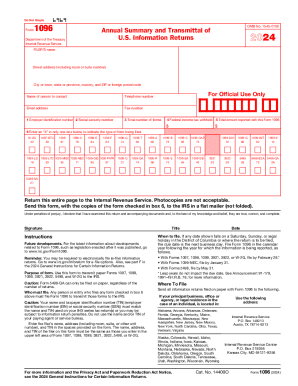

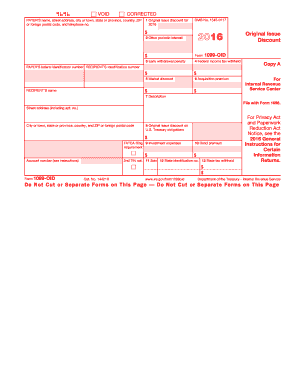

IRS Form 1096 - the Annual Summary and Transmittal of US Information Return. "Huh", you say?

You've heard a lot about IRS Form 1096 in the past couple of weeks in relation to filing 1099s. We at IRS Form 1096 is a compilation form, which provides totals for all information forms that you submitted to the IRS and recipients. Form 1096 must be submitted for every type of information return you provided a recipient.

Who has to file a 1096?

The answer depends on which one of the thirty information forms listed on 1096 you are submitting to the IRS and to recipients. Filers include: financial institutions, corporate or small business payroll, educational institutions, government units, insurance companies, brokers, mortgage lenders, real estate agent closing sales, multiple homeowners, subsequent loan holders, multiple lenders, small businesses, corporations, casino, lottery, racetracks or other gambling operations.

A Form 1096 must accompany all PAPER filed Forms, 1097, 1098, 1099, 3921, 3922, 5498, or W-2G. You must group the forms by form number. Attach a separate form 1096 to each group of forms.

Why do I need to file form 1096?

The IRS requires that corporations or payers use this form in conjunction with other required informational forms when they are filing paper forms. It serves as a summary of informational returns that have been sent to the IRS for tracking purposes.

Is there a penalty if I don’t include a 1096 with my forms?

Yes. If you file up to 250 returns on paper, those returns will not be subject to a penalty for failure to file electronically. If you file late, the penalty starts at $30 per informational return and depends on how late you submit Form 1096 and the form filings.

How many 1096 forms do I need to submit?

You must submit a 1096 for every group of form filings that you are sending to the IRS. Put the total number of forms for that single group on the 1096 form. Use additional 1096 forms for each additional group of form filings. For example, if you are submitting ten 1099-A forms, then you would add that number in box 3 and an “x” in the appropriate form category in box 6. However, if you also need to submit 1099-B forms, you would use a new 1096 form.

If you are submitting 250 returns as part of your form filings, then you cannot submit these forms by paper. The IRS requires that you submit them electronically.

When is the 1096 form due?

Filing dates for Form 1096 vary. It is advisable that you check the deadline for the specific form that you are submitting. Most of the forms you plan on submitting by paper are due the last business day in February.

February 29, 2016: Forms 1097, 1098, 1099, 3921, 3922, or W-2G on paper. File Form 1096 with paper forms.

March 31, 2016: Forms 1097, 1098, 1099, 3921, 3922, or W-2G if filing electronically. If you file 250 or more returns, you MUST file electronically. You do not have to include form 1096 if you are filing these electronically.

May 31, 2016: Form 1096 with Forms 5498, 5498-ESA, and 5498-SA.

You can file by the next business day if the regular due date falls on a Saturday, Sunday, or legal holiday. Remember to follow deadlines for each informational form for submitting these forms to recipients.

Can I get an extension?

Yes. Fill out Form 8809, Application for Extension of Time to File Information Returns. This will provide you an automatic 30-day extension of time to file.

What forms that I submit to the IRS have to be accompanied with a 1096?

Thirty forms are listed on the 1096. You must include one 1096 form for each of the group of forms and tally up the number of contractors or parties you sent that specific form to on your 1096 form.

W-2G - Certain Gambling Winnings

1097 - BTC Bond Tax Credit

1098 - Mortgage Interest Statement

1098-C - Contribution of Motor Vehicles, Boats, and Airplanes

1098-E - Student Loan Interest Payments

1098-Q - Qualifying Longevity Annuity Contract Information - QLACs are deferred income annuities that pay monthly income beginning at an advanced age, such as 80 or 85. They are purchased from an insurance company for an employee. When you issue any contract that is intended to be a qualifying longevity annuity contract (QLAC), you must report this to the IRS to report the value of the QLAC. It reports to the IRS and the individual how much the individual has invested in a QLAC.

1098-T - Educational institutions file this form for each student they enroll. It’s a tuition statement.

