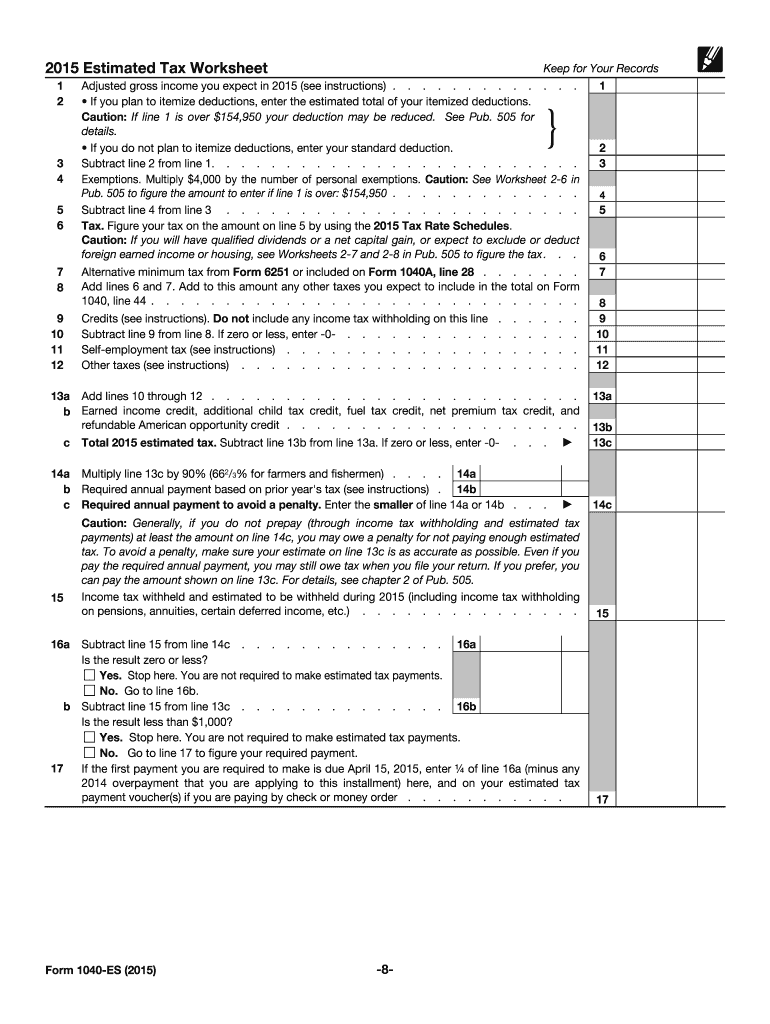

IRS 1040-ES 2015 free printable template

Instructions and Help about IRS 1040-ES

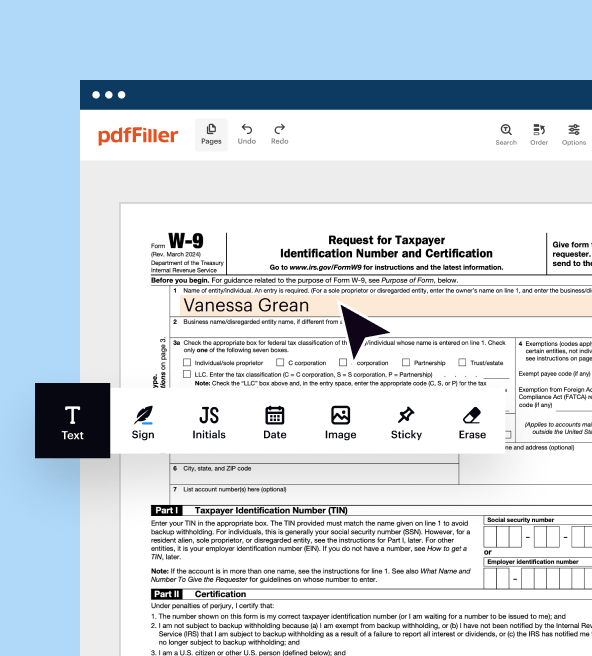

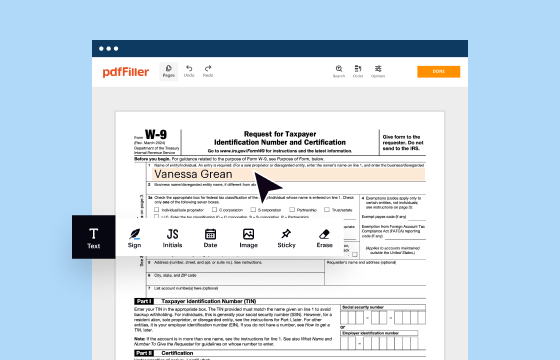

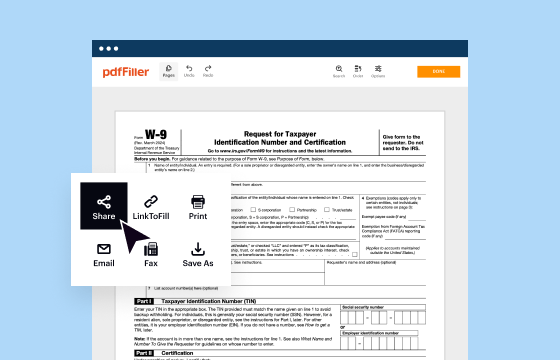

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

About IRS 1040-ES 2015 previous version

What is IRS 1040-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

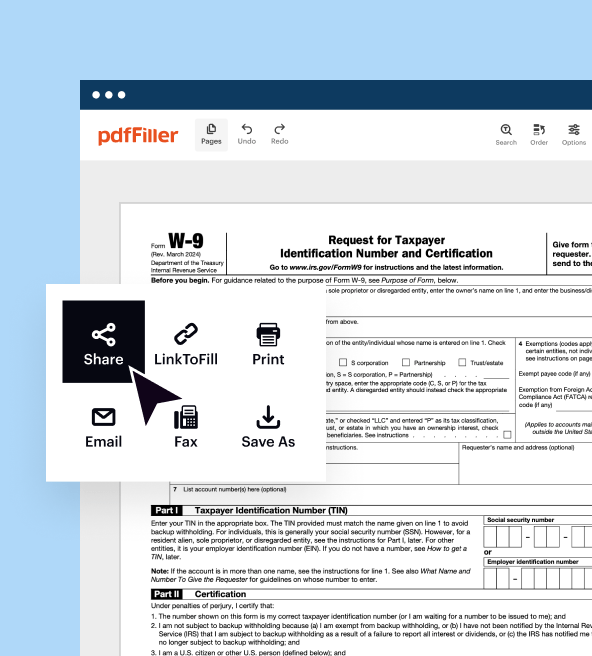

Where do I send the form?

FAQ about IRS 1040-ES

What should I do if I made a mistake on my IRS 1040-ES after filing?

If you made a mistake on your IRS 1040-ES, you can correct it by submitting an amended form. It's crucial to file this as soon as you discover the error to avoid any potential penalties or issues with processing your payment. Ensure you keep a copy of both the original and amended forms for your records.

How can I track the status of my IRS 1040-ES submission?

To track the status of your IRS 1040-ES submission, you can use the IRS's online tools, which provide updates on whether your payment has been processed. If you e-filed, you may encounter common rejection codes that indicate issues needing correction before resubmission. Regularly checking your status helps ensure that everything is in order.

