Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

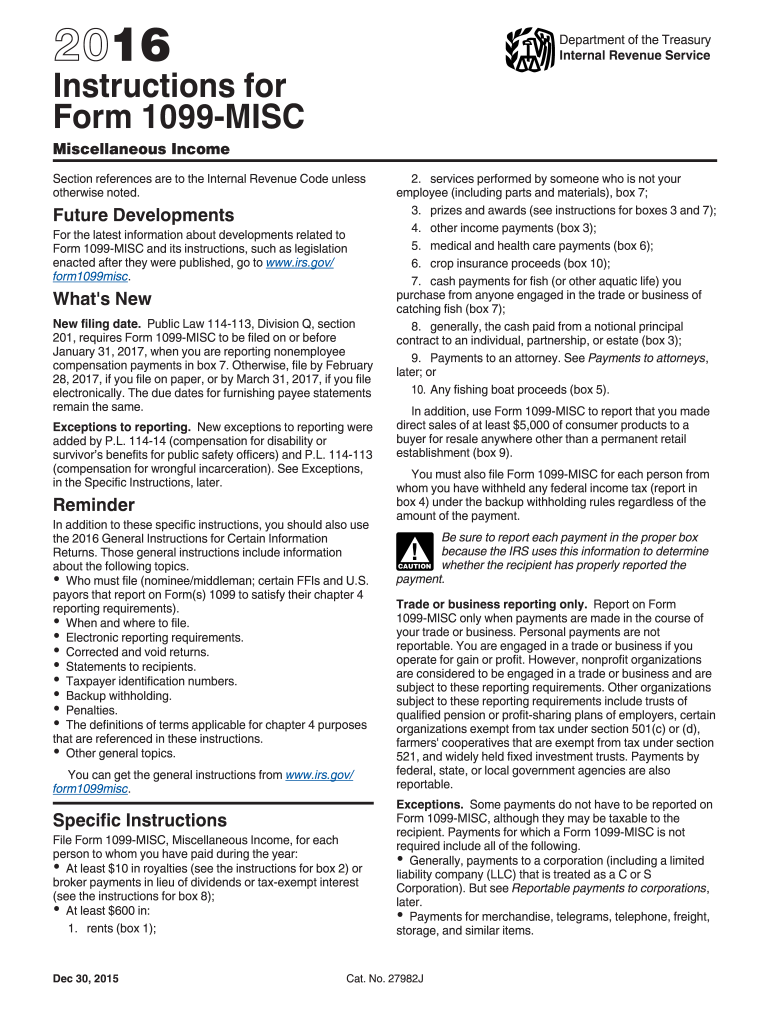

What is irs 1099 instructions form?

Form 1099 Instructions is a document provided by the Internal Revenue Service (IRS) to provide guidance on how to complete and submit Form 1099. It includes information on who needs to file the form, what types of payments should be reported, how to determine the amounts to report, and the deadlines for submission. Form 1099 is used to report various types of income, such as income from self-employment, rental income, and miscellaneous income. The instructions help taxpayers understand their reporting requirements and ensure compliance with tax laws.

Who is required to file irs 1099 instructions form?

The IRS requires certain individuals and businesses to file Form 1099. Those who are required to file Form 1099 are generally individuals or entities who:

1. Paid at least $600 in income to a non-employee individual or business, such as a contractor, freelancer, or vendor.

2. Made payment of $10 or more in royalties or broker payments in lieu of dividends or tax-exempt interest.

3. Paid at least $600 in rents, prizes, awards, or other income payments.

4. Made payments of $600 or more to an attorney for legal services.

5. Engaged in any fishing boat proceeds paid to individuals.

6. Made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

It's important to consult the official IRS instructions and guidelines to determine whether you are required to file Form 1099 in a specific situation.

How to fill out irs 1099 instructions form?

To fill out IRS form 1099, follow these steps:

1. Obtain a blank Form 1099 from the IRS website or from your tax software.

2. Check the box that corresponds to the type of income you are reporting. There are different boxes for various types of income such as miscellaneous income, interest income, dividend income, or real estate transactions.

