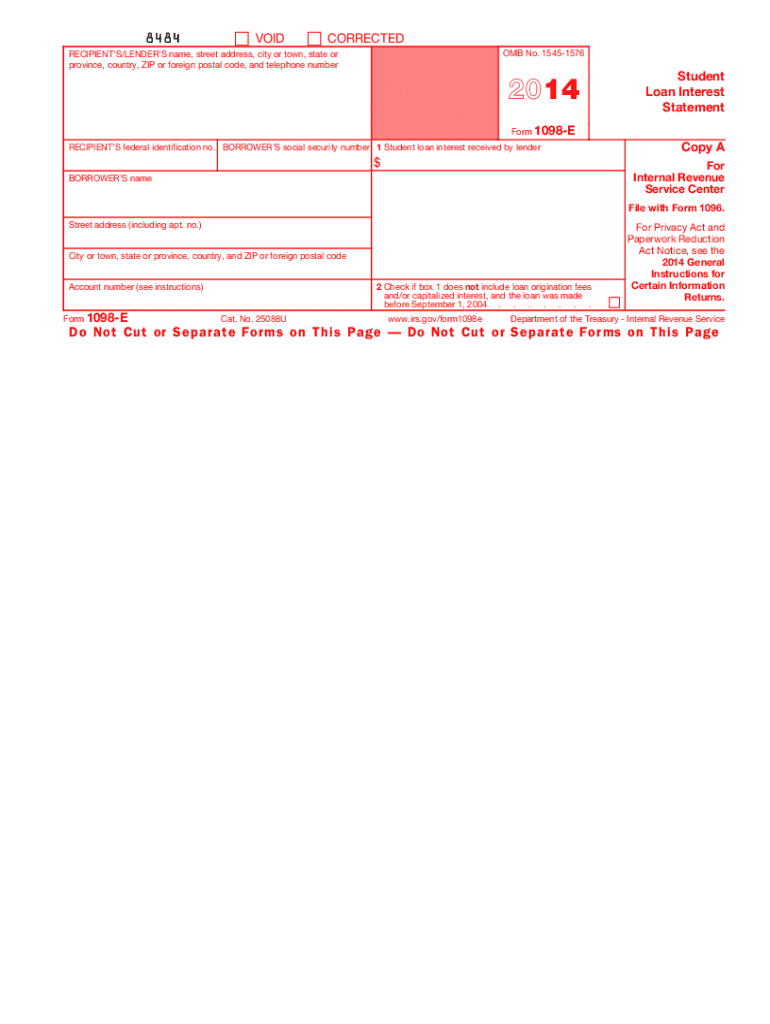

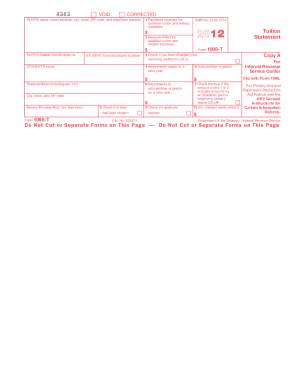

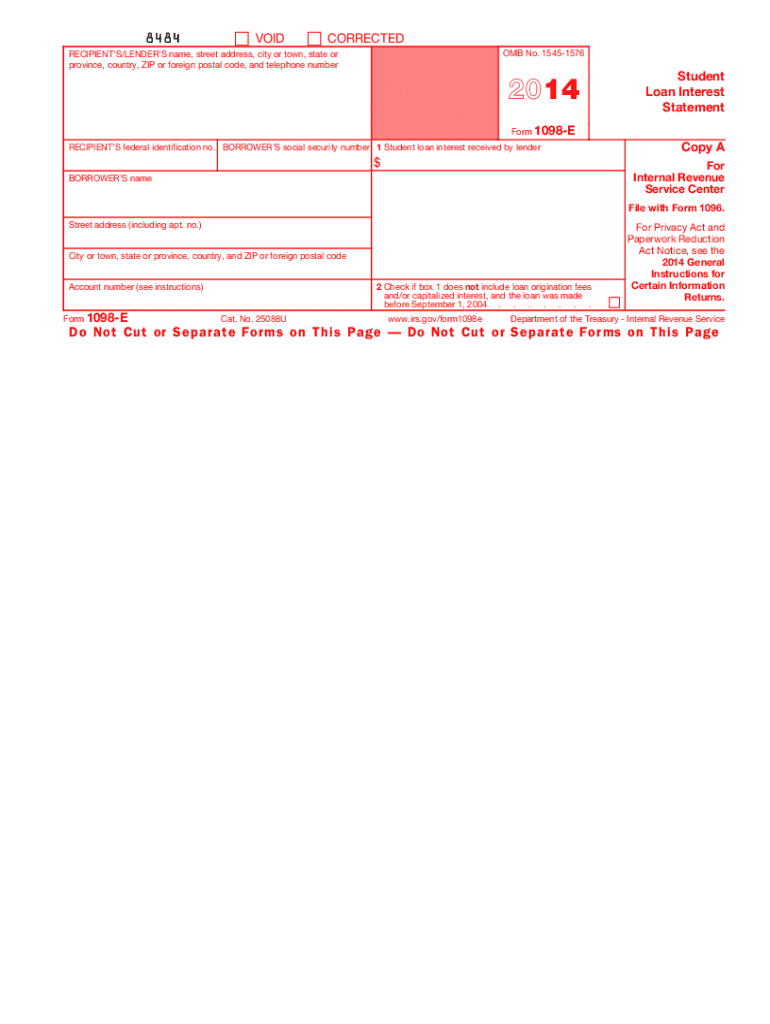

IRS 1098-E 2014 free printable template

Get, Create, Make and Sign

How to edit govform1098e - irs online

IRS 1098-E Form Versions

How to fill out govform1098e - irs

How to fill out govform1098e:

Who needs govform1098e:

Instructions and Help about govform1098e - irs

Hey there YouTube so in this video I wanted to cover the IRS form 1098-e this is the student loan interest statement that shows the amount of interest expense a student paid on their student loan payments throughout the year, so this form is issued by the student loan uh company the copy goes to the taxpayer and then another copy goes to the IRS, so they're going to know how much interest you paid during the year, so I want to cover this form and how it actually gets reported on your form 1040 right, so the form is pretty straightforward this is a 2020 example you have the um the actual student loan company so the lender's information is up here the lender's tax ID number and then you as the student are the borrower right, so you've got your social security number borrower's name and address and then box one is the amount of student loan interest paid during the year now this isn't it works kind of like a mortgage right the amount of interest you paid might only be a portion right if you're making principal payments as well you're going to have principal obviously...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your govform1098e - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.