Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

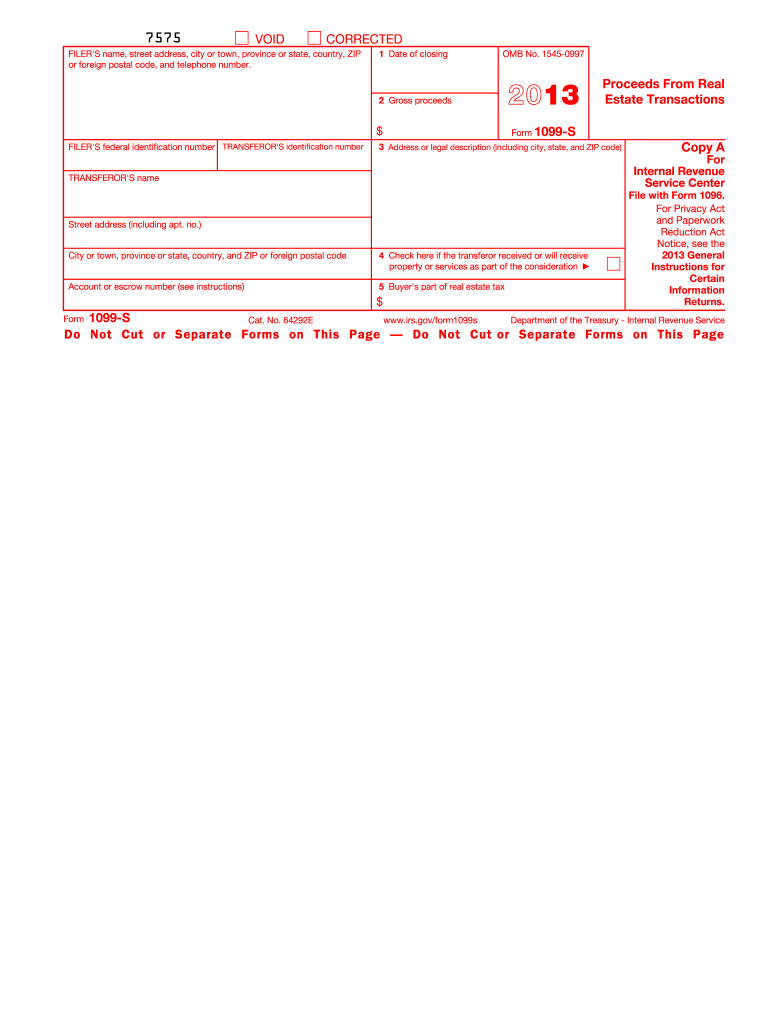

Form 1099 is a tax form used to report income received by individuals or entities other than employees. It is primarily used to report various types of income, such as non-employee compensation, dividends, interest, rental income, and more. The form is issued by the payer to the recipient and then filed with the Internal Revenue Service (IRS) to report the income for tax purposes.

Who is required to file form 1099?

There are various types of entities and individuals who are required to file Form 1099. Some examples include:

1. Businesses: If a business has paid $600 or more to an individual or unincorporated business for rent, services, prizes or awards, attorney fees, etc., they are required to file a 1099-MISC form.

2. Self-employed individuals: Self-employed individuals are required to file a 1099-MISC form if they have paid $600 or more for services provided by another individual or unincorporated business.

3. Landlords: Landlords are required to file a 1099-MISC form if they have paid $600 or more for rental-related services, such as repairs or maintenance, to an individual or unincorporated business.

4. Financial institutions: Banks and other financial institutions are required to file various types of 1099 forms, such as 1099-INT for interest earned, 1099-DIV for dividends, and 1099-B for broker transactions.

It is important to consult the IRS guidelines and regulations, as the requirements may vary depending on the specific circumstances.

How to fill out form 1099?