3. Enter your personal information in the appropriate fields, including your name, address, and social security number or employer identification number.

4. If you are reporting income for someone other than yourself, enter their name and identification number in the designated area.

5. Fill in the recipient's address and identification number in the provided fields.

6. If applicable, enter the account number related to the income being reported.

7. Enter the amount of income you are reporting in the appropriate box. Ensure you enter the correct numerical value.

8. If necessary, include any federal or state income tax withheld on the income reported.

9. Add any additional information required, such as tax-exempt interest, reimbursement of expenses, or backup withholding.

10. Fill out your contact information at the bottom of the form, including your name, telephone number, and email address, if provided.

11. Make a copy of the completed form for your records.

12. Send Copy A of the form to the IRS by the due date mentioned in the instructions. Copy B is for the recipient, Copy C is for your records, and Copy 1 is for state, city, or local tax department if necessary.

Note: It is crucial to review and follow the specific instructions provided by the IRS for the particular type of Form 1099 you are filling out, as certain requirements may vary. It is also recommended to consult a tax professional for assistance and ensure accuracy.

What is the purpose of irs 1099 instructions form?

The purpose of IRS 1099 Instructions form is to provide detailed guidance and instructions for the completion and submission of various types of 1099 forms. The instructions explain who needs to file these forms, which form to use, how to fill it out correctly, and when and where to submit it to the Internal Revenue Service (IRS). These instructions also include information on reporting requirements, deadlines, penalties for non-compliance, and any updates or changes to the regulations. The 1099 form is used to report various types of income, such as freelancers' earnings, rental income, interest income, or dividends, to the IRS for tax purposes.

What information must be reported on irs 1099 instructions form?

The IRS Form 1099 instructions typically require the following information to be reported:

1. Payer Information: The name, address, and TIN (Taxpayer Identification Number) of the payer (individual or business) who made the payments.

2. Recipient Information: The name, address, and TIN (usually the Social Security number or Employer Identification Number) of the recipient (individual or business) who received the payment.

3. Payment Information: The amount of the payment made to the recipient during the year, categorized into different types of income, such as interest, dividends, rent, royalties, nonemployee compensation, etc.

4. Backup Withholding: If backup withholding was applicable (i.e., the payer withheld taxes from the payment), this information must be included.

5. Federal Income Tax Withheld: If federal income tax was withheld from the payment, the amount withheld must be reported.

6. State Reporting: Some states require additional reporting, so the form may include sections for reporting the payment information for state tax purposes.

It's essential to review the specific instructions provided by the IRS for each type of 1099 form (e.g., 1099-MISC, 1099-INT, 1099-DIV) to ensure accurate and complete reporting.

When is the deadline to file irs 1099 instructions form in 2023?

The deadline for filing IRS Form 1099 in 2023 is January 31, 2024. This deadline applies to both paper and electronic filing.

What is the penalty for the late filing of irs 1099 instructions form?

The penalty for late filing of IRS Form 1099 can vary depending on the degree of lateness and the size of the business. Here are some general penalties:

1. If you file within 30 days of the due date (by March 30 if filing electronically), the penalty is $50 per form, with a maximum penalty of $194,500 per year.

2. If you file after 30 days but before August 1, the penalty increases to $110 per form, with a maximum penalty of $556,500 per year.

3. If you file after August 1 or if you don't file at all, the penalty is $280 per form, with a maximum penalty of $1,113,000 per year.

It's important to note that these penalties can be reduced or waived if there is reasonable cause for the late filing. Additionally, penalties may vary for small businesses with average annual gross receipts of $5 million or less. It is advised to consult with a tax professional for accurate and specific information related to your situation.

How can I edit irs 1099 instructions 2016 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including irs 1099 instructions 2016, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send irs 1099 instructions 2016 for eSignature?

Once your irs 1099 instructions 2016 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the irs 1099 instructions 2016 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your irs 1099 instructions 2016 in seconds.