Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs schedule form?

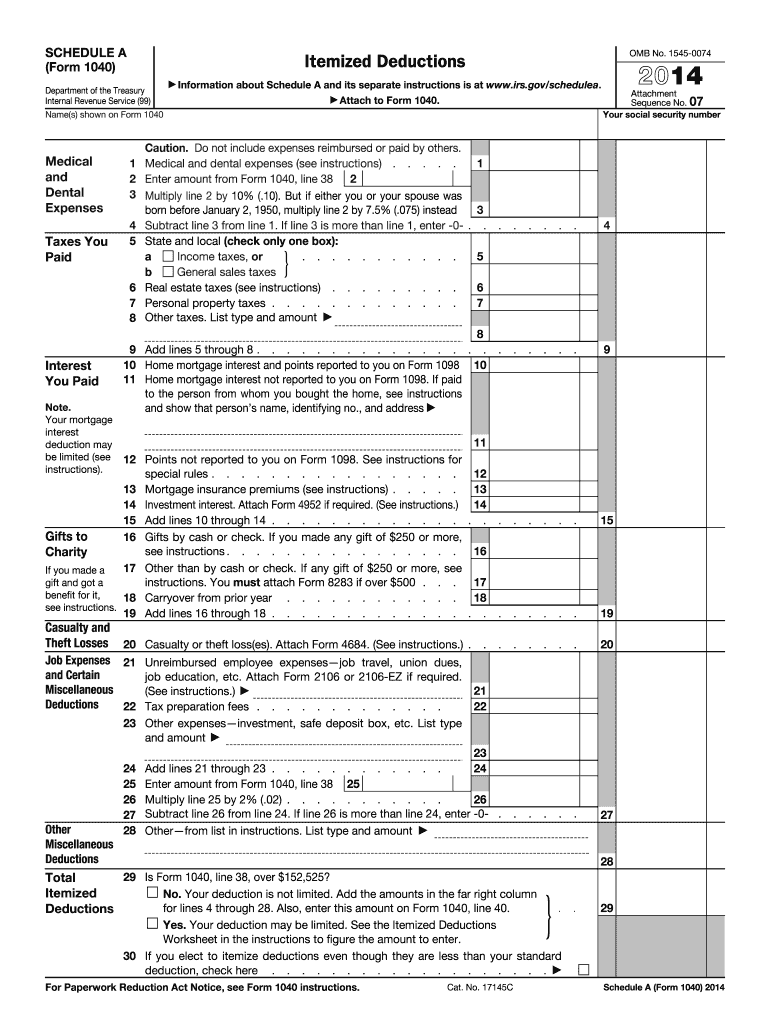

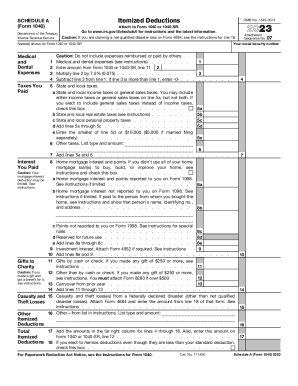

The IRS Schedule Form refers to various forms that individuals and businesses may need to complete and submit along with their tax return. These forms provide additional details and information regarding specific aspects of an individual's or business's income, deductions, credits, and liabilities. The specific schedule forms required may vary depending on the taxpayer's circumstances. Some common examples include Schedule A for itemized deductions, Schedule C for business income and expenses, and Schedule D for capital gains and losses. These forms are used to accurately report various types of income and expenses to the IRS.

Who is required to file irs schedule form?

There are various IRS schedule forms that individuals or businesses may be required to file, depending on their specific circumstances. Some common IRS schedule forms include:

1. Schedule C: This form is used by sole proprietors and single-member LLCs to report their business income and expenses.

2. Schedule D: This form is used to report capital gains and losses from the sale of assets such as stocks, bonds, and real estate.

3. Schedule E: This form is used to report income and expenses from rental properties, royalties, partnerships, S corporations, estates, and trusts.

4. Schedule SE: This form is used to calculate self-employment taxes for individuals who have net self-employment income of $400 or more.

5. Schedule A: This form is used to itemize deductions, such as medical expenses, mortgage interest, state and local taxes, and charitable contributions, for individuals who choose not to take the standard deduction.

It is important to note that the requirement to file specific IRS schedule forms varies based on the taxpayer's income, deductions, credits, and other factors. It is recommended to consult with a tax professional or review the IRS guidelines to determine which schedule forms are applicable to an individual or business.

How to fill out irs schedule form?

Filling out IRS Schedule forms can vary depending on the specific form you are referring to. However, here is a general overview of the steps involved in completing an IRS Schedule form:

1. Determine the correct form: Identify the specific IRS Schedule form you need to fill out based on your specific tax situation. For example, Schedule C is used for self-employment income, Schedule D for capital gains and losses, Schedule E for rental income, and so on.

2. Gather necessary documents: Collect all relevant documents and records needed to complete the form, such as income statements, expense receipts, and other supporting documentation.

