Get the free Contract Surety Claims - How To File A Claim

Show details

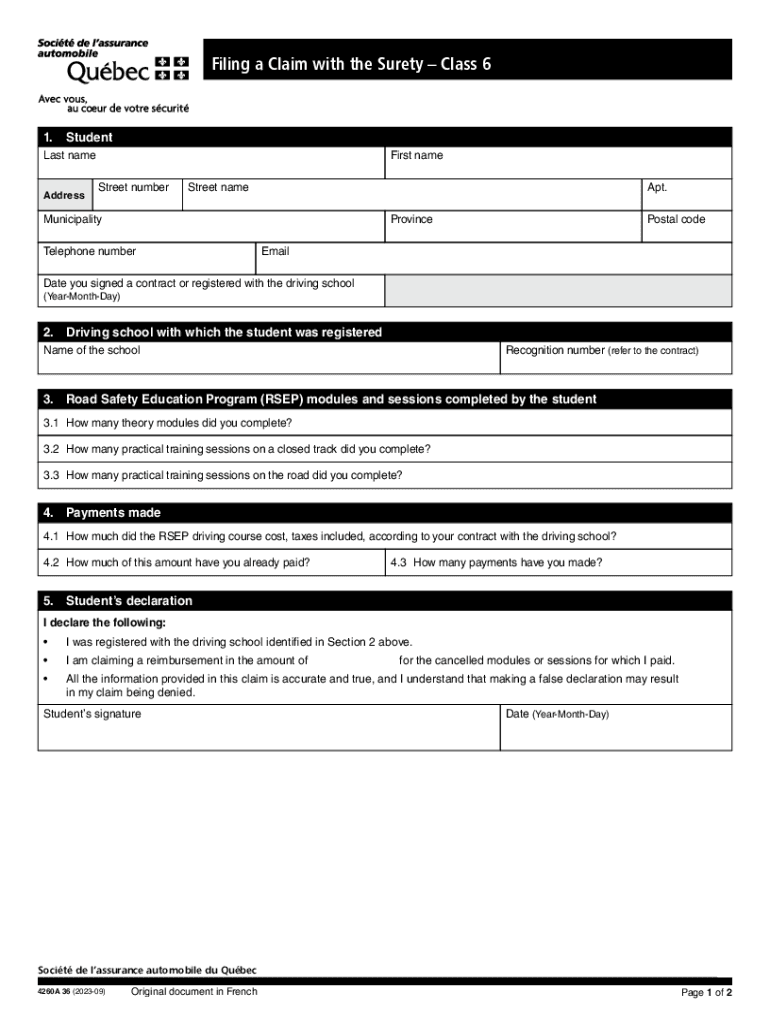

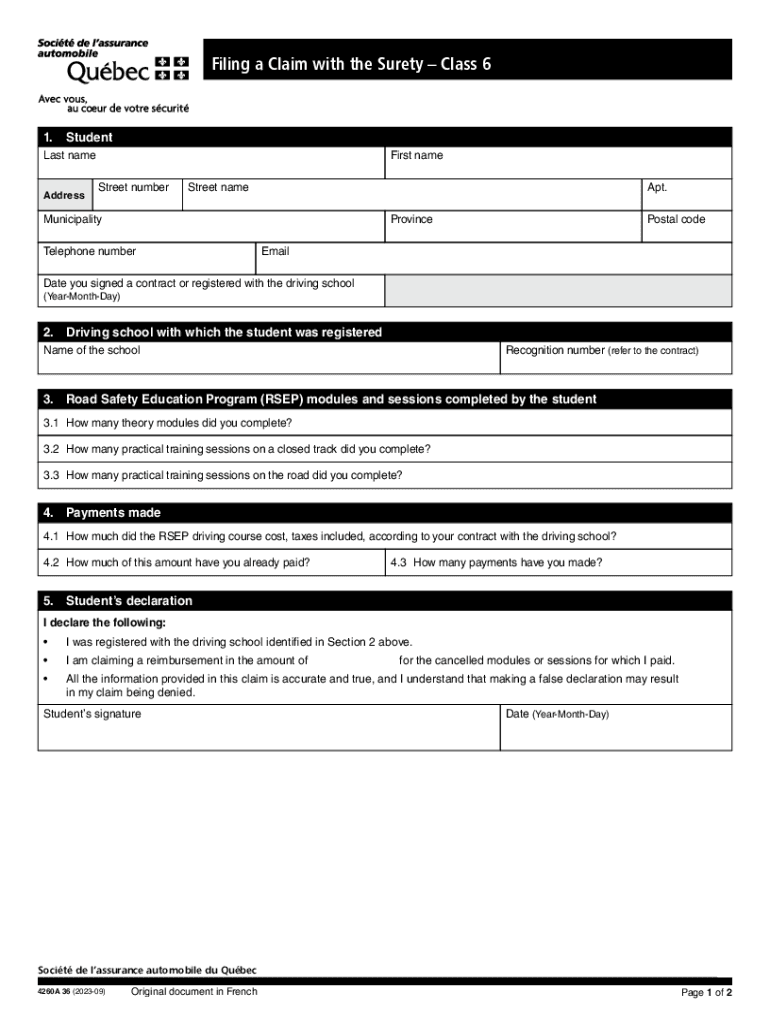

Filing a Claim with the Surety Class 61. StudentLast name

AddressFirst name

Street numberStreet name. MunicipalityProvinceTelephone numberPostal codeEmailDate you signed a contract or registered with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contract surety claims

Edit your contract surety claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contract surety claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contract surety claims online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit contract surety claims. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contract surety claims

How to fill out contract surety claims

01

To fill out contract surety claims, follow these steps:

02

Gather all necessary documents and information related to the claim, including the contract, bond agreement, change orders, communication records, and any other relevant documents.

03

Identify the specific breach or default that gave rise to the claim, and gather evidence to support the claim.

04

Review the bond agreement and contract terms to understand the procedures and requirements for filing a claim.

05

Prepare a written claim document that outlines the nature of the claim, the amount being claimed, and any supporting evidence.

06

Include any applicable supporting documentation with the claim, such as invoices, receipts, or expert reports.

07

Submit the completed claim to the appropriate party, such as the surety company or bond issuer, according to the procedures outlined in the bond agreement.

08

Follow up with the party to whom the claim was submitted to ensure it is being reviewed and processed.

09

Provide any additional requested information or documentation promptly to facilitate the processing of the claim.

10

Communicate with the surety company or bond issuer throughout the claims process to address any questions or concerns that may arise.

11

Keep records of all correspondence and communications related to the claim for future reference.

12

Consider seeking legal advice or assistance from a contract attorney specializing in surety claims if needed.

Who needs contract surety claims?

01

Contract surety claims are needed by various parties involved in a construction project:

02

- Contractors: Contractors may need to file contract surety claims if they believe they have been wrongfully terminated, have not been paid for work performed, or have suffered damages as a result of a breach of contract by another party.

03

