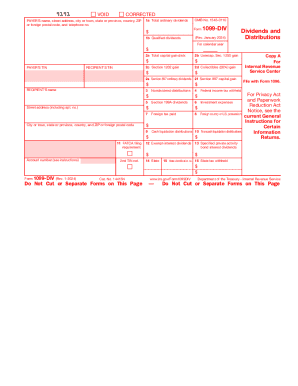

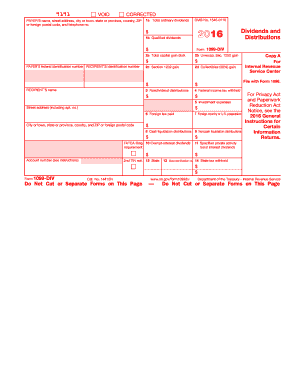

What is the purpose of 1099-DIV 2015 form?

Financial entities, like banks and investment companies, use 1099-DIV (Dividends and Distribution Form) to report dividends and distributions (that are considered a taxable income) paid out to taxpayers. They can include but are not limited to total capital gains, qualified dividends, foreign tax paid, and others. The form must be sent to the investors by mail and furnished to IRS. Please note that taxpayers may receive a few 1099 DIV forms and must provide the information from each form on their annual tax return.

Who needs a 1099-DIV 2015 form?

Form 1099 DIV is used to record the paid dividends, foreign tax on dividends, and other distributions on the stock that exceed $10 or more. This tax form should be completed by the person or financial institution which paid the dividends and sent to the person who received these dividends.

What information should be provided in the 1099-DIV?

In 1099 DIV Forms, the filer has to indicate the payer’s name, address, federal identification number, recipient’s identification number, recipient’s address, account number.

The information about the income and withheld taxes also should be provided: total ordinary dividends, qualified dividends, total capital gain, non-dividend distribution, foreign tax paid, cash liquidation distribution, exempt-interest dividends, federal income tax withheld, investment expenses, etc.

If you need additional information on the amounts provided on your Form 1099-DIV, please contact your tax advisor or the financial institution that sent the form in 2016.

What other forms must accompany 1099-DIV Form?

Depending on your unique case, you might also receive 1099 DIV along with 1099-CAP, 1099-INT, 1099-OID, 1099-PATR, or 1099-R.

When do I receive 1099-DIV Form in 2016?

The taxpayers receive 1099-DIV by the end of January.

What to do after I receive Form 1099 DIV?

The information on 1099-DIV Form (Box 1a through Box 12) is used to file your tax return (1040 and Schedule B). For more information, please make sure to check out 1099 DIV instructions.