Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

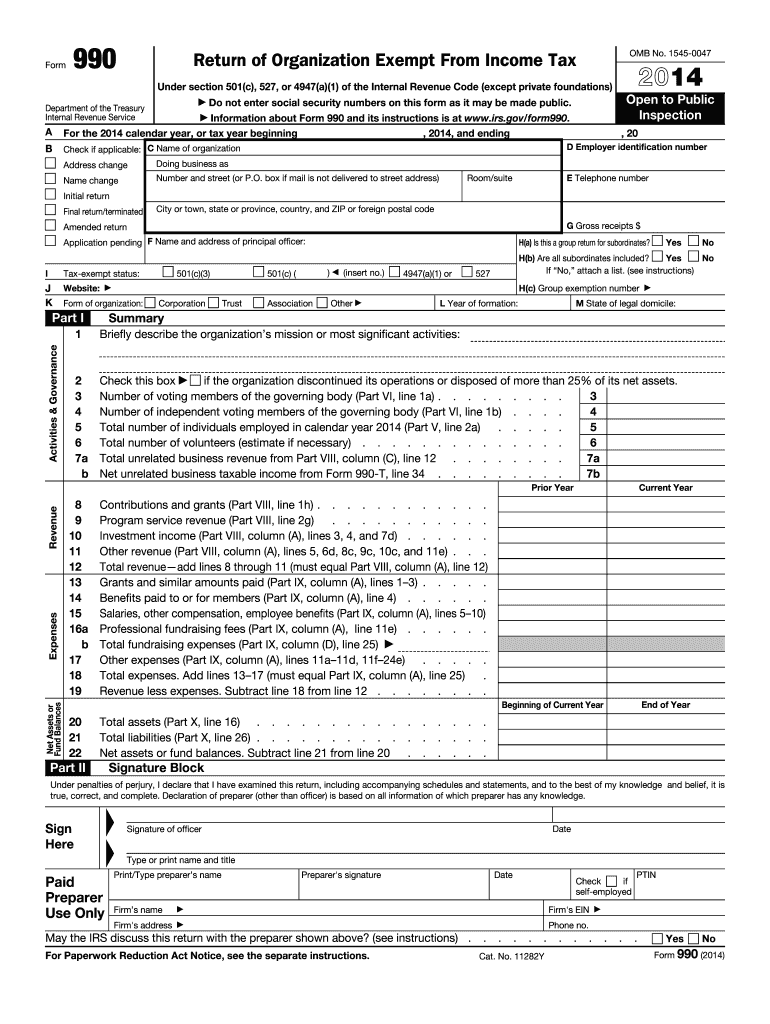

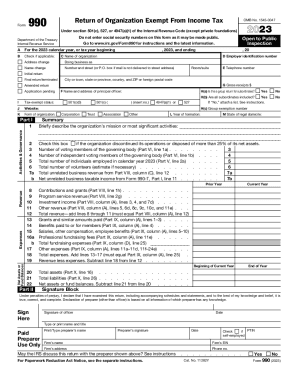

IRS Form 990 is an informational tax form that is used by tax-exempt organizations to report their financial information to the Internal Revenue Service (IRS). It is filed annually by organizations such as charities, foundations, religious organizations, and other non-profit entities. Form 990 provides details about an organization's mission, programs, governance, revenue, expenses, assets, and activities. It helps the IRS and the public to evaluate the organization's compliance with tax law regulations and to assess how it operates and uses its resources. The form is available to the public, which promotes transparency and accountability for tax-exempt organizations.

Who is required to file irs form 990?

Non-profit organizations that are exempt from federal income tax under section 501(a) of the Internal Revenue Code are generally required to file Form 990 with the IRS. This form includes information about the organization's activities, governance, and financial statements.

How to fill out irs form 990?

Filling out IRS Form 990 can be a complex process, but here are general guidelines to help you through it:

1. Gather the necessary information: Collect all financial and operational information for your organization, including details about revenue, expenses, assets, liabilities, programs, governance structure, and key individuals.

2. Understand the form's sections:

- Part I: Summary: Basic information about your organization.

- Part II: Signature Block: Provides legal affirmation that the form is accurate.

- Part III: Statement of Program Service Accomplishments: Details your organization's mission and major activities.

- Part IV: Checklist of Required Schedules: Indicate which schedules you will include with your form.

- Part V: Statements Regarding Other IRS Filings and Tax Compliance: Report any additional filings your organization has submitted.

- Part VI: Governance, Management, and Disclosure: Describe your organization's governing body, policies, and disclosures.

