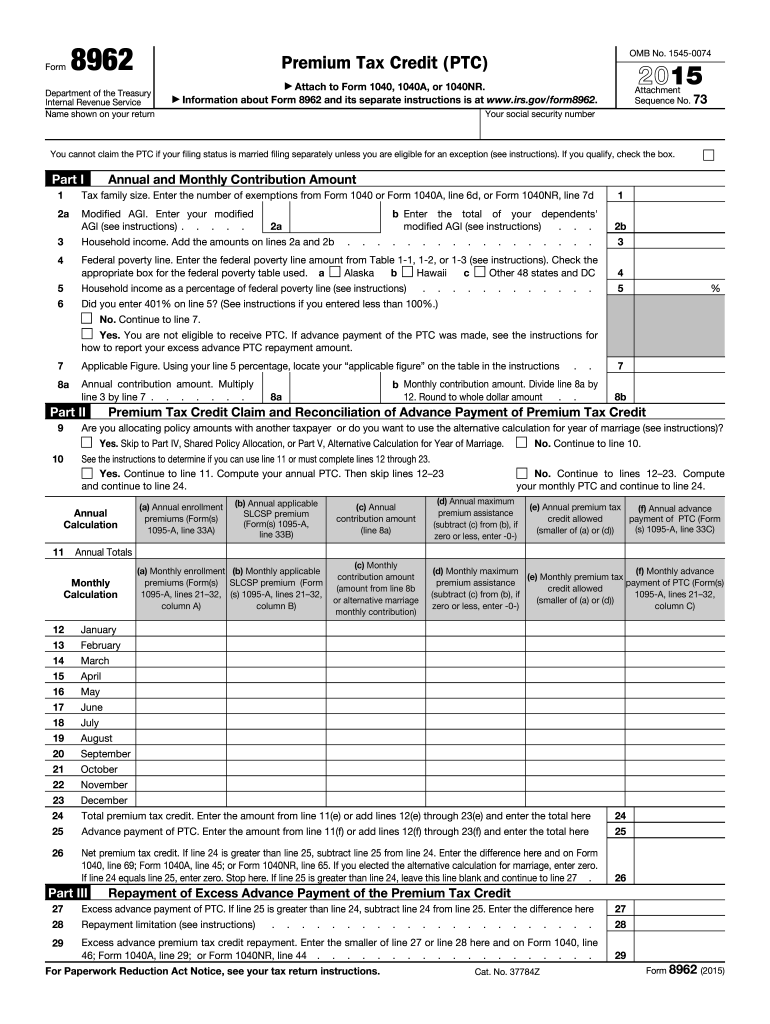

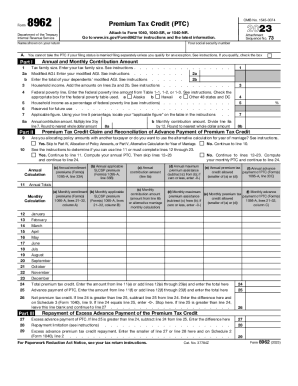

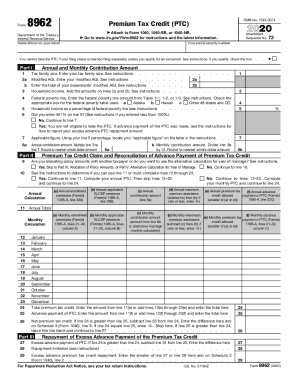

IRS Form 8962 - the Premium Tax Credit

Following on Form 8962 for those of you claiming the Premium Tax Credit.

What is the purpose of Form 8962?

Individuals need an 8962 Form if they filed the Form 1040, Form 1040A, or Form 1040-NR, and if either of the following conditions apply:

• The individual is taking the PTC.

• APTC (Advanced Premium Tax Credit) was paid the taxpayer or another individual in the taxpayer’s tax family.

