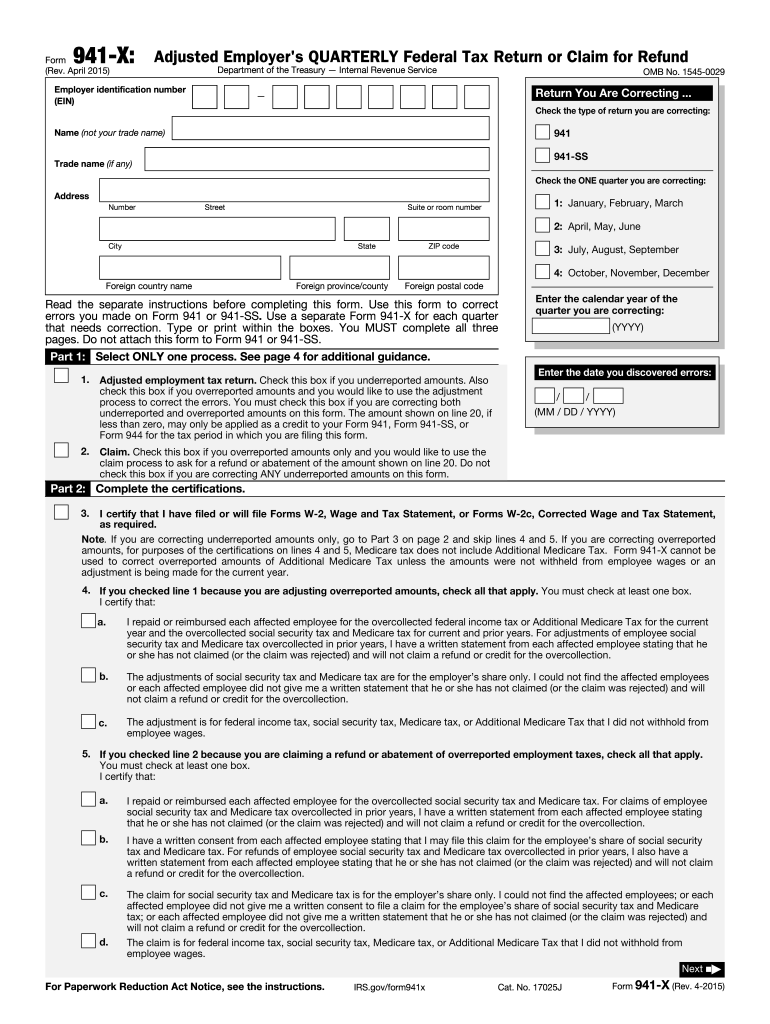

Who needs a 941-X form?

The IRS form 941-X is used by the taxpayers who want to amend their business’ quarterly federal tax return on employee wages or claim for a refund. A separate form 941-X is required for each tax return you wish to amend. This form can be used only by the individuals who filed the IRS forms 940 or 941.

What is the purpose of the 941-X form?

The main purpose of this form is to report the IRS about the important amendments to the Employer’s Quarterly Tax Return form. The filler indicates all the required corrections in special sections and explains why they occur.

With the IRS Form 941-X the taxpayer can amend:

• Wages, tips, and other compensation;

• Income tax withheld from wages, tips, and other compensation;

• Taxable social security wages;

• Taxable social security tips;

• Taxable Medicare wages and tips;

• Taxable wages and tips subject to Additional Medicare Tax withholding

What other forms and documents must accompany the 941-X form?

The taxpayers don’t have to attach other forms to the 941-X form. However, they need to send proof of the changes to their return. For example, a bank statement or other document that evidence the new wage should be provided.

When is the 941-X form due?

There is no due date for this form. Send it in as soon as you discover an error on your quarterly tax forms. The last page of the form contains instructions as for the filing process which depends on the date of filing the 941-X form.

What information should be provided in the 941-X form?

The employers have to indicate their personal information and fill out all the required sections.

The form should be signed by the preparer as well.

What do I do with the form after its completion?

The completed and signed form is forwarded to the IRS. Choose the appropriate address on the instruction for form 941-X.