NY DTF ET-30 2014 free printable template

Show details

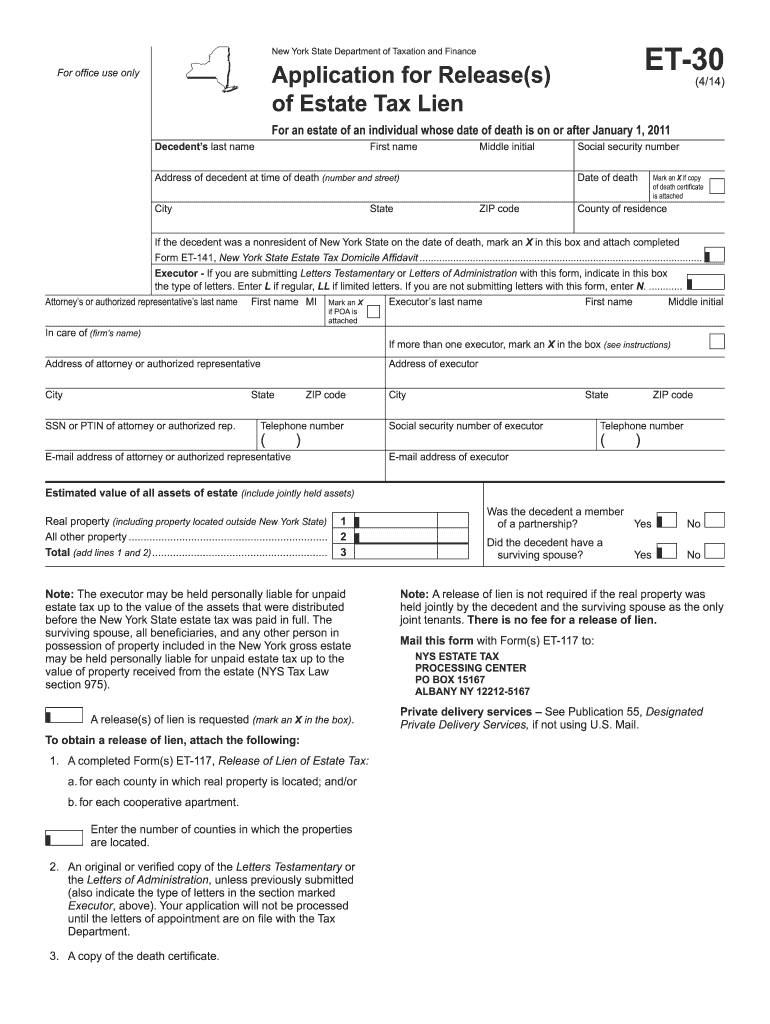

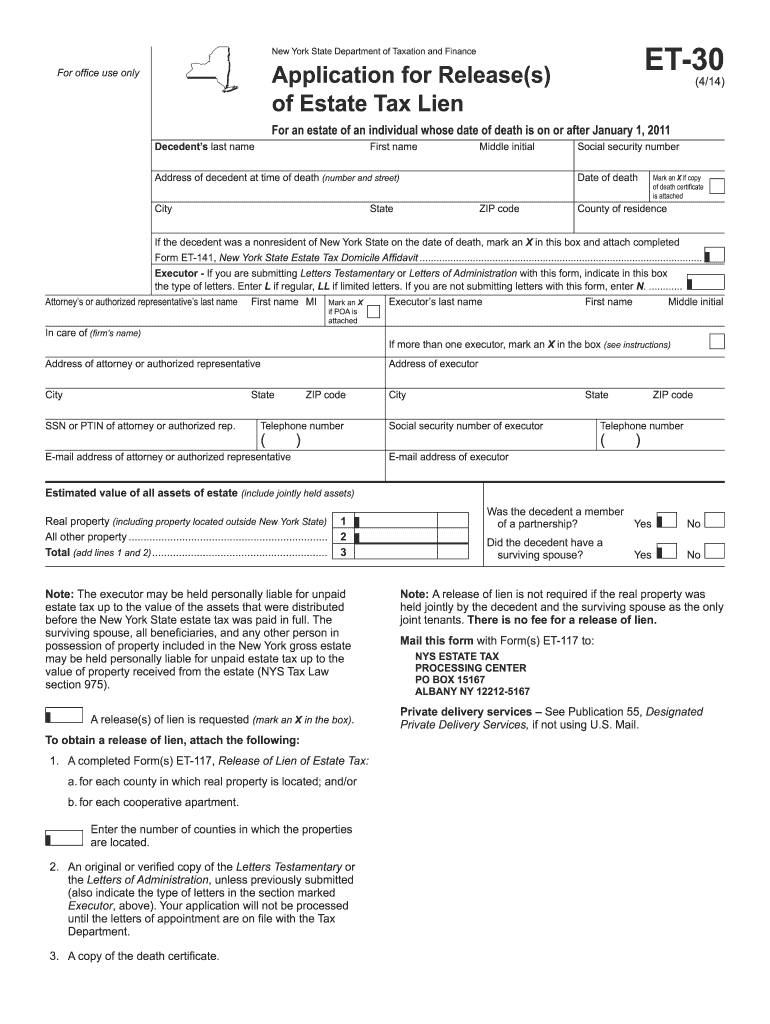

When to use forms other than Form ET-30 Use Form ET-706 New York State Estate Tax Return when the estate is required to file a New York State estate tax return and either 1. There is no fee for a release of lien. Mail this form with Form s ET-117 to NYS ESTATE TAX PROCESSING CENTER PO BOX 15167 ALBANY NY 12212-5167 Private delivery services See Publication 55 Designated ET-30 4/14 back Instructions When to use Form ET-30 Use this form to obtain release s of an estate tax lien if you are the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your et 30 2014 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your et 30 2014 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit et 30 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form et 30. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

