Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Form can refer to several different things, depending on the context. Here are a few common definitions:

1. In the context of physical objects, form refers to the shape, structure, or appearance of something. For example, the form of a sculpture, the form of a building, or the form of a letter.

2. In the context of art, form refers to the way elements such as lines, shapes, colors, and textures are arranged in a composition to create an overall structure or visual effect.

3. In the context of mathematics, form refers to the way in which a number or equation is expressed or written. For example, standard form, scientific notation, or algebraic form.

4. In the context of language and communication, form refers to the structure or organization of words, phrases, sentences, or paragraphs. This includes grammatical rules, syntax, and linguistic conventions.

5. In the context of sports, form refers to the physical condition, technique, or skill level of an athlete or team.

Overall, form can encompass various aspects such as shape, structure, arrangement, expression, and condition, depending on its application.

Who is required to file form?

It is not clear what specific form you are referring to. The requirement to file a form depends on the specific form and the individual's circumstances. For example, in the United States, the Internal Revenue Service requires individuals to file a tax return form (Form 1040) if they meet certain income thresholds. Similarly, businesses may be required to file various forms with government agencies for tax or compliance purposes. Without more specific information, it is difficult to provide a definitive answer.

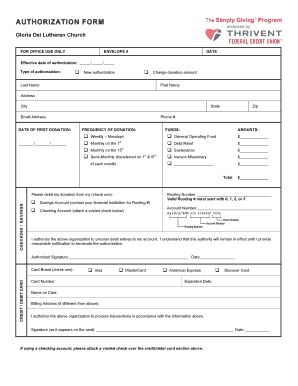

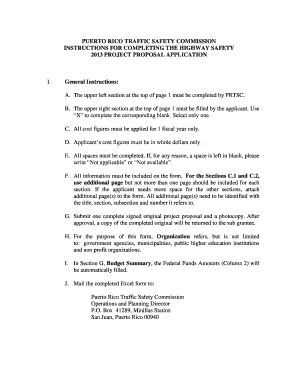

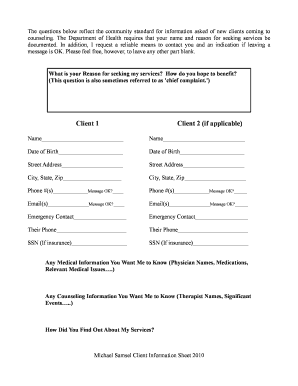

To fill out a form, follow these general steps:

1. Read the instructions: Familiarize yourself with the purpose and requirements of the form. Make sure you understand what information is being asked for and any specific rules or guidelines.

2. Gather necessary documents: Gather any documents or information that may be required to complete the form. This could include identification, addresses, dates, or other specific details.

3. Use readable handwriting: If the form is to be filled out by hand, use clear and readable handwriting. Write with a pen or pencil in the spaces provided. Avoid smudging or crossing out mistakes. If you make an error, use correction fluid or neatly cross out the incorrect information.

4. Provide accurate information: Fill in the requested information accurately and truthfully. Double-check your entries to ensure there are no spelling mistakes or missing details. If unsure about something, refer to supporting documents or seek clarification before completing the form.

5. Follow formatting instructions: Some forms may have specific instructions for formatting, such as using uppercase letters, specific date or phone number formats, or providing information in specific areas. Adhere to these formatting guidelines as instructed.

6. Check for completeness: Review the completed form to ensure all required fields are filled in. Make sure there are no missing pages or sections. If any optional sections are relevant or helpful, consider completing those as well.

7. Sign and date: If the form requires your signature, sign using your usual signature style. Ensure that the date is also provided if necessary.

8. Keep a copy: Make a copy of the filled-out form for your records before submitting it, either through photocopying, scanning, or taking a clear picture.

9. Submit the form: Send the completed form to the intended recipient by mail, online submission, or any other designated method mentioned in the instructions. Keep any tracking numbers or proof of receipt if applicable.

Remember, these steps can vary depending on the specific form and instructions provided. Always carefully read and follow the guidelines provided by the form's issuer.

What is the purpose of form?

The purpose of a form is to collect structured information from individuals or users. Forms are commonly used in various settings, such as online surveys, job applications, feedback forms, order forms, registration forms, and more. The information gathered through forms helps businesses or organizations understand customer preferences, gather data for analysis, process applications or orders, and communicate effectively with individuals. Forms serve as a organized and efficient way to collect specific data in a structured manner.

What information must be reported on form?

The specific information that must be reported on a form can vary depending on the purpose and nature of the form. However, some common types of information that may be required on various forms include:

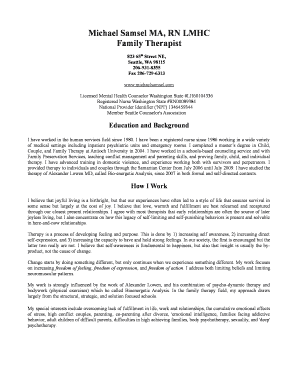

1. Personal information: This typically includes the individual's full name, address, phone number, email address, and date of birth.

2. Identification details: This may include providing a valid government-issued identification document such as a passport number, driver's license number, or social security number.

3. Financial information: Forms related to financial matters may require information such as bank account details, income information, tax filing status, or credit card information.

4. Employment details: Certain forms may ask for information about current and previous employers, job titles, salary, or employment history.