To properly fill out form 1099, you will need the following information:

1. Your business name, address, and tax identification number (TIN) or social security number (SSN).

2. The recipient's name, address, and TIN or SSN.

3. The payment details, including the amount paid and the date the payment was made.

4. The type of income being reported (e.g., nonemployee compensation, interest, dividends, etc.).

5. Any federal income tax withheld from the payment, if applicable.

Here are the steps to fill out form 1099:

1. Obtain a copy of the official form 1099 from the IRS website or an authorized source.

2. Enter your business name, address, and TIN or SSN in the appropriate fields.

3. Fill in the recipient's name, address, and TIN or SSN in the designated sections.

4. Indicate the type of income being reported by checking the appropriate box (e.g., box 7 for nonemployee compensation).

5. Enter the total amount paid to the recipient in the "Payment" box.

6. Record the date of payment in the "Date" box.

7. If you withheld any federal income tax from the payment, enter the amount withheld in the "Federal income tax withheld" box.

8. Repeat steps 3-7 for each recipient you need to report on the form.

9. Review the filled-out form for accuracy and completeness.

10. Keep a copy for your records, submit Copy A to the IRS, and provide Copy B to the recipient.

It's important to note that there are different variations of form 1099 for specific types of income, so ensure you are using the correct form based on the income being reported. If you have any doubts or complex situations, it's advisable to consult with a tax professional or accountant for guidance.

What is the purpose of form 1099?

The purpose of Form 1099 is to report various types of income, other than wages, salaries, and tips, to recipients for tax purposes. It is filed by businesses or individuals who have paid income to someone during the tax year. Form 1099 provides information to the recipient, the IRS, and other parties involved, to ensure appropriate reporting and taxation of the income. The various types of income reported on different versions of Form 1099 include income from freelancing, self-employment, rental property, interest, dividends, and miscellaneous earnings.

What information must be reported on form 1099?

Form 1099 is used to report various types of income other than wages, salaries, and tips. The specific information required to be reported on Form 1099 depends on the specific type of income being reported. Here are some common types of Form 1099 and the information usually required for each:

1. Form 1099-MISC: This form is used to report miscellaneous income, such as non-employee compensation, rent, royalties, and other income. The information required includes the recipient's name, address, and taxpayer identification number (TIN), as well as the amount of income paid during the year.

2. Form 1099-INT: This form is used to report interest income received, usually from a bank or financial institution. The information required includes the recipient's name, address, TIN, and the amount of interest paid during the year.

3. Form 1099-DIV: This form is used to report dividends and other distributions from investments, such as stocks or mutual funds. The information required includes the recipient's name, address, TIN, and the amount of dividends or distributions paid during the year.

4. Form 1099-NEC: Starting from tax year 2020, this form is used to report non-employee compensation paid to independent contractors or self-employed individuals. The information required includes the recipient's name, address, TIN, and the amount of compensation paid during the year.

These are just a few examples of the various types of income that may be reported on Form 1099. It's important to consult the specific instructions for each type of Form 1099 to ensure accurate reporting.

When is the deadline to file form 1099 in 2023?

The deadline to file form 1099 for tax year 2022 will most likely be on January 31, 2023. However, please note that tax deadlines can change, so it is always best to check with the IRS or a tax professional for the most up-to-date information.

What is the penalty for the late filing of form 1099?

The penalty for late filing of Form 1099 varies depending on the time the form is filed after the due date.

- If the form is filed within 30 days after the due date but before August 1st, the penalty is $50 per form.

- If the form is filed after August 1st, the penalty increases to $110 per form.

- If the form is not filed at all or if the omission is due to intentional disregard, the penalty is $280 per form.

These penalties may vary based on the size of the business and the taxpayer's compliance history. It's important to consult the official IRS guidelines or consult a tax professional for specific information related to your situation.

Where do I find 2013 form 1099?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 2013 form 1099 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit 2013 form 1099 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 2013 form 1099, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out the 2013 form 1099 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2013 form 1099 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.