Get the free Credit Report Dispute and Investigation Form

Show details

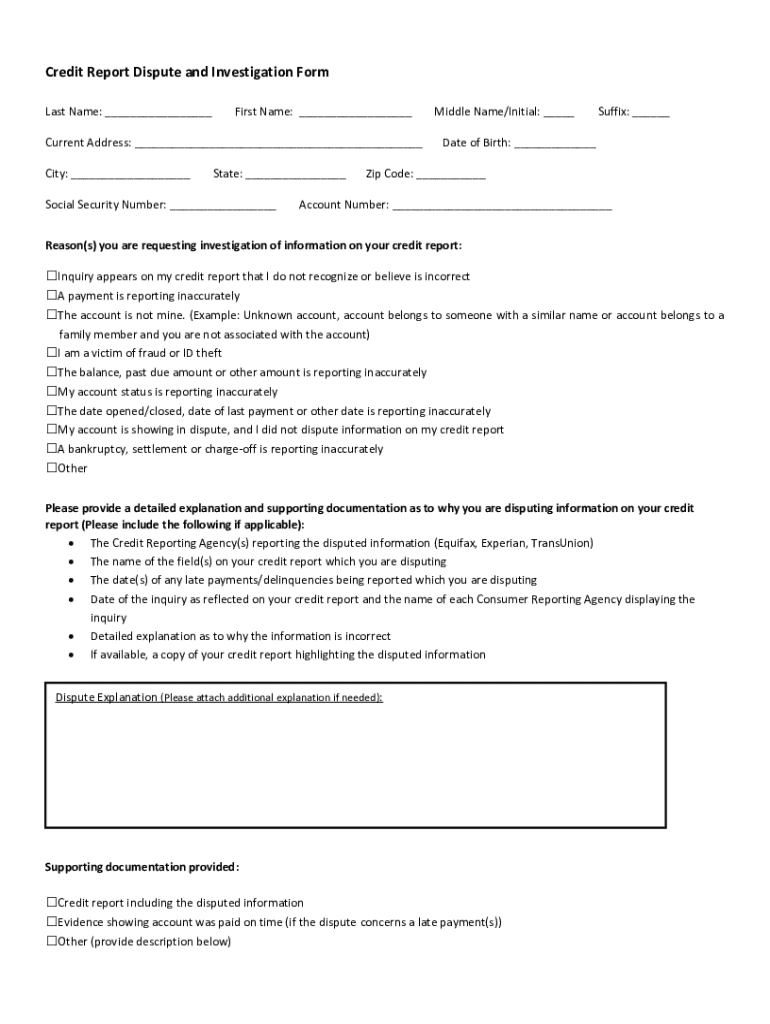

Credit Report Dispute and Investigation Form Last Name: ___First Name: ___Current Address: ___ City: ___State: ___Social Security Number: ___Middle Name/Initial: ___Suffix: ___Date of Birth: ___Zip

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit report dispute and

Edit your credit report dispute and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit report dispute and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit report dispute and online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit report dispute and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit report dispute and

How to fill out credit report dispute and

01

Obtain a copy of your credit report from one of the three major credit bureaus (Equifax, Experian, TransUnion).

02

Review your credit report carefully for any errors or inaccuracies.

03

Gather documentation to support your dispute, such as receipts, bank statements, or letters from creditors.

04

Write a formal dispute letter to the credit bureau, explaining the errors and providing any supporting documentation.

05

Send the dispute letter and documentation via certified mail with a return receipt requested.

06

Wait for the credit bureau to investigate your dispute and respond with their findings.

07

If the errors are not corrected to your satisfaction, you may need to escalate the dispute to higher authorities or seek legal assistance.

Who needs credit report dispute and?

01

Anyone who finds errors or inaccuracies on their credit report.

02

Individuals who have been a victim of identity theft and have fraudulent accounts on their credit report.

03

Those who have been denied credit or faced higher interest rates due to incorrect information on their credit report.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit report dispute and without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including credit report dispute and, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send credit report dispute and for eSignature?

credit report dispute and is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I edit credit report dispute and on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share credit report dispute and from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is credit report dispute and?

Credit report dispute is a process in which individuals can challenge information on their credit report that they believe is inaccurate or incomplete.

Who is required to file credit report dispute and?

Any individual who believes that there is inaccurate or incomplete information on their credit report is required to file a credit report dispute.

How to fill out credit report dispute and?

To fill out a credit report dispute, individuals can contact the credit reporting agency either online, by phone, or by mail and provide the necessary information to support their dispute.

What is the purpose of credit report dispute and?

The purpose of credit report dispute is to ensure that individuals have accurate and up-to-date information on their credit reports, which can affect their ability to obtain credit or loans.

What information must be reported on credit report dispute and?

Individuals must provide their personal information, details about the specific information being disputed, and any supporting documents that can help validate their claim.

Fill out your credit report dispute and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Report Dispute And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.