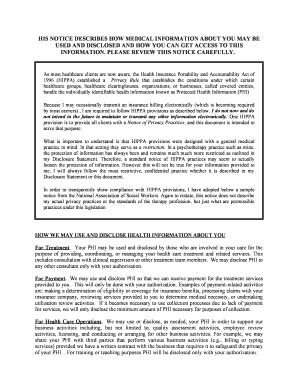

5. Medical or health information: Forms related to healthcare or insurance may require individuals to disclose their medical history, current health conditions, or insurance policy details.

6. Education and qualifications: Some forms may request details about educational background, degrees earned, certifications, or professional qualifications.

7. Legal or criminal history: Certain forms may ask individuals to disclose any past criminal convictions or legal proceedings they have been involved in.

8. Consent and signatures: Many forms require individuals to provide consent to certain terms or conditions by signing or digitally indicating agreement.

It's important to note that the specific information required on a form can vary widely depending on the context. It is generally advisable to carefully read the instructions provided with each form to ensure accurate and complete reporting.

What is the penalty for the late filing of form?

The penalty for late filing of a form typically depends on the specific form and the governing laws or regulations in place. In many cases, late filing penalties can include fines or penalties imposed by the relevant regulatory body or government agency. These penalties can vary widely and may be assessed based on the length of the delay in filing, the type of form, and the jurisdiction. It is advisable to consult the specific regulations or seek professional advice to determine the penalties associated with the late filing of a particular form.

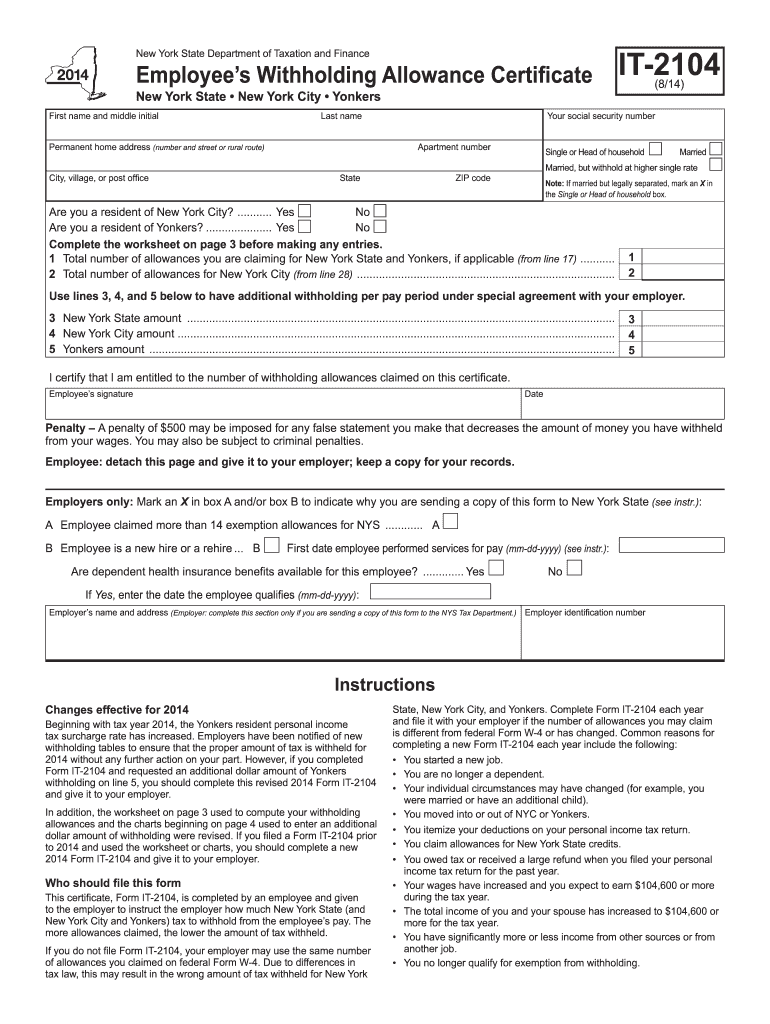

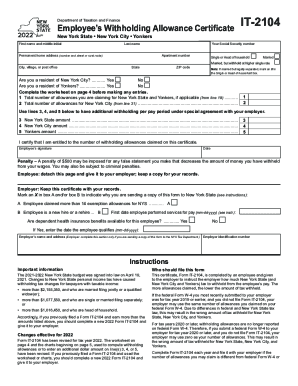

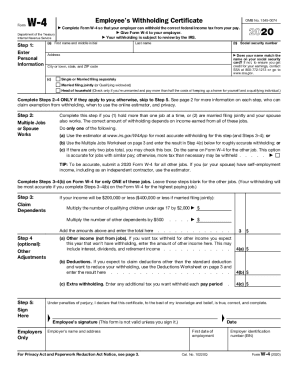

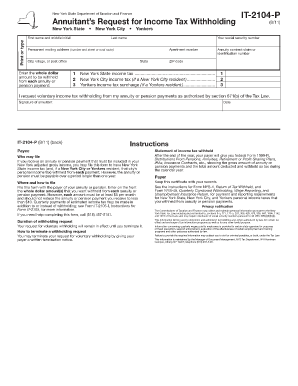

How can I modify 2014 form - tax without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 2014 form - tax into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I get 2014 form - tax?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the 2014 form - tax. Open it immediately and start altering it with sophisticated capabilities.

How can I edit 2014 form - tax on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 2014 form - tax.