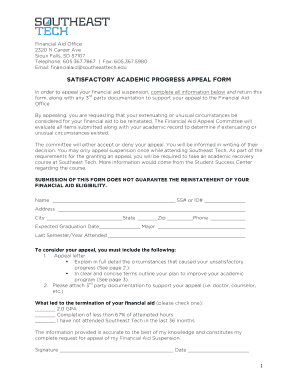

Get the free Credit Union Loan Officer Job Code: 115035

Show details

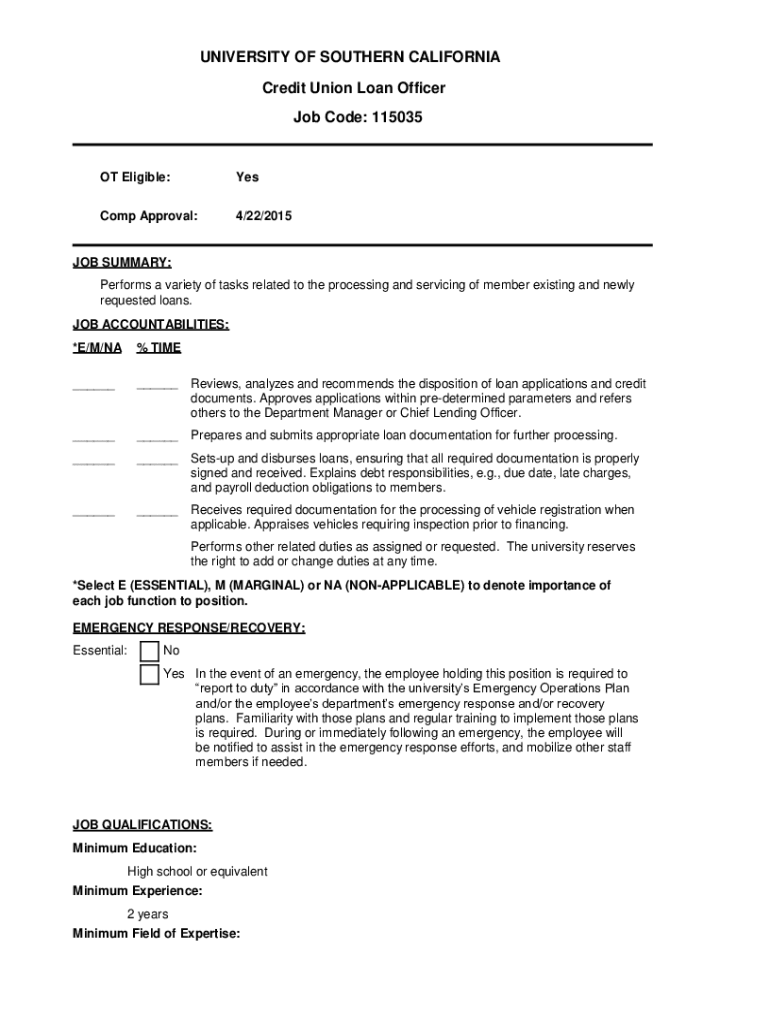

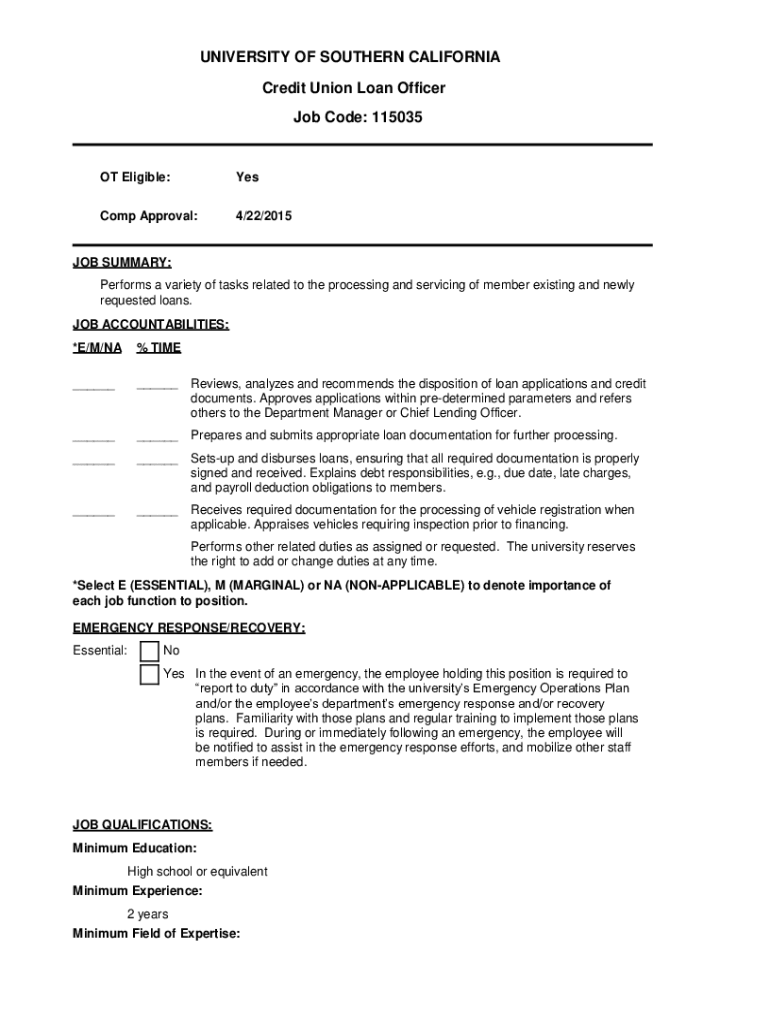

UNIVERSITY OF SOUTHERN CALIFORNIA Credit Union Loan Officer Job Code: 115035OT Eligible:YesComp Approval:4/22/2015JOB SUMMARY: Performs a variety of tasks related to the processing and servicing of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit union loan officer

Edit your credit union loan officer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit union loan officer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit union loan officer online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit union loan officer. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit union loan officer

How to fill out credit union loan officer

01

To fill out a credit union loan officer application, follow these steps:

02

Gather necessary documents: Before starting the application process, gather all the required documents such as identification proof, income statements, and any other documents specified by the credit union.

03

Research credit union eligibility: Find a credit union that you are eligible to join based on its requirements. This may depend on factors such as your location, employer, or membership in certain organizations.

04

Contact the credit union: Get in touch with the credit union either through their website, phone, or in-person to request the loan officer application form.

05

Complete the application form: Fill out the application form accurately and provide all the required information. Double-check the form for any errors or missing information.

06

Attach supporting documents: Make sure to attach all the necessary supporting documents as mentioned in the application form. This may include proof of income, identification proof, bank statements, etc.

07

Submit the application: Once you have completed the form and attached all the necessary documents, submit the application either online or by visiting the credit union in person. If submitting online, follow the instructions provided by the credit union.

08

Follow up: After submitting the application, it's a good idea to follow up with the credit union to ensure they have received your application and to inquire about the next steps in the loan officer application process.

09

Wait for approval: The credit union will review your application and supporting documents. Wait for their response regarding the approval or rejection of your loan officer application.

10

Provide additional information if required: If the credit union requires any additional information or documentation, promptly provide them with the requested details.

11

Loan officer training (if applicable): If your application is approved, the credit union may provide you with training or onboarding to become a loan officer. Follow their instructions and attend any required sessions or courses.

