CT DRS CT-1040X 2013 free printable template

Show details

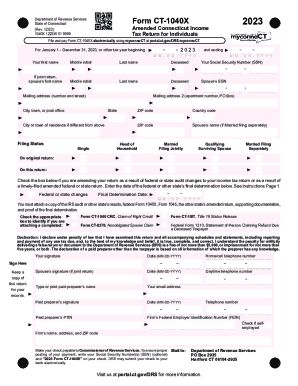

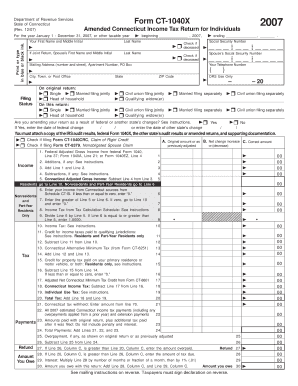

Department of Revenue Services State of Connecticut Amended Rev. 12/13 Form CT-1040X beginning 2013 ending Print or type in blue or black ink. 70h. 70. Total Connecticut income tax withheld Enter here and on Line 21 Column C. Instructions for Amended Connecticut Income Tax Return Purpose Use this form to amend a previously- led 2013 not be used to amend any other year s return. Do not use this form to amend Form CT-1041 or Form CT-1065/CT-1120SI. For the year January 1 - December 31 2013 or...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 2013 amended form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 amended form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 amended form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2013 amended form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

CT DRS CT-1040X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2013 amended form

How to fill out 2013 amended form:

01

Locate the 2013 amended form. It can typically be found on the website of the tax authority or obtained from a local tax office.

02

Fill in your personal information accurately. This includes your name, address, social security number, and any other required identification details.

03

Review the specific instructions provided with the form to understand what changes should be made compared to the original 2013 form.

04

Identify the sections that require amendment and make the necessary corrections. This may involve updating income details, deductions, or any other relevant information.

05

Double-check all the numbers and calculations to ensure accuracy. Any mistakes may lead to further complications or delays in processing your tax return.

06

Attach any supporting documentation that may be required. This could include receipts, statements, or other proof of the changes made.

07

Sign and date the amended form.

08

Make copies of the completed form and all supporting documents for your records.

09

Submit the amended form to the appropriate tax authority as instructed.

Who needs 2013 amended form:

01

Individuals or taxpayers who have already filed their 2013 tax return but need to make corrections or changes to the original form.

02

Those who have received additional income or discovered errors in deductions or credits claimed on the original 2013 return.

03

Anyone who wants to claim missed credits or deductions that were eligible during the 2013 tax year.

04

Individuals who had a change in their filing status or personal circumstances during the 2013 tax year that may affect their tax liability.

05

Taxpayers who want to correct mistakes or errors made on their original 2013 tax return to avoid potential penalties or audits.

Instructions and Help about 2013 amended form

Fill form : Try Risk Free

People Also Ask about 2013 amended form

What is a common reason for filing a 1040X?

How do I fill out an amended 1040X tax return?

How many years back can you file amended tax return?

Can I file an amended tax return for 2013?

Can I amend a tax return from 5 years ago?

Can I amend my 2013 tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is amended form?

An amended form is a revised version of a previously filed form that is submitted to correct errors or provide updated information. It is used to make changes to the original form.

Who is required to file amended form?

Anyone who needs to correct errors or update information on a previously filed form is required to file an amended form. This includes individuals, businesses, and organizations.

How to fill out amended form?

To fill out an amended form, you need to review the original form and identify the errors or changes that need to be made. Then, you must complete the amended form with the corrected or updated information. It is important to follow the instructions provided with the specific form to ensure accurate completion.

What is the purpose of amended form?

The purpose of an amended form is to provide a means for individuals, businesses, and organizations to correct errors or update information on previously filed forms. It allows for accuracy and completeness in reporting.

What information must be reported on amended form?

The specific information that must be reported on an amended form depends on the type of form being amended. Generally, the amended form should include the corrected or updated information that needs to be changed from the original form.

When is the deadline to file amended form in 2023?

The deadline to file an amended form in 2023 will depend on the specific form and its associated requirements. It is recommended to refer to the instructions or guidelines provided with the form to determine the deadline.

What is the penalty for the late filing of amended form?

The penalty for the late filing of an amended form can vary depending on the specific circumstances and regulations. It is advisable to consult the relevant tax authority or agency to understand the specific penalties associated with late filing of amended forms.

Can I create an electronic signature for signing my 2013 amended form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 2013 amended form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit 2013 amended form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 2013 amended form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit 2013 amended form on an Android device?

You can make any changes to PDF files, like 2013 amended form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your 2013 amended form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.