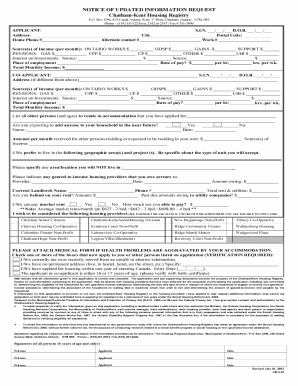

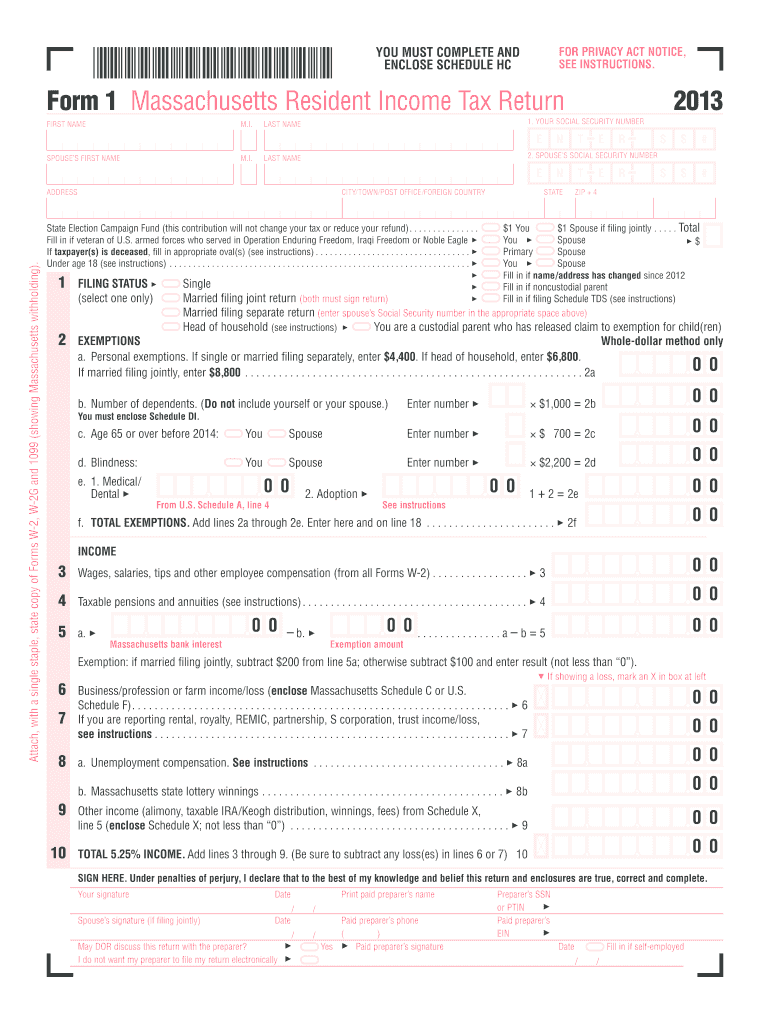

MA Form 1 2013 free printable template

Instructions and Help about MA Form 1

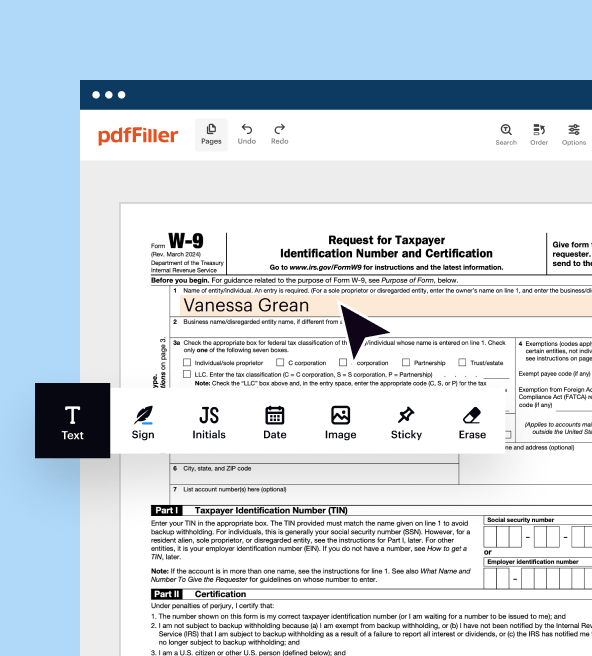

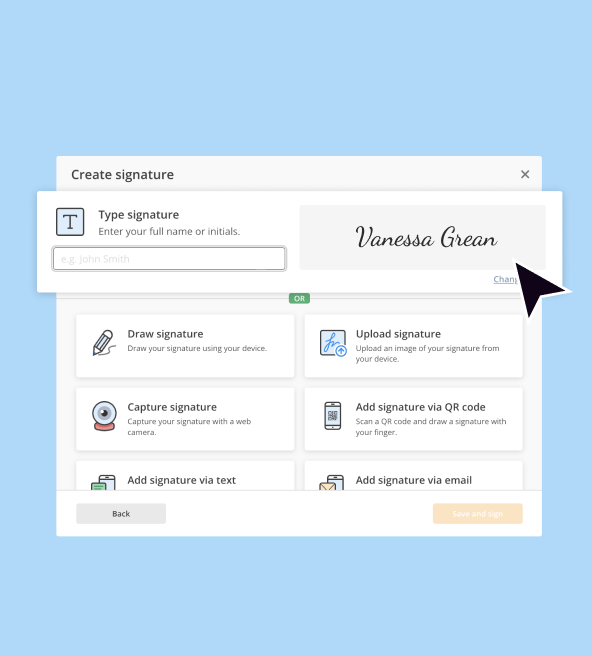

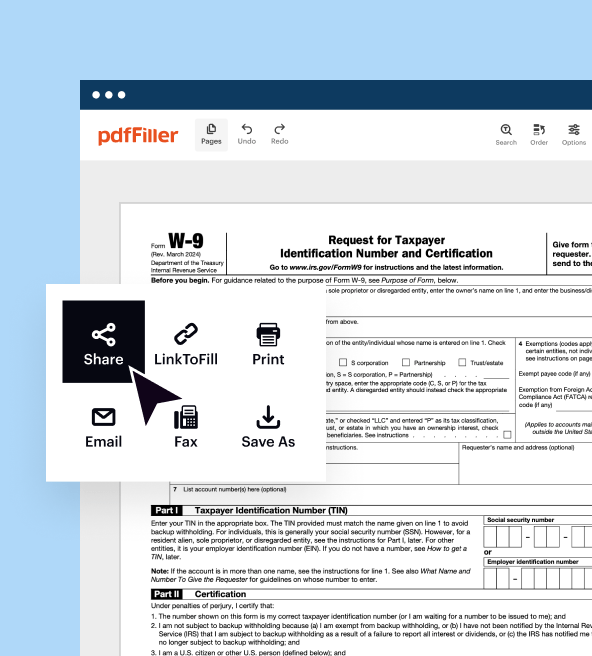

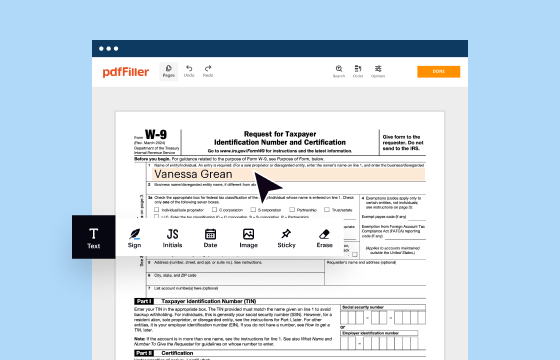

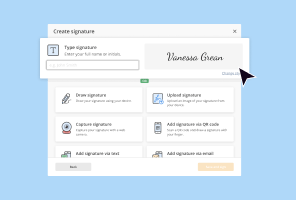

How to edit MA Form 1

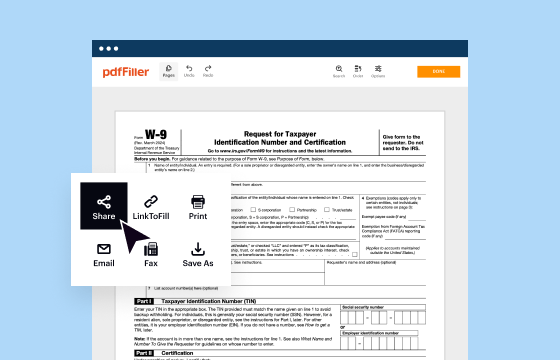

How to fill out MA Form 1

About MA Form 1 2013 previous version

What is MA Form 1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MA Form 1

What should I do if I realize I made an error after filing my massachusetts resident income tax?

If you've filed your massachusetts resident income tax and notice an error, you can submit an amended return to correct it. Ensure you include all necessary documentation that supports your amendment. It's best to file as soon as possible to avoid potential penalties or issues with the IRS.

How can I track the status of my massachusetts resident income tax return?

You can check the status of your filed massachusetts resident income tax return online by visiting the Massachusetts Department of Revenue website. You'll need your Social Security number, the amount you claimed as a refund, and the filing status to access your information.

Are there special considerations for nonresidents filing a massachusetts resident income tax?

Nonresidents who earned income in Massachusetts may have different criteria for filing. It’s essential for them to understand what income is taxable and if they’re eligible to claim any deductions. Consulting with a tax professional can provide clarity on compliance with state regulations.

What types of common mistakes should taxpayers avoid when filing their massachusetts resident income tax?

Taxpayers often miss out on credits or deductions, misreport income, or fail to double-check math errors in their massachusetts resident income tax forms. Keeping accurate records and having another set of eyes review your return can significantly reduce the risk of mistakes.

See what our users say