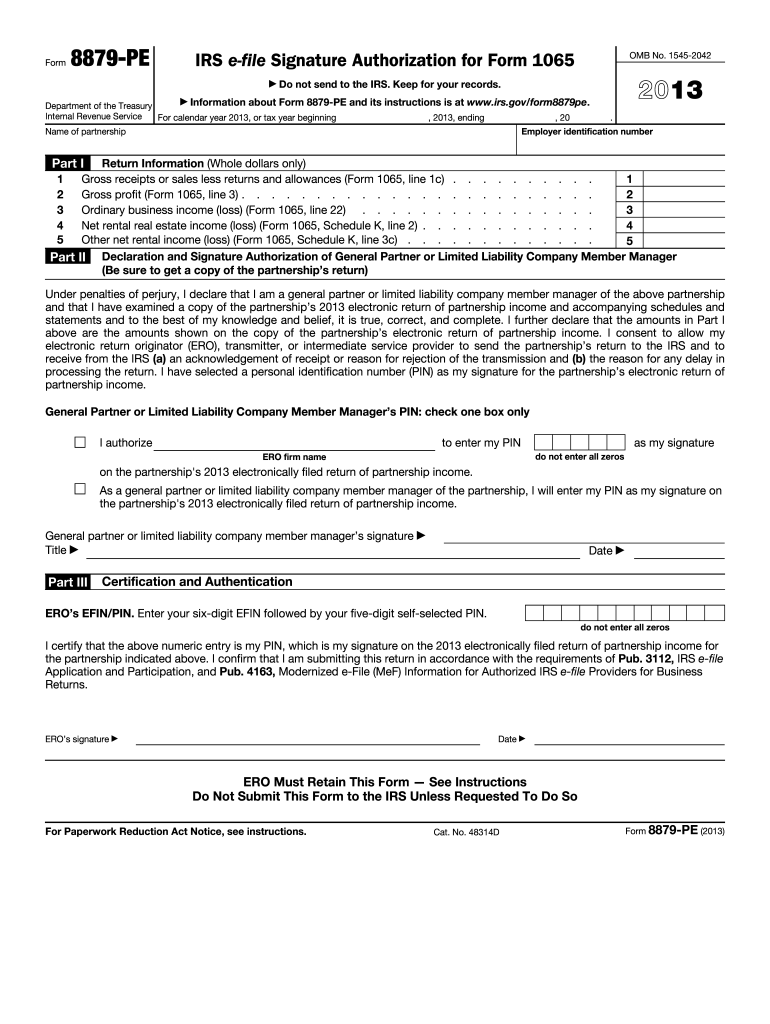

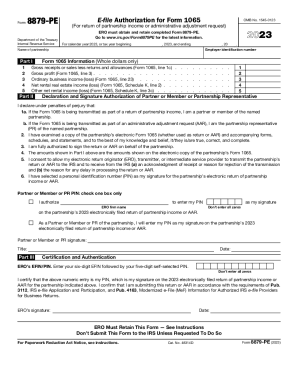

Who Needs IRS Form 8879-PE?

IRS Form 8879-PE is an IRS e-file Signature Authorization for Form 1065. If a general partner or limited liability company member manager is willing to use a personal identification number (PIN) to sign a partnership's electronic income tax return electronically and consent to electronic funds withdrawal, the form must be completed by two parties: a general partner or limited liability company member manager and an ERO (electronic return originator).

An ERO is the Authorized IRS e-file Provider who is in charge of originating the electronic submission of a return to the IRS and consulting taxpayers in terms of e-filing returns.

Is Form 8879-PE Accompanied by any Other Documents?

No, there is no need to attach any other forms or documents to the IRS e-file Signature Authorization for Form 1065, however, the form is filed with reference to Form 1065.

When is Form 8879-PE due?

The form is to filed when the need arises, and the completed document must be retained for three years from the return (Form 1065) due date or from the date when it was received at the IRS (whichever is later).

How do I Fill out Form 8879-PE?

The form is not difficult to complete, it also contains an instruction to guide the partnership’s representative and the ERO through the document.

The following data is required for the form to be properly filed:

- Partnership’s name and EIN (employer identification number);

- Information about the tax return;

- Information about the ERO;

- The applicable PIN to be used as a signature;

- Information about the general partner or limited liability company member manager;

- Date and signatures of the parties.

Where do I File Form 8879-PE?

The document shouldn’t be sent to the IRS. It must be directed to the ERO and kept by this party.