Get the free dopl accounting form - dopl utah

Show details

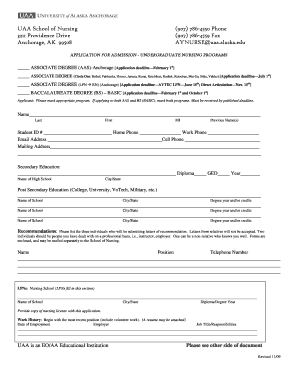

Registration as a Certified Public Accounting Firm Anyone engaged in the practice of public accountancy must be either registered as a firm or be employed with a properly registered firm. If you are employed full time with a firm or other employer but practice accountancy for your own account moonlighting you must apply for licensure with DOPL as a CPA firm. If needed a Certified Public Accountancy Firm application can be obtained from DOPL s we...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dopl accounting form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dopl accounting form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dopl accounting form online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dopl accounting form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

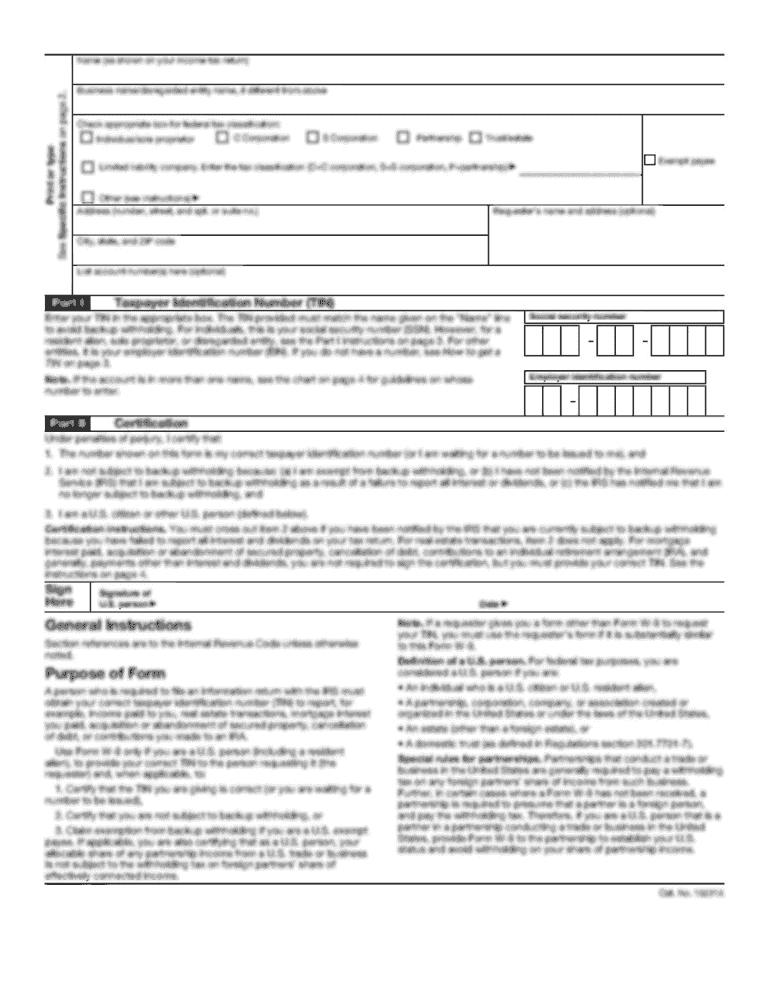

How to fill out dopl accounting form

How to fill out dopl accounting form:

01

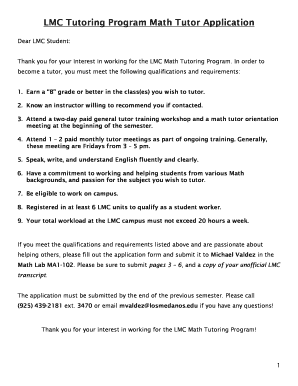

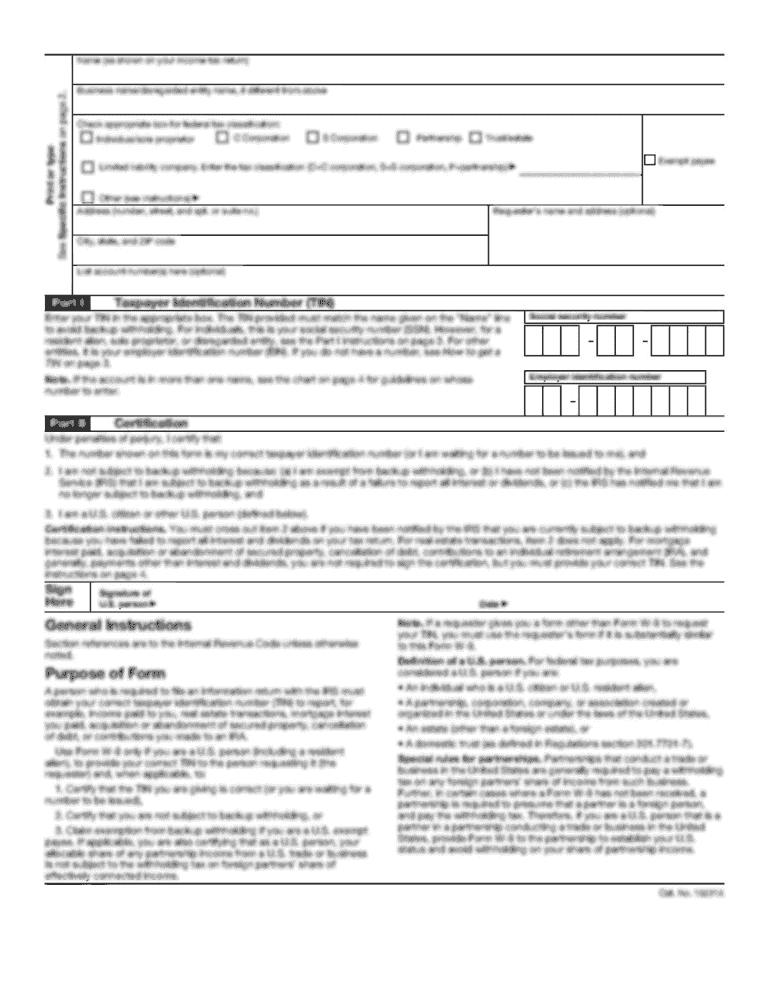

Start by gathering all relevant financial documents, such as income statements, expense receipts, and bank statements.

02

Make sure you have a clear understanding of the different sections of the form, including income, expenses, assets, liabilities, and equity.

03

Begin filling out the form by entering your personal and business information accurately, including your name, address, and tax identification number.

04

Proceed to the income section and list all your sources of income, such as sales revenue, interest, and investment income. Provide detailed information for each source, including dates and amounts.

05

Move on to the expenses section and record all your business expenses, such as rent, utilities, wages, and advertising costs. Again, be specific and thorough with the details.

06

Next, complete the assets section of the form by listing all your business assets, such as cash, inventory, equipment, and property. Include the current value and any depreciation.

07

Proceed to the liabilities section and record any outstanding debts, loans, or other financial obligations your business has. Include specific details, such as creditor names, amounts, and repayment terms.

08

Finally, calculate your equity by subtracting your liabilities from your assets. Enter this result in the equity section of the form.

09

Review your completed dopl accounting form carefully, ensuring that all the information is accurate and properly documented.

10

Sign and date the form, and make a copy for your records before submitting it to the relevant authority or organization.

Who needs dopl accounting form?

01

Business owners who want to maintain accurate and organized financial records.

02

Entrepreneurs who need to provide financial information to potential lenders or investors.

03

Individuals or companies required by law or regulatory bodies to submit a dopl accounting form as part of their compliance obligations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dopl accounting form?

The dopl accounting form is a document used by businesses to report their financial transactions and calculate their taxable income.

Who is required to file dopl accounting form?

All businesses, including sole proprietors, partnerships, and corporations, are required to file the dopl accounting form.

How to fill out dopl accounting form?

To fill out the dopl accounting form, businesses need to provide detailed information about their income, expenses, assets, and liabilities. They must also accurately calculate their taxable income.

What is the purpose of dopl accounting form?

The purpose of the dopl accounting form is to ensure businesses report their financial information accurately and calculate their tax liabilities correctly.

What information must be reported on dopl accounting form?

Businesses must report their income, such as sales revenue and interest earned, as well as their expenses, including salaries, rent, and utilities. They also need to report their assets, liabilities, and equity.

When is the deadline to file dopl accounting form in 2023?

The deadline to file the dopl accounting form in 2023 is April 15th.

What is the penalty for the late filing of dopl accounting form?

The penalty for the late filing of the dopl accounting form is a monetary fine based on the amount of tax owed and the number of days the form is overdue.

How do I make changes in dopl accounting form?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your dopl accounting form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out dopl accounting form using my mobile device?

Use the pdfFiller mobile app to complete and sign dopl accounting form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit dopl accounting form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as dopl accounting form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your dopl accounting form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.