12

Begin your role as a credit union loan officer: Once you have successfully completed the application process and any required training, you can start working as a credit union loan officer.

Who needs credit union loan officer?

01

A credit union loan officer may be needed by individuals or businesses who are looking to secure a loan from a credit union. Some specific examples of who may need a credit union loan officer are:

02

- Individuals who need funds for personal reasons such as buying a car, financing a home, or covering unexpected expenses.

03

- Small businesses or startups in need of finance to expand their operations, purchase equipment, or invest in new ventures.

04

- Students who require financial assistance for education-related expenses like tuition fees, books, or housing.

05

- People with low credit scores or limited credit history who may find it easier to qualify for a loan through a credit union rather than a traditional bank.

06

- Individuals who prefer the member-focused and often more personalized approach offered by credit unions compared to larger financial institutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit union loan officer from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your credit union loan officer into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit credit union loan officer online?

With pdfFiller, the editing process is straightforward. Open your credit union loan officer in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out credit union loan officer on an Android device?

Use the pdfFiller app for Android to finish your credit union loan officer. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is credit union loan officer?

A credit union loan officer is a financial professional who helps members of a credit union apply for loans, evaluate their financial situations, and determine suitable loan options.

Who is required to file credit union loan officer?

Typically, credit union loan officers are employed by the credit union and are responsible for managing loan applications, so they file reports related to loan activity as part of their job requirements.

How to fill out credit union loan officer?

Filling out a credit union loan officer application usually involves providing personal information, financial history, loan details, and any necessary supporting documentation.

What is the purpose of credit union loan officer?

The purpose of a credit union loan officer is to facilitate the lending process for members, ensuring they receive appropriate advice and assistance in managing their loans.

What information must be reported on credit union loan officer?

Information that must be reported includes applicant details, loan amounts, interest rates, terms, and any relevant financial disclosures.

Fill out your credit union loan officer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Union Loan Officer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.