Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

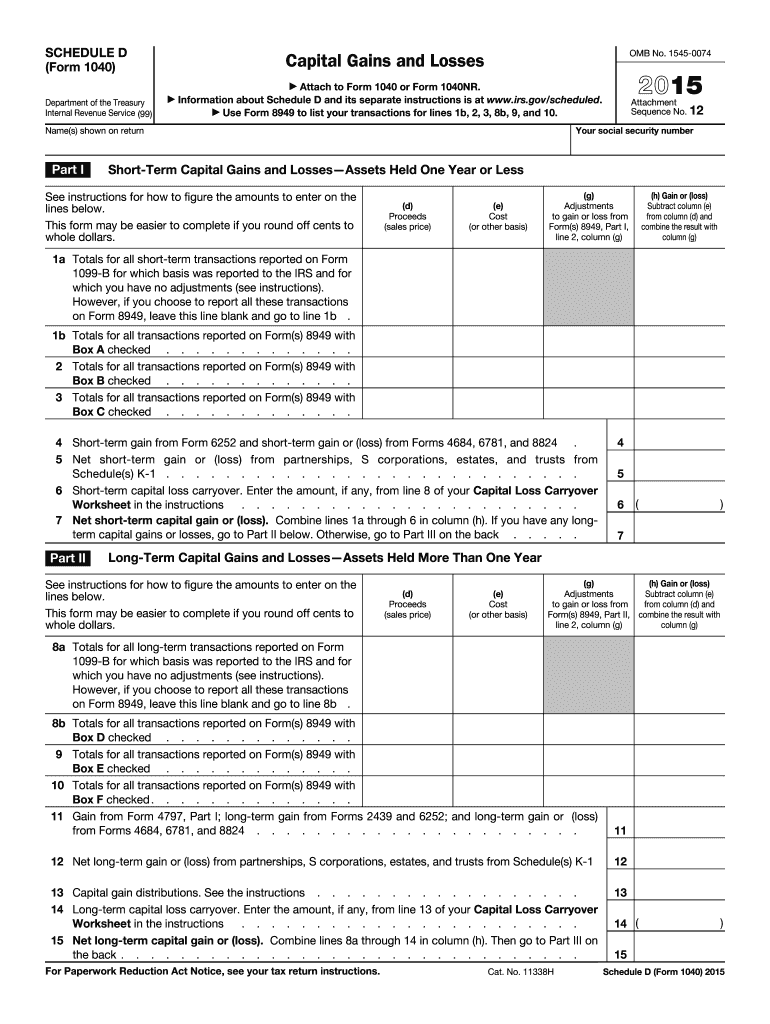

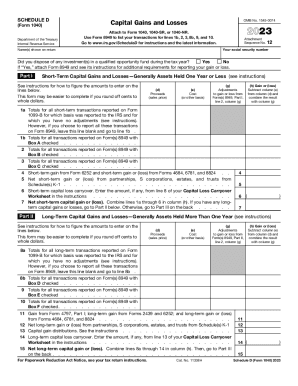

Form Schedule D (Capital Gains and Losses) is a tax form used by individuals to report their capital gains or losses from the sale of assets such as stocks, bonds, real estate, or other investments. It is filed along with Form 1040 (U.S. Individual Income Tax Return) in order to calculate and report any taxable gains or losses incurred during the tax year. The schedule requires individuals to provide detailed information about each asset sold, including the purchase price, sale price, and any adjustments or adjustments to the cost basis.

How to fill out schedule d form?

To fill out a Schedule D form, which is used to report capital gains and losses from the sale of assets, follow these steps:

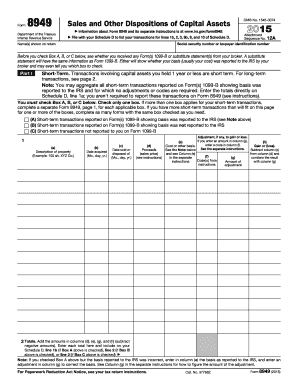

1. Gather all relevant information: Collect all the information about any assets you have sold or disposed of during the tax year, such as the purchase and sale dates, sales price, cost basis, and any related expenses.