3. Understand the form: Review the form instructions and understand the sections and fields you need to complete, as well as any specific requirements or guidelines.

4. Fill out required information: Start by entering your taxpayer identification number (usually your Social Security Number) and basic personal information. Then, proceed to input the requested financial details, such as income, expenses, deductions, credits, or other relevant information as required by the specific form.

5. Perform necessary calculations: Some Schedule forms require you to perform calculations, such as computing the total of certain categories or applying specific formulas. Follow the provided instructions to accurately complete these calculations.

6. Double-check for accuracy: Go through each section of the form and ensure that all information entered is correct and accurate. Mistakes or errors may lead to potential audits or delays in processing your tax return.

7. Attach or include other forms: Depending on the requirements, you may need to attach additional forms, schedules, or supporting documents to your completed Schedule form. Carefully follow the instructions to ensure all necessary items are included.

8. Sign and date the form: Make sure you sign and date the form as required. Certain Schedule forms may also require additional signatures from spouses or other individuals if applicable.

9. Retain copies: Before submitting your completed Schedule form to the IRS, make copies of all the documents for your own records.

10. Submit your form: Finally, submit your completed Schedule form along with your tax return to the IRS. The submission method can vary, so review the specific form instructions to determine the appropriate method for your situation (mail, e-file, etc.).

It is important to note that tax preparation can be complex and professional assistance may be necessary. If you are unsure about any aspect of filling out an IRS Schedule form, consider consulting a tax professional or using tax preparation software.

What is the purpose of irs schedule form?

The purpose of IRS Schedule forms is to report specific types of income, deductions, credits, or tax liabilities that are not addressed on the main tax return form (such as Form 1040). These schedules provide a detailed breakdown of specific aspects of an individual's or a business's financial situation, allowing the IRS to calculate their total tax liability accurately. Depending on the type of income or deductions, various schedule forms may be required, such as Schedule C for reporting business income, Schedule D for reporting capital gains and losses, Schedule E for reporting rental property income, and so on.

What information must be reported on irs schedule form?

The IRS Schedule C form is used to report income or loss from a business or profession operated as a sole proprietorship. The information that must be reported on the Schedule C form includes:

1. Business Information: This includes the name, address, and taxpayer identification number (such as a social security number or employer identification number) for the business.

2. Gross Receipts or Sales: The total amount of money received from all sources related to the business. This includes sales, services rendered, rent, royalties, and other income.

3. Returns and Allowances: The total amount of returns, refunds, and allowances granted to customers.

4. Cost of Goods Sold: If the business sells products, the cost of goods sold must be calculated. This includes the cost of purchasing or producing the goods, including materials, labor, and overhead expenses.

5. Other Expenses: This includes all other expenses directly related to operating the business, such as rent, utilities, advertising, office supplies, insurance, travel, professional fees, and vehicle expenses.

6. Business Use of Home: If the business is operated from a home, the expenses related to the business use of the home, such as mortgage interest, insurance, utilities, repairs, and depreciation, should be reported.

7. Vehicle Expenses: If the business uses a vehicle, the expenses related to its use, such as fuel, maintenance, repairs, insurance, and depreciation, should be reported.

8. Depreciation and Section 179 Expense Deduction: If the business had any depreciable assets (such as equipment or machinery) or made a Section 179 expense deduction, these should be reported.

9. Net Profit or Loss: The net profit or loss is calculated by subtracting the total expenses from the gross receipts or sales.

10. Other Information: The Schedule C form may also require additional information, such as whether the business has employees, whether it engages in certain activities (such as farming or fishing), and whether any payments were made to contractors or vendors.

It is important to note that the Schedule C form should only be completed by individuals operating a sole proprietorship. Different forms and reporting requirements apply to businesses operated as partnerships, corporations, or other entities.

When is the deadline to file irs schedule form in 2023?

The deadline to file IRS Schedule C form in 2023 is typically April 15th. However, it's always recommended to check with the IRS or a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of irs schedule form?

The penalty for the late filing of IRS Schedule forms depends on whether you owe taxes or are due a refund. If you owe taxes, the penalty for filing IRS Schedule forms late is usually 5% of the unpaid tax liability per month or part of a month, up to a maximum of 25% of the total tax owed. If you are due a refund, there is generally no penalty for filing the forms late.

It's important to note that the penalty for late filing can be different if you have a valid extension to file your tax return or if you have reasonable cause for the delay in filing. Additionally, penalties and interest may vary depending on the specific tax laws and regulations applicable in your jurisdiction. It is always recommended to consult with a tax professional or review the official IRS guidelines for accurate and up-to-date information.

How can I send 2014 irs schedule form to be eSigned by others?

Once you are ready to share your 2014 irs schedule form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find 2014 irs schedule form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 2014 irs schedule form and other forms. Find the template you need and change it using powerful tools.

How do I edit 2014 irs schedule form straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit 2014 irs schedule form.