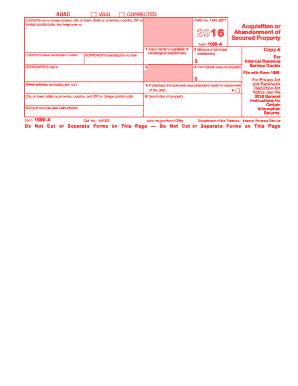

1099-A - Acquisition or Abandonment of Secured Property for a borrower if money was lent in connection with a trade or business

1099-B - Proceeds from Broker and Barter Exchange Transactions

1099-C - Acquisition or Abandonment of Secured Property and Cancellation of Debt – if you cancel a debt of $600 or more in connection with a foreclosure or abandonment of secured property, you can file this form rather than 1099-A.

1099-CAP - Changes in Corporate Control and Capital Structure for shareholders of a corporation if control of the corporation was acquired or it underwent a substantial change in capital structure. Shareholders who receive cash, stock, or other property from an acquisition of control or a substantial change in capital structure.

1099-DIV - Banks and other financial institutions report dividends and other distributions to taxpayers and the IRS.

1099-G - Officer or employee of the government unit having control of payments must file this form. Certain government payments if, as a unit of a federal, state, or local government, you made payments of unemployment compensation; state or local income tax refunds, credits, or offsets; reemployment trade adjustment assistance (RTAA) payments; taxable grants; or agricultural payments. Also, used if they received payments on a Commodity Credit Corporation (CCC) loan.

1099-INT - Banks send this to recipients to report interest income that they paid an individual from savings accounts, bonds and certain treasury accounts.

1099-K - Payment settlement entity (PSE) files this form to report payments made with a credit card or payment card and certain other types of payments, including third party network transactions. It is income that the form recipient received from credit cards, debit cards, or other electronic payments, such as eBay and Pay Pal. Business will see their income on these forms if they had more than 200 credit card transactions and more than $20,000 gross income form credit card sales.

1099-LTC - Long-Term Care and Accelerated Death Benefits. Insurance companies, government units and life insurance providers file this form if they paid any long-term care benefits, including accelerated death benefits.

1099-MISC - Miscellaneous income that you pay to each person during the year, which must be at least $10 in royalties, at least $600 for various other reasons, or made through direct sales of at least $5,000 of consumer products to a buyer for resale.

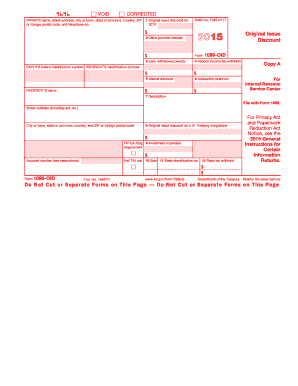

1099-OID - OID is a form of interest mostly from zero coupon bonds or some periodic coupon payments. The issuer of the debt instrument or broker gives you the form Original Issue Discount, if the total OID for the calendar year is $10 or more.

1099-PATR - Taxable Distributions Received from Cooperatives. When a cooperative pays a person at least $10 in patronage dividends and other deductions the IRS requires that they submit this form.

1099-Q - Payments from Qualified Education Programs. This reports the total withdrawals you made from a qualified tuition program. It comes from the administrator or bank that manages your educational program.

1099-QA - Distribution from ABLE Account. The Achieving a Better Life Experience (ABLE) Act was passed in 2014 and authorized the creation of tax-favored accounts for qualified individuals challenged by disabilities.

1099-R - Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance, Contracts

1099-S - Report Sale or Exchange of Real Estate

1099-SA - Distribution from a HAS, Archer MSA, or Medicare Advantage MSA

3921 - Exercise of an Incentive Stock Option under Section 422(b). Employers provide this to employees for each exercise of incentive stock options that occurred during a calendar year.

3922 - Transfer of Stock Acquired Through an Employee Stock Purchase Plan under Section 423(c). An employee stock purchase is a way in which employees of corporations can purchase corporation’s stock often at a discount. Businesses are required to report any of these acquisitions.

5498 - IRA Contribution Information – Financial institutions send this form to report information about individual retirement accounts and tax-preferred savings accounts. It confirms the amounts an individual contributed to IRAs and other tax-preferred savings accounts.

5498-ESA - Contribution Information that reports rollover contributions about Coverdell Education Savings Accounts that provide tax incentives for saving for future school expenses.

5498-QA - Any State or its agency or instrumentality that establishes and maintains a qualified ABLE program must file this form with the IRS, for each ABLE account.

5498-SA - HSA, Archer MSA, or Medicare Advantage MSA Information – Health Savings Account summary of contributions to and the fair market value of your health related accounts.

How do I fill out a 1096 form?

Supply your company’s name and address, as well as a name of a person to contact and all of their contact information. Include either an EIN or Social Security Number. Include the total number of forms that you are sending to the IRS and add that to Box 3. In Box 4, enter the total amount of Federal income tax withheld on all the forms you are submitting. In Box 5, enter the total amount of reported payments on all forms you are submitting. In Box 6, enter an “x” in the box for the type of form you are submitting. You can use Form 1096.

For those of you who are real gluttons for punishment, you can check out the following video about filling out Form 1096:

Whew! That's a wrap!