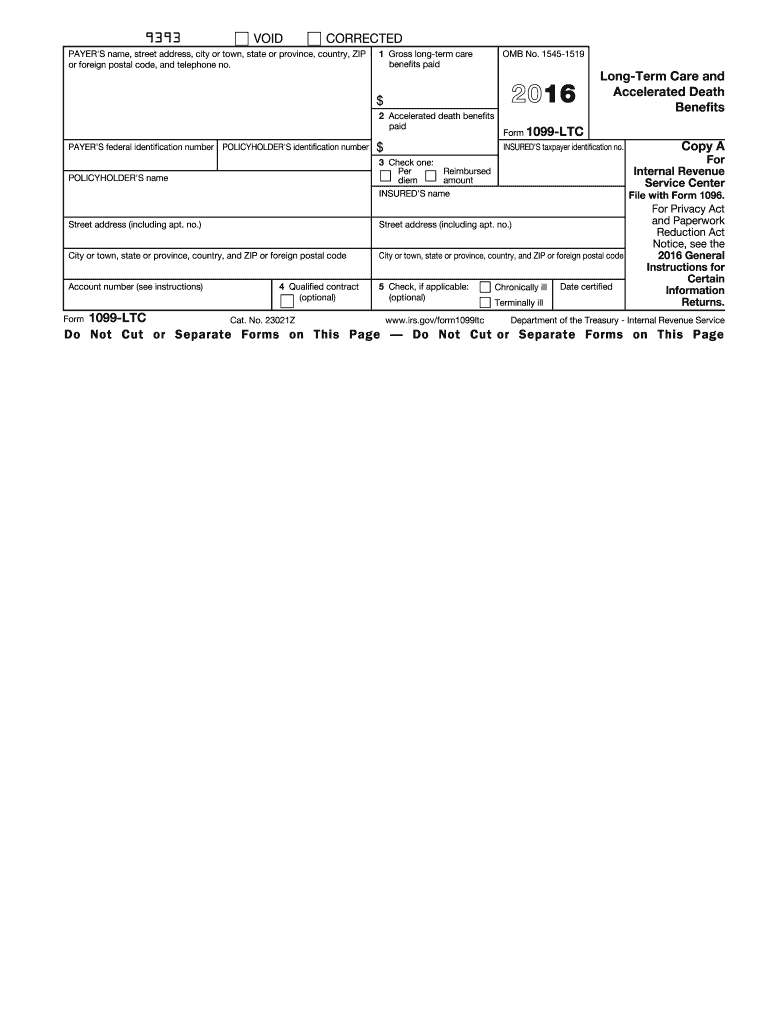

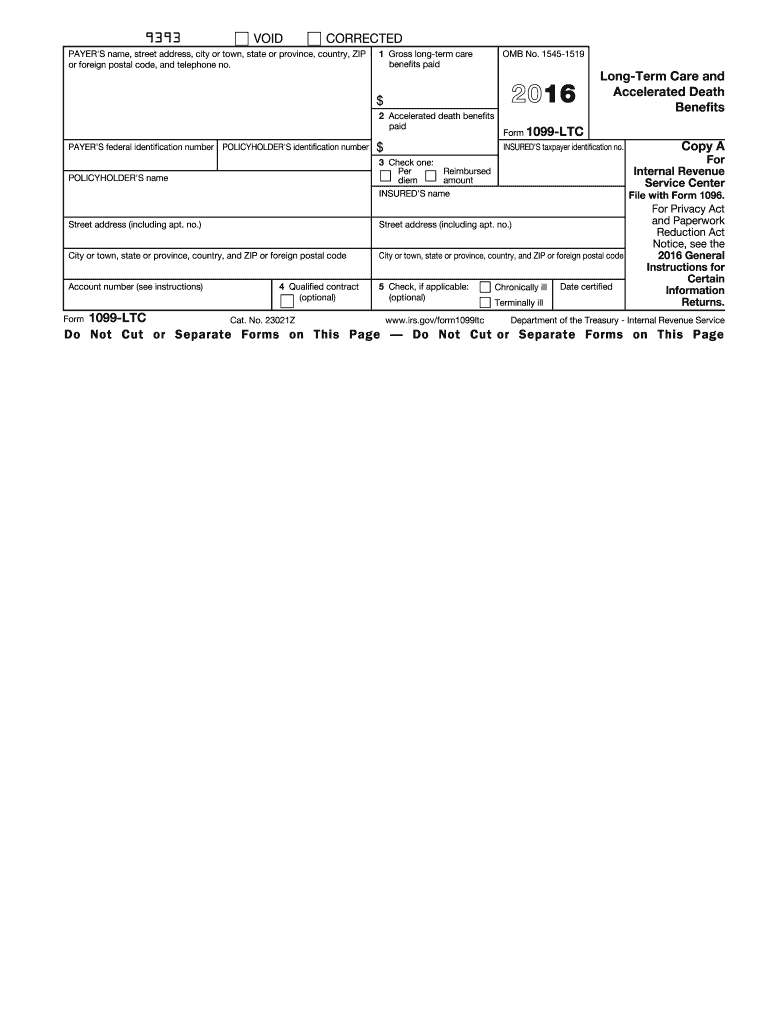

IRS 1099-LTC 2016 free printable template

Get, Create, Make and Sign

How to edit 2016 form 1099-ltc online

IRS 1099-LTC Form Versions

How to fill out 2016 form 1099-ltc

How to fill out 2016 form 1099-ltc?

Who needs 2016 form 1099-ltc?

Instructions and Help about 2016 form 1099-ltc

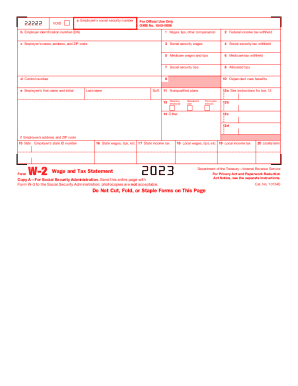

Welcome to form 1099 the forum that has gotten a lot of people not probably millions of people into tax trouble over the course of time the 1099 is a form that you receive at the end of the tax year stating how much gross revenues you earned from a particular company it is the single most misunderstood form I think and the people who receive them oftentimes say I don't know why did that get this form I thought I was an employee no you're not an employee where taxes are taken out of every check when you are a contract labor person if you filled out the w9 the famous w9 that means you're receiving the infamous 1099 so if we go to the 1099 has information on it that looks very much like a w-2 has the company name for which you worked their identification number then your identification number your name your address and then over here in number seven note what it says non employee compensation that means you were not an employee you do not pay taxes out of your paycheck when you get if it's not even called the paycheck actually a paycheck...

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 2016 form 1099-ltc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.