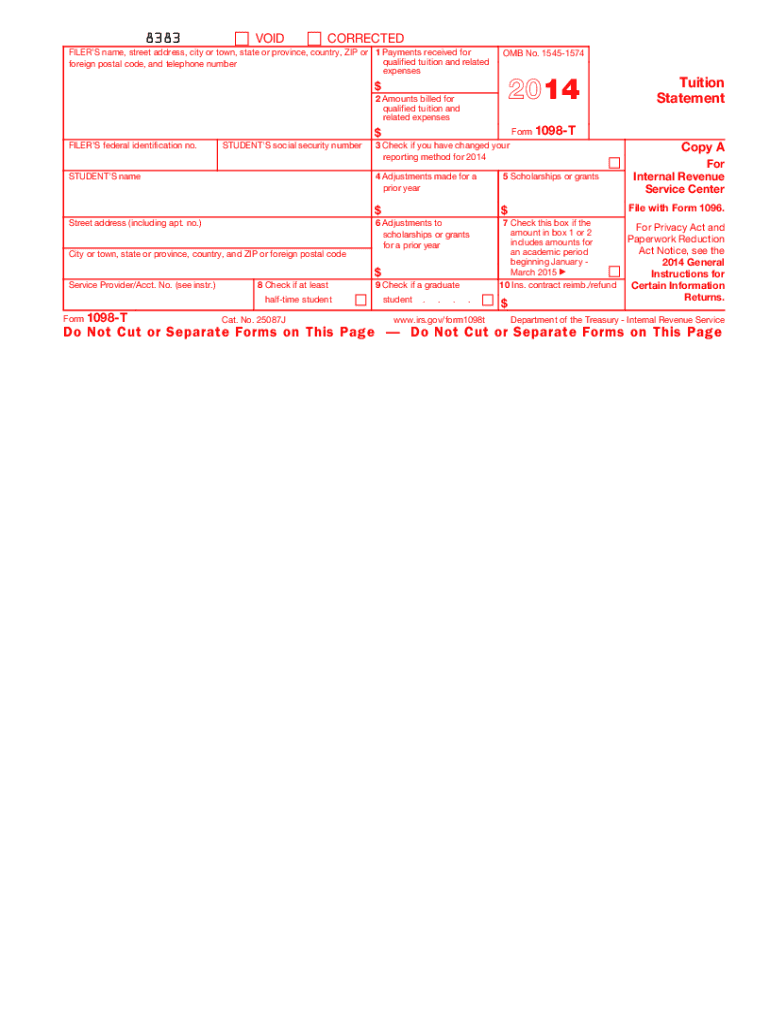

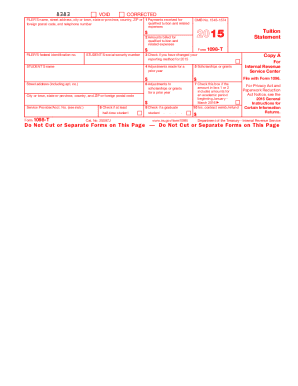

What is a 1098 T form?

A 1098 T form is a form submitted by post-secondary educational institutions that reports the qualified education expenses of each tuition-paying student. Eligible institutions complete the form and file it with the IRS, and send a copy to each respective student. The document helps students determine whether they or their parents/guardians can claim an education tax credit on their 1040 or 1040-SR forms.

Who should file the 1098 T form 2014?

Eligible educational institutions (colleges, universities, and other post-secondary schools) should file a 1098 T form to the IRS for each enrolled student who made a qualified tuition payment. Each student should also recieve a copy of their form.

The 1098 T form may affect what tax benefits students or their parents/legal guardians can claim when filing IRS forms 1040 and 1040-SR. However, it's an informational tuition report, so filers should not attach it to their individual tax returns.

What information do you need when you file the 1098 T form?

When preparing the 1098 T form, colleges and schools must complete two identical pages, one for the Internal Revenue Service and the other for a student who paid qualifying tuition fees. The institution filing should provide the following information:

- The educational institution's name, address, telephone number, and employer identification number (EIN)

- The student's name, address, and taxpayer identification number (TIN)

- The student's account number within the filer's system for payment identification, and whether the student is enrolled at least half-time or is a graduate student

- The total amount of payments received from the student during 2014 and any related refunds

- Adjustments to the tuition fees reported in the previously filed college tax form

- The amount of scholarships and grants the student received, and any adjustments made to them for a prior year

How do you fill out the 1098 T form in 2015?

If you're searching for how to get 1098 T form and complete it electronically, you're in the right place. Here's how you can quickly fill it out with pdfFiller:

- Upload the document to the editor by clicking the Get Form button.

- Read the instructions on printing the sample and click Start.

- Type in the text fields and click on the checkboxes to provide the required information.

- Review each field to ensure the information you provided is accurate.

- Click Done when finished and select whether to download, print out, or share your document electronically.

Is the 1098 T form accompanied by other forms?

Educational institutions must file their college tax form along with IRS Form 1096.

When is the 1098 T form due?

The deadline for sending the college tax report to each student is January 31, 2015. The due date for filing it to the IRS is March 31, 2015.

Where do I send the 1098 T form?

Colleges and other post-secondary institutions must provide the completed college tax form to each student who made them a qualified tuition payment. With pdfFiller, you can file your completed 1098-t form online via email, fax, or using the USPS mail delivery right from the editor after completing the document. Also, institutions must file the document to the IRS via the service's e-filing system or by mail. To save time, take advantage of the pdfFiller Send via USPS option and request mail delivery without wasting paper or time from printing or visiting a post office.