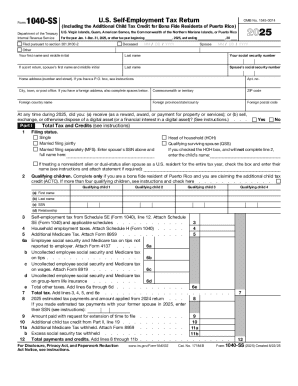

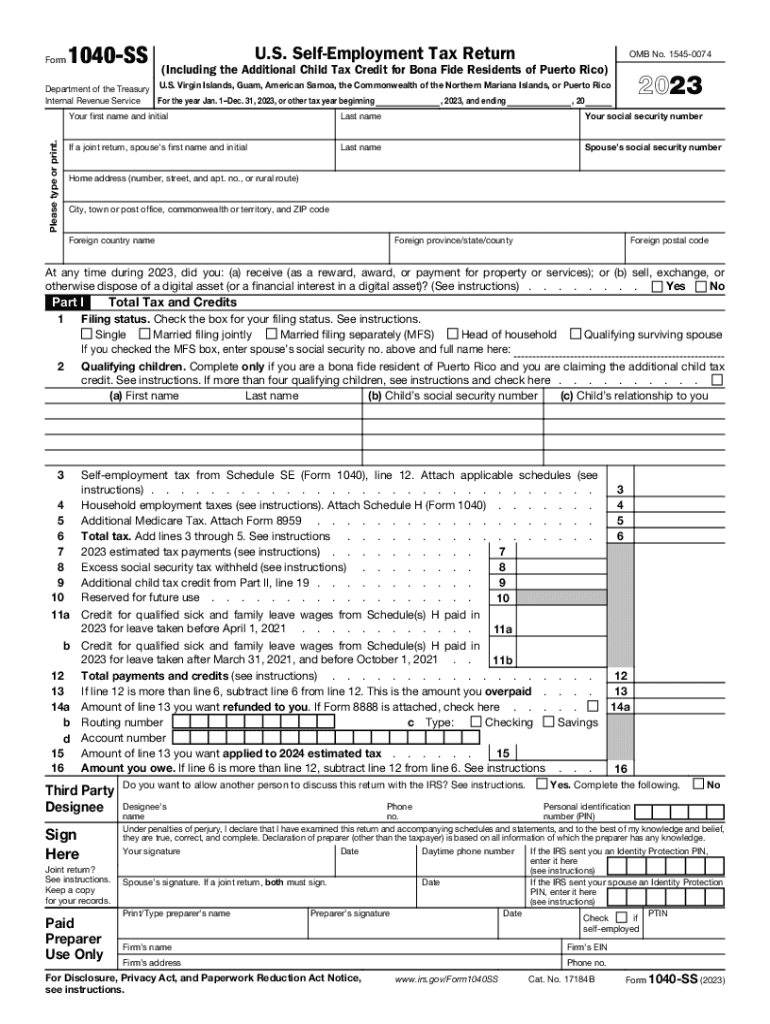

IRS 1040-SS 2023 free printable template

Instructions and Help about IRS 1040-SS

How to edit IRS 1040-SS

How to fill out IRS 1040-SS

About IRS 1040-SS 2023 previous version

What is IRS 1040-SS?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040-SS

What should I do if I realize I made a mistake after filing my IRS 1040-SS?

If you discover an error after submitting your IRS 1040-SS, you may need to file an amended return using Form 1040-X. Be sure to clearly explain the changes made and provide any necessary documentation. It's essential to rectify mistakes promptly to avoid potential issues with the IRS.

How can I verify if the IRS has received and processed my IRS 1040-SS?

To check the status of your IRS 1040-SS, you can use the IRS 'Where's My Refund?' tool if expecting a refund, or contact the IRS directly. Be prepared to provide your personal information to verify your identity when inquiring about your submission status.

What are the common reasons for e-file rejection when submitting the IRS 1040-SS?

E-file rejection of the IRS 1040-SS can occur due to errors such as incorrect Social Security numbers, inconsistent names, or issues with prior tax records. Ensure all information is accurate and matches IRS records to minimize the risk of rejection.

What privacy measures are in place for my information when filing the IRS 1040-SS electronically?

When filing your IRS 1040-SS electronically, the IRS employs various encryption and security protocols to protect your data during transmission and storage. It's advisable to use reputable software and ensure your internet connection is secure to further safeguard your information.

What should I do if I receive an audit notice from the IRS after submitting my IRS 1040-SS?

If you receive an audit notice regarding your IRS 1040-SS, carefully read the document and follow the instructions provided. Gather the requested documentation and consider consulting a tax professional to assist you in addressing the audit and responding appropriately.

See what our users say