Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

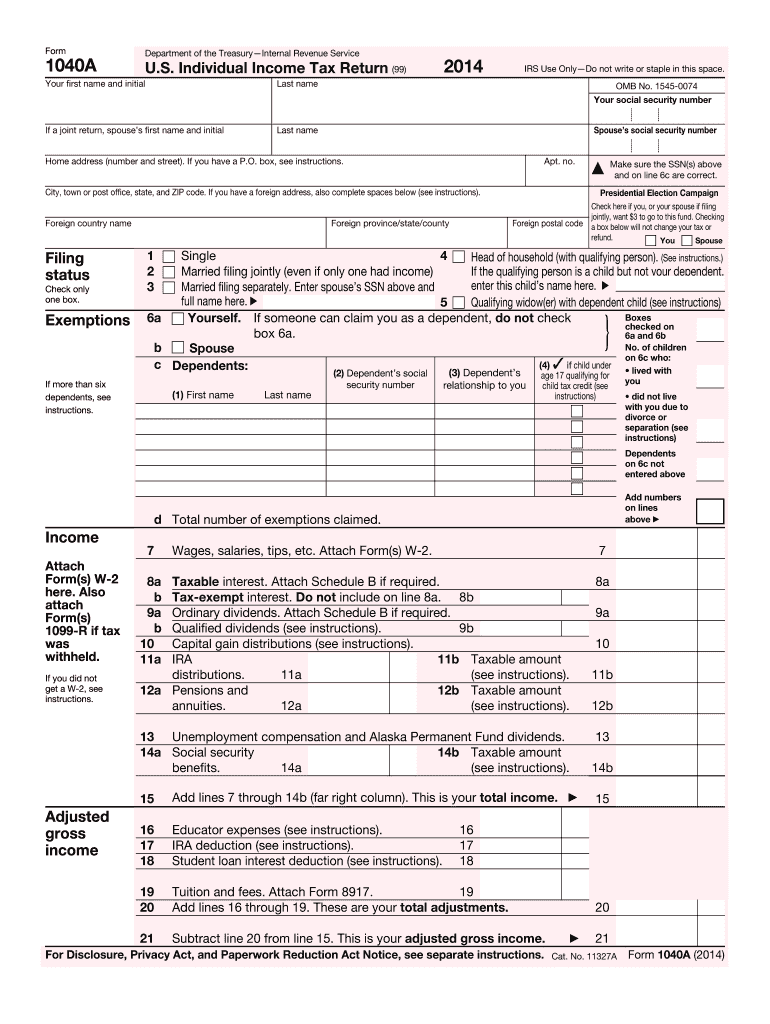

The 1040A form is a simplified version of the Internal Revenue Service (IRS) Form 1040, which is used for reporting an individual's federal income tax return in the United States. It is designed for taxpayers who have relatively straightforward tax situations and do not require itemized deductions. The 1040A form allows taxpayers to claim various credits and deductions, including the Earned Income Credit, the Child Tax Credit, and education credits. This form is often used by individuals with moderate levels of income and standard deductions. As of tax year 2018, the 1040A form has been discontinued, and taxpayers are now required to use Form 1040 or Form 1040-SR.

Who is required to file 1040a form?

The 1040A form is used by individuals with relatively simple tax situations who meet certain criteria. Specifically, the following conditions must be met to file a 1040A form:

1. Taxable income should be less than $100,000.

2. Only standard deductions can be claimed (itemized deductions are not allowed).

3. Only certain tax credits are available for the filer.

4. Interest income should be less than $1,500.

5. The taxpayer cannot claim any adjustments to income (e.g., student loan interest deduction).

It is important to note that the 1040A form has been replaced by the new Form 1040. Taxpayers now generally use Form 1040 to file their federal income tax returns.

How to fill out 1040a form?

Filling out a 1040A form is fairly straightforward. Here are the steps to fill it out:

1. Gather your necessary documents: Before starting, ensure you have all the necessary documents handy, including your W-2 forms, 1099 forms, and any other relevant forms or documentation related to your income, deductions, and credits.

2. Personal information: Begin by entering your personal information at the top of the form, including your name, address, Social Security number, and filing status.