2. Categorize your assets: Determine the appropriate categories for your assets, such as stocks, bonds, mutual funds, real estate, etc. This will help you complete the appropriate sections of the form.

3. Complete Part I: In Part I of Schedule D, report any short-term capital gains and losses, which are gains or losses from assets held for one year or less. Start by filling in your name, Social Security number, and address.

4. Enter your transactions: Enter the details of each transaction, including the description of the asset, its acquisition and disposition dates, and the proceeds from the sale. Determine the cost basis by subtracting any related expenses from the purchase price.

5. Calculate the gains or losses: Calculate the difference between the proceeds and cost basis for each asset. If you have multiple transactions for the same asset (e.g., if you sold a stock in multiple lots), you may need to complete additional rows or Schedule D Worksheets.

6. Complete Part II: In Part II, report any long-term capital gains and losses, which are gains or losses from assets held for more than one year. Follow the same steps as in Part I to enter the relevant transactions.

7. Calculate the total gains or losses: Sum up all the gains and losses for both short-term and long-term transactions separately and transfer the totals to the appropriate lines on your tax return.

8. Attach additional schedules if necessary: If you have more than 15 transactions to report on Schedule D, complete and attach additional Schedule D Worksheets.

9. Keep records of supporting documentation: Retain copies of transaction confirmations, brokerage statements, or any other documents that substantiate the information reported on Schedule D in case of an audit.

It is recommended to consult a tax professional or refer to the official IRS instructions for Schedule D (Form 1040) for specific guidance and to ensure accurate completion of the form.

What is the purpose of schedule d form?

The purpose of Schedule D form is to report capital gains and losses incurred from the sale or exchange of capital assets, such as stocks, bonds, real estate, and other investments. It is used by individuals, partnerships, corporations, or estates and trusts to summarize their capital gains and losses and calculate the net capital gain or loss for tax purposes. This form is filed as an attachment to the individual or entity's tax return (Form 1040 for individuals or Form 1120 for corporations, for example).

What information must be reported on schedule d form?

The Schedule D form is used to report capital gains and losses during the tax year. The following information must be reported on Schedule D:

1. Identification information: Your name, Social Security number, and address.

2. Description of property: Detailed information about each asset or investment sold, including the date of acquisition, date of sale, and a description of the property.

3. Sales price: The amount of money you received from selling the property.

4. Cost basis: The original cost of the property, including any additional expenses such as commissions or fees.

5. Adjustments to cost basis: Any adjustments made to the cost basis, such as depreciation.

6. Capital gains or losses: The difference between the sales price and the cost basis, which determines whether you have a capital gain or loss.

7. Net capital gain or loss: The sum of all your capital gains and losses.

8. Reporting of short-term and long-term capital gains and losses: These need to be reported separately, as they are subject to different tax rates.

9. Carryover losses: Any capital losses that you were not able to use in the current tax year can be carried over to future tax years.

It's worth noting that the reporting requirements for Schedule D may differ based on the complexity of your investments and transactions. It's recommended to consult a tax professional or review the IRS instructions for Schedule D for more specific guidance.

When is the deadline to file schedule d form in 2023?

The deadline to file Schedule D Form in 2023 for individual taxpayers is typically April 15th. However, tax deadlines may vary, so it is recommended to consult official sources such as the Internal Revenue Service (IRS) or a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of schedule d form?

The penalty for the late filing of Schedule D form depends on the amount of tax owed and the length of the delay. As of 2021, the penalty for late filing of the Schedule D form is generally 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid tax. However, if the return is filed more than 60 days after the due date (including extensions), the minimum penalty is whichever is smaller - $210 or 100% of the unpaid tax. It is important to note that these penalties can vary depending on individual circumstances, so it is advisable to consult with a tax professional or refer to the official IRS guidelines for precise penalty information.

How can I send 2015 schedule d form to be eSigned by others?

Once your 2015 schedule d form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in 2015 schedule d form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 2015 schedule d form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit 2015 schedule d form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 2015 schedule d form, you can start right away.