- Part VII: Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors: Provide details of compensation.

- Part VIII: Statement of Revenue: Report your organization's revenue.

- Part IX: Statement of Functional Expenses: Outline your organization's expenses by category.

- Part X: Balance Sheet: Present your organization's assets, liabilities, and net assets.

- Part XI: Reconciliation of Net Assets: Explain the changes in your organization's net assets.

- Part XII: Financial Statements and Reporting: Provide financial statements and related information.

- Part XIII: Supplemental Information: Include any additional details that may be required.

3. Complete the necessary schedules: Review the checklist in Part IV and complete the schedules applicable to your organization. The commonly used schedules include Schedule A (Public Charity Status), Schedule B (Contributors), and Schedule O (Supplemental Information).

4. Ensure accuracy and review: Once completed, carefully review all sections and schedules for accuracy, ensuring that all required fields are filled correctly.

5. File the form: Sign and date the form, make copies for your records, and submit the form to the IRS by the designated due date. Consult the form's instructions or seek professional assistance if needed.

It is important to note that the instructions and requirements for Form 990 may change over time, so double-check the latest instructions provided by the IRS for accurate and up-to-date guidance. Additionally, it may be beneficial to consult with a tax professional or accountant to ensure compliance with all regulations.

What is the purpose of irs form 990?

The purpose of IRS Form 990 is to provide information about the activities, governance, and financial status of tax-exempt organizations. It is a reporting tool for these organizations to disclose their mission, programs, and financial details for the purpose of maintaining their tax-exempt status and promoting transparency. The form allows the IRS and the general public to assess how the organization is fulfilling its tax-exempt purpose, whether it is properly using its resources, and if it is compliant with tax laws.

What information must be reported on irs form 990?

The IRS Form 990 is an informational tax form that must be filed by tax-exempt organizations to provide details about their finances, operations, and governance. Some of the key information that must be reported on Form 990 includes:

1. Basic information: Name, address, and employer identification number (EIN) of the organization.

2. Mission statement and program description: A summary of the organization's mission and the programs and activities it carries out to achieve its mission.

3. Governance and management: Details about the organization's governing body, including the names and addresses of its key officers, directors, and trustees.

4. Tax-exempt status and public charity classification: Information about the organization's tax-exempt status, including whether it is a public charity or a private foundation.

5. Financial information: Comprehensive financial statements, including a statement of revenue, expenses, assets, and liabilities. This includes reporting on grants and contributions received, salaries and compensation paid to key employees, and other expenditures.

6. Public support and revenue: Information about the organization's sources of revenue, such as contributions, program fees, and other sources of income. It also includes reporting on the percentage of public support received, which determines the organization's public charity status.

7. Fundraising and lobbying activities: Details about the organization's fundraising activities, including any professional fundraising fees paid. It also includes reporting on lobbying expenses and political campaign activities.

8. Compliance with tax regulations: Information about the organization's compliance with various tax regulations, including reporting on certain transactions (such as excess benefit transactions) and disclosure of certain governance practices.

9. Schedules: Depending on the organization's activities and financial situation, additional schedules may be required to provide more specific information. These schedules could be related to compensation, foreign activities, investments, and more.

It's important to note that the reporting requirements may vary depending on the size and type of organization. Additionally, certain tax-exempt organizations, such as churches, may be exempt from filing a Form 990 but may need to file other forms to maintain their tax-exempt status.

When is the deadline to file irs form 990 in 2023?

The deadline to file IRS Form 990 for the year 2023 would typically be the 15th day of the fifth month following the end of the organization's fiscal year. For calendar year organizations, this would mean May 15, 2024. However, it's important to note that the IRS may grant an extension of time to file the Form 990, pushing the deadline to a later date.

What is the penalty for the late filing of irs form 990?

The penalty for the late filing of IRS Form 990 depends on the size of the organization and the length of the delay. Here are the general penalties:

1. Small Organizations (revenues below $1 million): The penalty is $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less.

2. Large Organizations (revenues above $1 million or filing a 990-EZ): The penalty is $100 per day, up to a maximum of $50,000 or 5% of the organization's gross receipts, whichever is less.

For organizations that are consistently late in filing their Form 990, the penalty can be increased to $100 per day, with no maximum penalty limit.

It's important to note that these penalties are subject to change and it's always recommended to consult with a tax professional or refer to the most recent IRS guidelines for accurate information.

How can I edit irs form 990 2014 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including irs form 990 2014, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the irs form 990 2014 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your irs form 990 2014.

How do I edit irs form 990 2014 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing irs form 990 2014 right away.