Who needs the Form 8863?

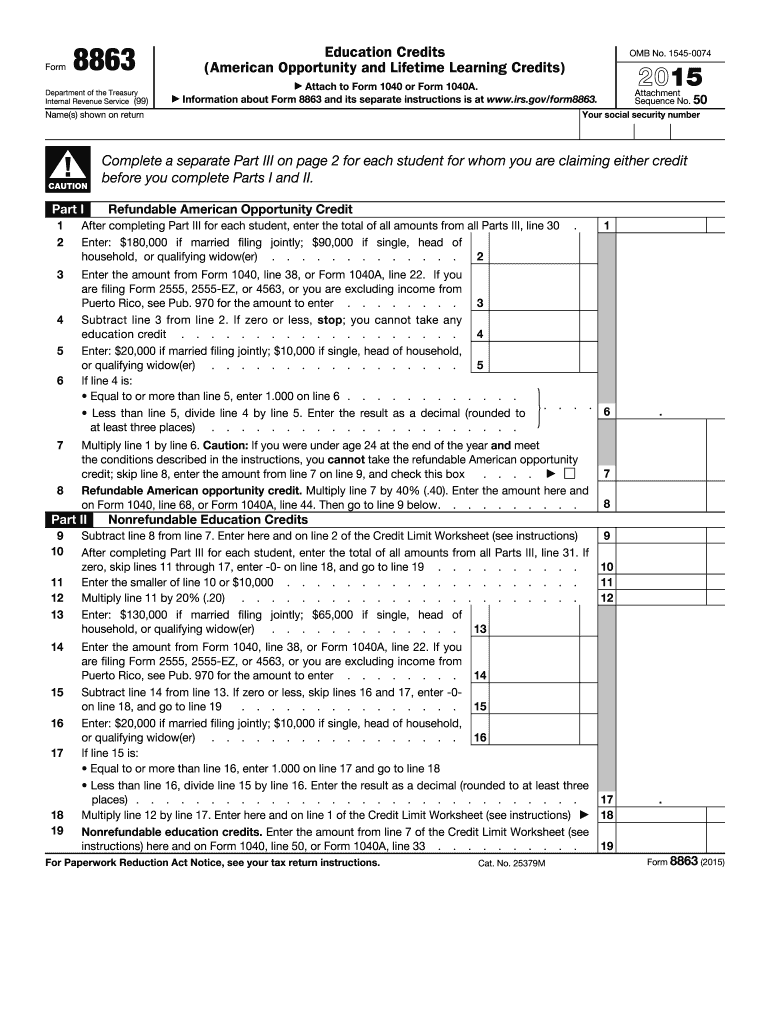

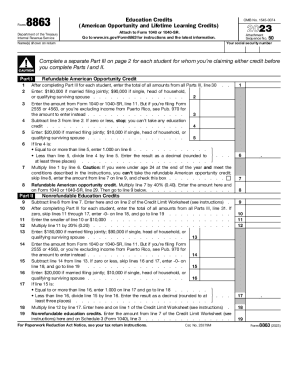

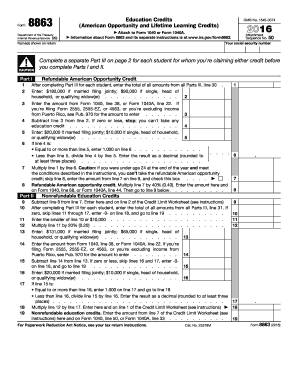

Form 8863 is the United States Internal Revenue Service forms that should be filled out by taxpayers to figure out and claim their education credits. Logically, this form, Education Credits (American Opportunity and Lifetime Learning Credit), can be used for claiming the American opportunity credit, the Lifetime Learning credit, or both. Part of the American Opportunity Credit may be refundable while the Lifetime Learning Credit is not. This means that a refundable credit can give the taxpayer a refund regardless of whether they owe any tax and are required to file a tax return, or not. A non-refundable credit can reduce the amount of their tax, but any excess amount will not be refunded.

What is the Education Credits Form 8863 for?

The form should be filed if the taxpayers, their spouse or dependent (indicated on the tax return) was enrolled at, or attending, an eligible educational institution as a student.

Is the IRS 8863 Form accompanied by any other forms?

The Form 8863 is to be filed as an accompaniment to the individual income tax return. It is not meant to be submitted separately.

When is the Form 8863 due?

So far as the Education Credits form is submitted with Form 1040 or equivalent, it is expected on the 15th day of the fourth month after the end of the reported tax year.

How to fill out the Form 8863?

The completed form is to give the following information:

- Name and SSN of the taxpayer;

- Financial details of the American Opportunity Credit (Part 1);

- Details of the nonrefundable education credits (Part 2);

- Information about the student and educational institution (Part 3).

Where to send the filled out form?

The completed Education Credit Form 8863 must be directed to the local office of the Internal Revenue Service.