NY DTF ET-30 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out et 30 2014 form

Point by point, here's how to fill out et 30:

01

Begin by gathering all the necessary information required for et 30, such as personal details, relevant documents, and any specific instructions provided.

02

Carefully read and understand each section and question on the form. If there are any parts that are unclear, seek clarification from the appropriate authority.

03

Fill in the form accurately and thoroughly, ensuring that all required fields are completed. Double-check the provided information for any errors or mistakes.

04

If there are any supporting documents or attachments required, make sure to include them with the completed form.

05

Before submitting the et 30 form, review it once again to ensure nothing has been missed or overlooked.

06

Follow the specified submission procedure and submit the filled-out et 30 form within the designated timeframe to the appropriate recipient or authority.

As for who needs et 30, it may vary depending on the specific context or location. However, generally, anyone who is required to provide certain information or documentation related to a particular process, application, or legal requirement might need to fill out et 30. It could be individuals applying for permits, licenses, visas, or participating in specific programs or activities. It is always advisable to consult the relevant guidelines or authorities to determine if et 30 is necessary for a specific situation.

Video instructions and help with filling out and completing et 30

Instructions and Help about ny inheritance tax waiver form

Fill inheritance tax waiver form new york : Try Risk Free

People Also Ask about et 30

How do I get rid of a lien on my property in NY?

How much can you inherit tax free in NY?

Does the IRS release lien after 10 years?

How long does an IRS tax lien last?

What is the IRS Form et30?

How much is IRS inheritance tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is et 30?

ET 30 refers to the offset of a car's wheel. It is a numerical value that represents the distance between the center line of the wheel and the mounting face of the wheel. In particular, ET 30 means that the mounting face of the wheel is located 30 millimeters closer to the outside of the wheel compared to the center line. This offset determines how the wheel will fit within the wheel well of a car and affects the overall stance and handling characteristics.

Who is required to file et 30?

The term "et 30" does not correspond to any specific form or requirement. Therefore, it is impossible to determine who is required to file it. Please provide more information or clarify your question for a more accurate response.

How to fill out et 30?

To fill out an ET 30 form, you must follow these steps:

1. Obtain the ET 30 form: You can usually find this form on the website of the organization or government agency that requires it, or you may need to request it in person.

2. Read the instructions: Carefully review the provided instructions to understand what information is required and any specific guidelines you need to follow while filling out the form.

3. Provide your personal details: Start by entering your personal information, such as your full name, date of birth, address, and contact information, in the designated spaces on the form.

4. Fill out the relevant sections: The ET 30 form may have various sections asking for different types of information. Fill out each section accurately and completely, providing all necessary details.

5. Attach supporting documents (if required): If the form requires you to submit any supporting documentation, make sure to attach the necessary documents as specified. This could include identification, proof of address, or any other documents relevant to the purpose of the form.

6. Review and double-check: Once you have filled out all the required sections, carefully review your answers to ensure accuracy and completeness. Check for errors, missing information, or any other mistakes that may need correction.

7. Sign and date the form: Sign and date the ET 30 form, usually at the bottom or in a designated signature box.

8. Submit the form: Determine where and how to submit the form. It may be in person, via mail, or electronically, depending on the instructions provided. Follow the required submission process to ensure your form reaches the intended recipient.

Remember to keep a copy of the filled-out ET 30 form for your personal records before submitting it.

What is the purpose of et 30?

ET30 typically refers to the offset of a vehicle's wheel, specifically the distance from the mounting surface of the wheel to the centerline of the wheel. The purpose of ET30, or any other specific offset value, is to determine the positioning of the wheel on the vehicle's hub assembly. It affects how the wheel sits in relation to the body of the vehicle when properly mounted. Different offset values can result in various handling characteristics and impacts the appearance of the vehicle as well. ET30 implies that the wheel has a positive offset of 30 millimeters.

How do I complete et 30 online?

Filling out and eSigning form et 30 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I fill out the inheritance tax waiver form ny form on my smartphone?

Use the pdfFiller mobile app to fill out and sign nys et 30 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete et 30 fillable form on an Android device?

Use the pdfFiller Android app to finish your et30 form and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your et 30 2014 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Inheritance Tax Waiver Form Ny is not the form you're looking for?Search for another form here.

Keywords relevant to et 30 form

Related to nys tax form et 30

If you believe that this page should be taken down, please follow our DMCA take down process

here

.