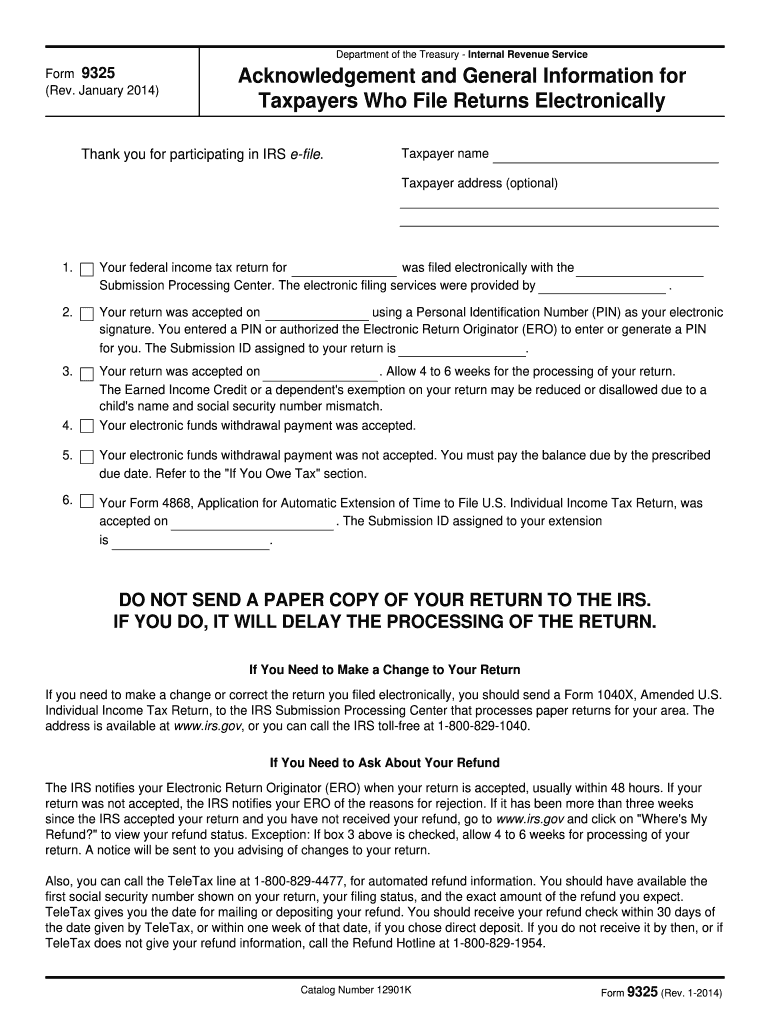

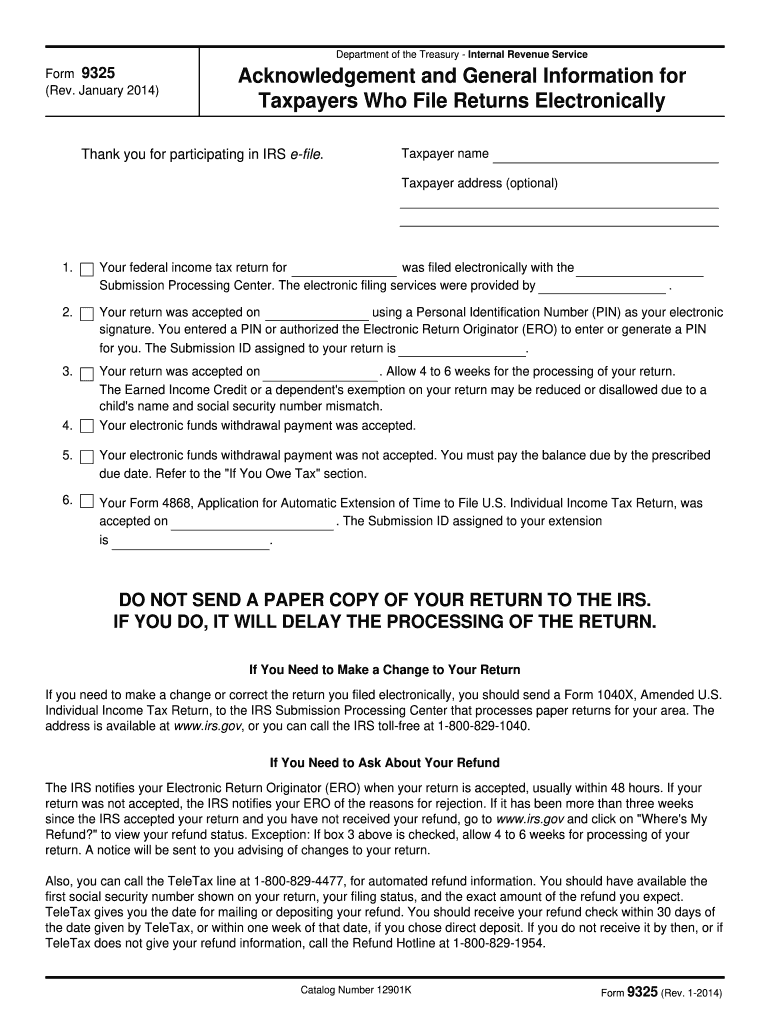

IRS 9325 2014 free printable template

Get, Create, Make and Sign

How to edit form 9325 2014 online

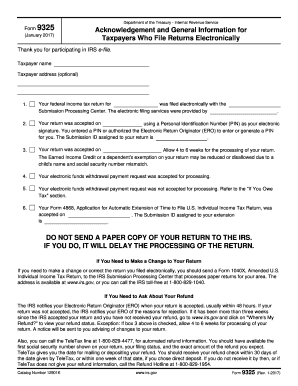

IRS 9325 Form Versions

How to fill out form 9325 2014

How to fill out form 9325 2014:

Who needs form 9325 2014:

Instructions and Help about form 9325 2014

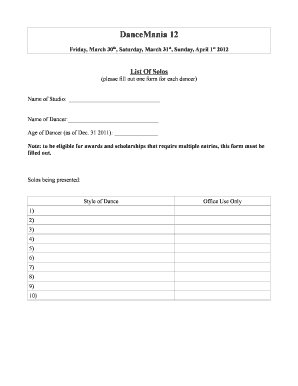

493 25 acknowledgment and general information for taxpayers who file returns electronically is used to notify taxpayers of the status of their file return you can print this form from View mode, or you can have Drake automatically email form 90 325 to the taxpayer when they're method return has been accepted to turn on the feature that automatically emails your clients in ninety-three twenty-five when the return has been accepted go to setup options from the EF tab check the box to enable the email ninety-three twenty-five notice two taxpayers this option needs to be enabled before the return is e-filed and the taxpayers valid email address is accurately entered on screen one of the return you can enable or disable this option on a per-return basis from the EF screen of the clients return and that's your Drake tip

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 9325 2014 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.