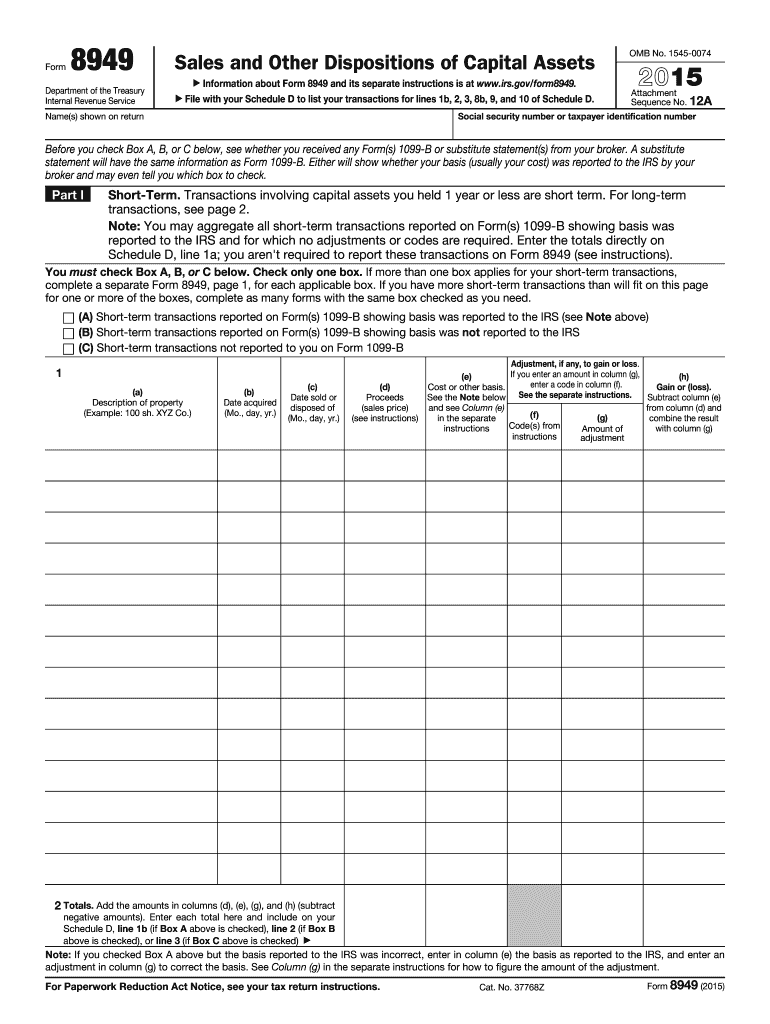

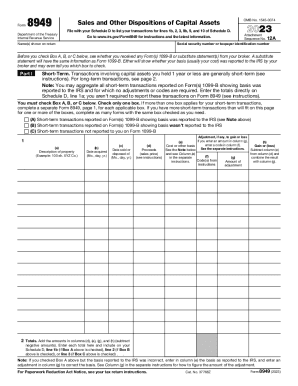

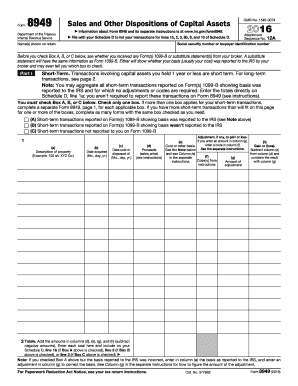

Who needs an IRS 8949 Form?

The Internal Revenue Service issued 8949 Form in 2011 to oblige individuals, partnerships and corporations to report short- and long-term capital gains and losses from sales or investment exchange. Previously, investment activity was reported on Schedule D.

What is IRS Form 8949 for?

The full name of the IRS 8949 Form is the Sales and Other Dispositions of Capital Assets. It is required to report gains and losses in the short- or long-term transactions involving sales or exchange of capital assets; these can be distributed and undistributed capital gains, sales of partnership interest or stocks, losses from wash sales, profit and losses for options trading, disposition of inherited assets, etc.

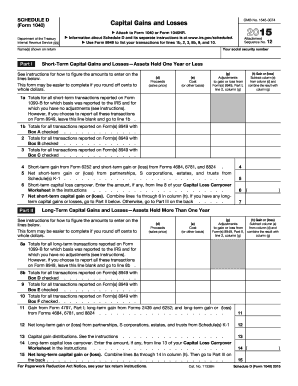

Is the IRS 8949 Form accompanied by other forms?

According to the new IRS requirements, form 8949 must be filed in conjunction with form 1099-B and Schedule D. Schedule D, in its turn, includes Forms, 1040, 1041, 1065,1120, 1120-S, 8282, etc.

When is the fillable 8949 Form due?

The IRS form 8949 must be submitted when the federal tax return is. In 2016, its due date is April, 18.

How do I fill out 8949 Form?

The 8949 is a two-page form, which should bear the information about a person filing tax return (their name and SSN or TIN). Then, the for has two parts: Part 1—- for short-term transactions and Part 2 — for long-term. The information on the transactions listed should include the following: property (and its description), dates of acquisition and sale, proceeds, cost, gain or loss.

Where do I send IRS Form 8949?

The completed IRS Form 8949 should be directed to the IRS local office along with the yearly tax return report.