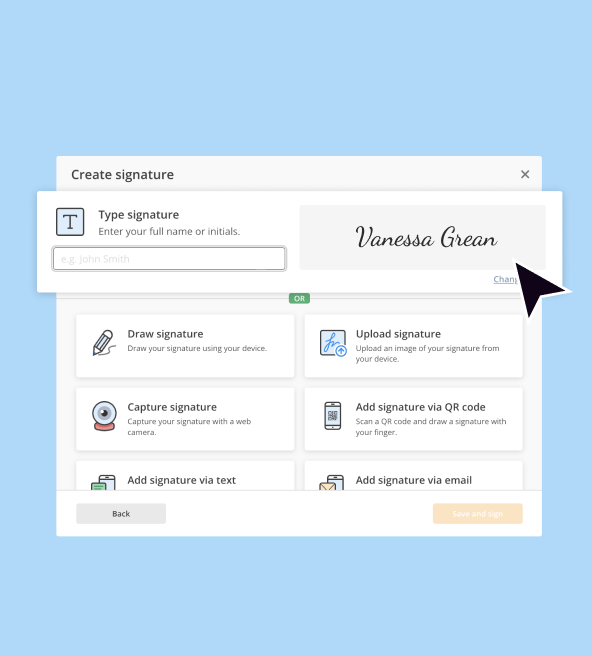

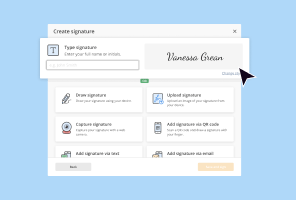

Are electronic signatures acceptable for IRS 1040-ES?

Yes, electronic signatures are acceptable for IRS 1040-ES submissions, but it is essential to ensure that your e-filing software is compliant with IRS standards. Always review your software’s specific requirements to maintain record security and verification.

What should I do if I receive a notice from the IRS regarding my IRS 1040-ES?

If you receive a notice from the IRS about your IRS 1040-ES, promptly read the instructions provided. It's crucial to respond within the given time frame, preparing any necessary documentation to substantiate your case. Ignoring the notice may lead to further complications, including potential audits.

What are some common errors to avoid when filing IRS 1040-ES?

Common errors when filing IRS 1040-ES include incorrect amounts, misreported Social Security numbers, and not following the specific instructions for various payment methods. Double-checking your entries and ensuring you're using the latest version of the form can help prevent these issues.

See what our users say