- Subcontractors and Suppliers: Subcontractors and suppliers may need to file contract surety claims if they have not been paid for their services or materials provided on a project.

04

- Project Owners: Project owners may need to file contract surety claims if a contractor has failed to meet contractual obligations or deliver the project as specified.

05

- Surety Companies: Surety companies may need to file contract surety claims on behalf of the contractors they have bonded if the contractors fail to fulfill their obligations under the bond agreement.

06

- Bond Issuers: Bond issuers may need to file contract surety claims if a contractor or surety company fails to fulfill the terms and conditions of the bond agreement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get contract surety claims?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific contract surety claims and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit contract surety claims on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute contract surety claims from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete contract surety claims on an Android device?

Complete contract surety claims and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is contract surety claims?

Contract surety claims are assertions made by a party who has suffered a loss under a contract, seeking compensation from a surety bond that guarantees the performance or payment obligations of the principal.

Who is required to file contract surety claims?

Typically, the party who has incurred a loss due to non-performance or default of the principal, such as subcontractors or suppliers, is required to file contract surety claims.

How to fill out contract surety claims?

To fill out contract surety claims, the claimant must complete the claim form provided by the surety company, including details such as the nature of the claim, supporting documentation, and any relevant contract information.

What is the purpose of contract surety claims?

The purpose of contract surety claims is to provide a mechanism for parties to seek financial compensation for losses incurred due to the failure of the principal to fulfill contractual obligations.

What information must be reported on contract surety claims?

The information that must be reported on contract surety claims typically includes the claimant's contact information, details of the original contract, a description of the loss incurred, and any supporting documentation proving the claim.

Fill out your contract surety claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contract Surety Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.