Certain deductions are allowed to arrive at your AGI, such as the educator expenses, IRA contributions, student loan interest deduction, and tuition and fees deduction.

4. Exemptions: You must claim any exemptions you are eligible for, including either your own exemption or those for your spouse and dependents.

5. Taxable Income: This is calculated by subtracting your exemptions from your AGI. The applicable tax rate is applied to calculate your federal income tax liability.

6. Payments and credits: This part includes any federal income tax withheld from your paychecks, as well as any other credits you may be eligible for, such as the earned income credit or additional child tax credit.

7. Refund or Amount Due: This section shows the total amount of tax you owe or the refund you are entitled to receive.

8. Signature: The form must be signed and dated by the taxpayer(s).

Note: It is important to review the instructions provided with the form to ensure the accuracy and completeness of the information reported on Form 1040EZ.

When is the deadline to file 1040ez form in 2023?

The deadline to file Form 1040EZ for the tax year 2022 would typically be April 17, 2023. However, please note that tax deadlines may vary slightly from year to year, so it's always a good idea to double-check with the IRS website or consult a tax professional to ensure you have the most accurate and up-to-date information.

What is the penalty for the late filing of 1040ez form?

The penalty for late filing of a 1040EZ form can vary depending on the circumstances. Generally, if you file your 1040EZ form after the April 15th deadline, you may be subject to a late filing penalty. The penalty is typically 5% of the unpaid taxes for each month (or partial month) that the return is late, up to a maximum of 25% of the unpaid taxes. However, if you are eligible for a refund, there is no penalty for filing a late return. It's important to note that penalties and interest can accumulate over time, so it is recommended to file your tax return as soon as possible to avoid any potential penalties.

How do I modify my 1040ez 2013 form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 1040ez 2013 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send 1040ez 2013 form for eSignature?

When you're ready to share your 1040ez 2013 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit 1040ez 2013 form on an iOS device?

Create, modify, and share 1040ez 2013 form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.