3. Exemptions: If you have any dependents, indicate the number of exemptions you are claiming in the box provided.

4. Income: Report your income on the lines provided in each section. This includes wages, salaries, tips, interest income, dividends, and any other sources of income you have. Follow the instructions provided for each line in order to report your income accurately.

5. Adjustments: If you are eligible for any adjustments, such as student loan interest deduction or IRA contributions, report them on the appropriate lines.

6. Taxable income: Subtract the total adjustments from your income to calculate your taxable income and enter it on the designated line.

7. Tax and credits: On the tax table provided in the instructions, locate the tax amount corresponding to your taxable income and filing status, and enter it on the appropriate line.

8. Credits: If you qualify for any tax credits, report them on the appropriate lines, such as the Child and Dependent Care Credit or the Retirement Savings Contributions Credit. Follow the instructions closely to ensure accurate reporting.

9. Payments and refund/amount owed: Report any tax withheld from your paychecks, estimated tax payments, or any other payments made towards your tax liability. Calculate the difference between your total tax and total payments to determine if you are entitled to a refund or if you owe any additional tax.

10. Sign and date: Finally, sign and date the form at the bottom.

Remember to double-check your calculations, review the instructions provided with the form, and keep copies of all documents and the completed form for your records. If you are uncertain about any aspect of the form, it may be helpful to consult a tax professional.

What is the purpose of 1040a form?

The purpose of the 1040A form is to report an individual's income and claim various tax deductions, credits, and adjustments to determine their federal income tax liability. It is a simplified version of the standard 1040 form and is available for certain taxpayers who meet specific criteria, such as having income under a certain threshold and not itemizing deductions.

What information must be reported on 1040a form?

The 1040A form is a simplified version of the 1040 form used by individuals to file their federal income tax returns with the Internal Revenue Service (IRS). The information that must be reported on the 1040A form includes:

1. Personal information: This includes the taxpayer's name, address, filing status (such as single, married filing jointly, etc.), and Social Security number.

2. Income: The taxpayer must report their total income from various sources including wages, salaries, tips, interest, dividends, pensions, and certain types of retirement plans. These income sources must meet the eligibility requirements for using the 1040A form.

3. Adjustments to income: Certain deductions, also known as adjustments to income, can be claimed on the 1040A form. These include deductions for contributions to traditional Individual Retirement Accounts (IRAs), student loan interest, educator expenses, and certain self-employment expenses.

4. Tax credits: The 1040A form allows for claiming various tax credits, such as the Child Tax Credit, Child and Dependent Care Credit, and the Retirement Savings Contributions Credit.

5. Federal taxes withheld: The taxpayer needs to report the amount of federal income tax that was withheld from their paychecks or other income sources throughout the year.

6. Other taxes: If applicable, the taxpayer must report any additional taxes owed, such as self-employment taxes or household employment taxes.

7. Refund or amount owed: After calculating the total tax liability and applying any credits or deductions, the taxpayer will determine whether they are owed a refund or need to pay additional taxes.

It is important to note that the 1040A form is no longer available for use starting with the tax year 2018. Taxpayers now use Form 1040 or Form 1040-SR instead.

When is the deadline to file 1040a form in 2023?

The deadline to file Form 1040A for the year 2023 is typically April 17, 2024. However, it's always a good practice to check with the Internal Revenue Service (IRS) for any updates or changes to the deadline.

What is the penalty for the late filing of 1040a form?

The penalty for late filing of the 1040A form varies depending on whether you owe taxes or are owed a refund.

If you owe taxes and fail to file your 1040A form by the tax deadline (typically April 15th), you may be subject to a penalty for failure to file. The penalty is usually 5% of the unpaid tax amount for each month or part of a month that the return is late, up to a maximum penalty of 25% of the unpaid tax.

However, if you are owed a refund, there is no penalty for filing your 1040A form late. In such cases, you are basically giving the government an interest-free loan by delaying your refund.

It's worth noting that if you have a legitimate reason for not being able to file your tax return on time, such as a medical emergency or natural disaster, you may be able to request an extension or have the penalty waived.

How can I send 1040a 2014 form for eSignature?

1040a 2014 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my 1040a 2014 form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your 1040a 2014 form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit 1040a 2014 form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 1040a 2014 form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.