• APTC was paid for an individual including taxpayer for whom the taxpayer told the Marketplace that he or she would claim a personal exemption, and neither the taxpayer nor anyone else claims a personal exemption for that individual.

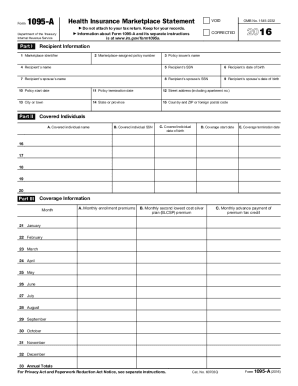

Is the Form accompanied by other forms?

If necessary, the Form 8962 is filed with Form 1040. While the Form 1095-A does not have to be attached the tax return, information from the Form 1095-A is used to complete the Form 8962.

When is the Form 8962 due?

The Form 8962 is attached to your tax return. The general filing date for an individual tax return is April 15th. If an extension is filed, the extended filing due date is generally October 15th.

How is the Form 8962 completed?

The Form 8962 is divided into five parts. Part I, (Annual and Monthly Contribution Amount), Part II, (Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit), Part III, (Repayment Excess Advance Payment of the Premium Tax Credit)., Part IV, (Shared Policy Allocation), Part V, (Alternative Calculation for Year of Marriage).

Part I:

Line 1: Enter the number of exemptions from your Form 1040 or Form 1040 A, (line 6d), or Form 1040 NR (line 7d).

Line 2a: Enter your modified AGI (Adjusted Gross Income).

Line 2b: Enter the combined modified AGI for your dependents who are required to file an income tax return because their income meets the income tax return filing threshold.

Line 3: Add the amounts on lines 2a and 2b.

Line 4: Check the box to indicate your state of residence for the current tax year.

Line 5: Figure your household income as a percentage of the federal poverty level guidelines.

Line 6: If the amount on 5 is at least 100%, but no more than 400%, check the box “No” on line 6 and continue to line 7.

Line 7: Enter the decimal number from Table 2 (page 8 of form instructions) that applies to the amount you entered on line 5.

Line 8a: Line 3 by line 7 and enter the result on line 8a rounded to the nearest whole dollar amount.

Line 8b: Divide line 8a by 12.0 and enter the result on line 8b, rounded to the nearest whole dollar amount.

Part II:

Line 9: Refer to form instructions.

Line 10: Refer to form instructions.

Line 11: Annual Totals (Columns A-F), refer to form instructions. If you checked the “Yes” box on line 6, or you are using the filing status, married filing separately and exception 2 – Victim of domestic abuse or spousal abandonment, earlier, does not apply to you, skip columns (a) through (e) and complete only column (f) later.

Lines 12-23: Monthly Calculation.

Refer to form instructions.

Line 24: Enter the amount from line 11 (e) or add lines 12 (e) through 23 (e) and enter the total.

Line 25: Enter the amount from line 11 (f) or add lines 12 (f) through 23 (f) and enter total.

Line 26: Net Premium Tax Credit. Refer to form instructions.

Part III:

Line 27: If line 25 is greater than line 24, subtract line 24 from line 25 and enter the result.

Line 28: Refer to form instructions.

Line 29: Enter the smaller of line 27 or line 28. If Line 28 is blank, enter the amount from line 27 on Line 29. Also the amount from Form 1040NR, line 44.

Part IV:

Lines 30-34: Refer to form instructions.

Part V:

Complete this section to elect the alternative calculation for your pre-marriage months. Electing the alternative calculation is optional, but may reduce the amount of excess APTC you must pay. Refer to form instructions for more details.

Line 35: Complete columns (a) through (d) as indicated in Publication 974 (Premium Tax Credit) under Alternative Calculation for Year of Marriage.

Line 36: Complete columns (a) through (d) as indicated in Publication 974 under Alternative Calculation for Year of Marriage.

Where do I file form 8962?

You should send form 8962 along with your 1040 to the following mailing address: Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0027