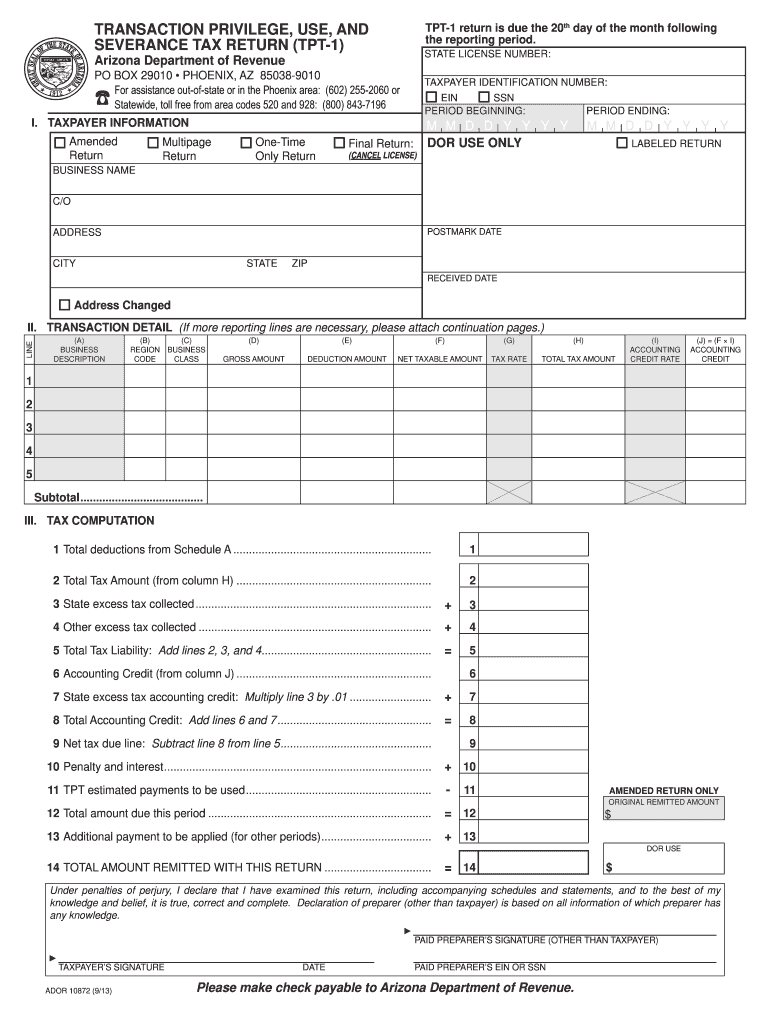

Who needs a form TPT-1?

Businesses registered in Arizona have to fill out this form if they overcome taxable transaction privileges or severances or if they need to report city taxes.

What is it for?

Form TPT-1 is a transaction privilege, use and severance tax return. This form is designed specifically by the Arizona Department of Revenue. It is used to report excess taxes, city taxes, deduction amounts and transaction taxes.

Is it accompanied by other forms?

It doesn’t require any addenda.

When is form TPT-1 due?

You should file this form monthly or upon request. If you file this form on a regular basis, you should send by the 20th of the month after the reported period.

How do I fill out form TPT-1?

On page 1, check in the box if this is an amended, multi-page, one-time return or final return for license cancel. Give your company name and address, state license number, taxpayer identification number, and the dates for the beginning and ending of the reported period. Fill in the table with your transactions. You have to write a description for every transaction, region code and business class, its amount, necessary deductions, net taxable amount, tax rate, total tax amount, accounting credit rate and the accounting credit itself. Fill in the list of taxes to calculate the total amount for this return. On page 2, use a table of deduction codes and report the total deduction amount specifying the amount for every item. On page 3 describe the additional transactions (if there wasn’t enough space on page 1). Don’t forget to put down your license number at the top of every page.

Where do I send it?

The form should be sent by post to the Arizona Department of Revenue, PO Box 29010, Phoenix, AZ 85038-9010. For online submission, go to www.aztaxes.gov