Get the free Taxanes Audit Report - Northern and Yorkshire Cancer Registry bb - nycris nhs

Show details

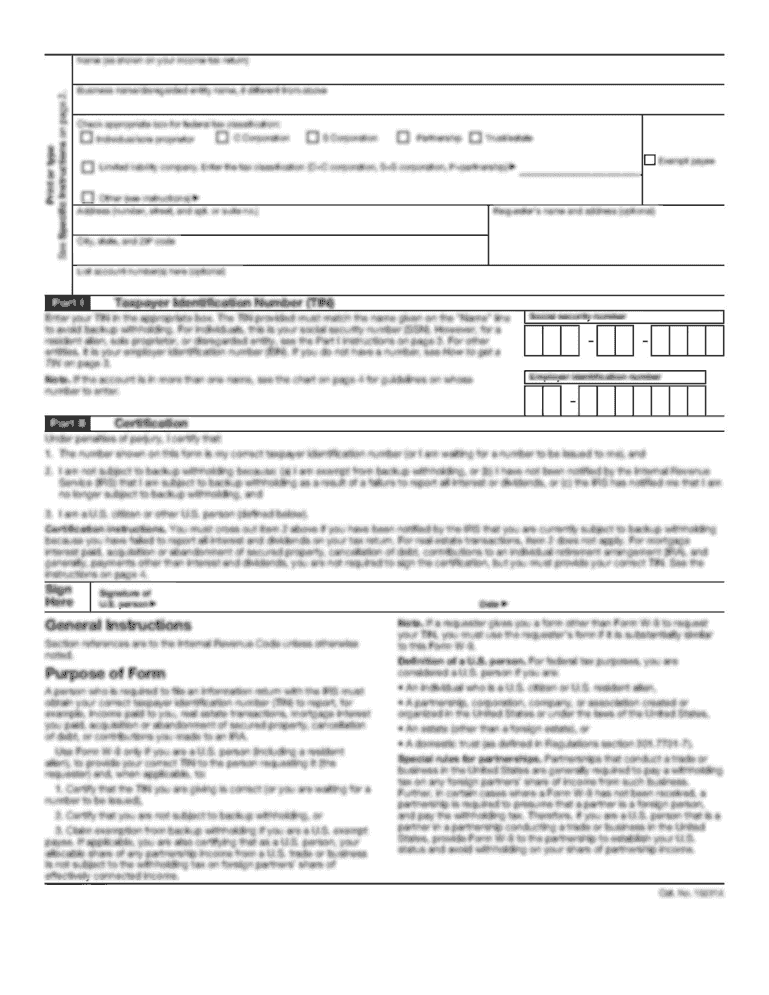

Northern and Yorkshire Cancer Registry and Information Service Taxes Audit Report Use of Taxes for patients with Ovarian Cancer in 2000 Evaluation Please tick one box per question: 1. What is your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your taxanes audit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxanes audit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxanes audit report online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit taxanes audit report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out taxanes audit report

How to fill out a taxanes audit report:

01

Begin by gathering all relevant financial information and documentation related to the taxanes audit. This may include receipts, invoices, bank statements, and any other records that pertain to the taxanes being audited.

02

Familiarize yourself with the specific requirements and guidelines for completing a taxanes audit report. These guidelines may vary depending on your jurisdiction and the relevant tax laws.

03

Start by filling out the necessary general information, such as the name of the taxpayer, their contact information, and the tax period being audited. This will help identify the specific taxanes being examined.

04

Next, carefully review and analyze the financial data and records associated with the taxanes in question. This may involve verifying the accuracy of calculations, checking for any discrepancies, and ensuring that all transactions are properly documented.

05

Based on your review, determine and document the tax liability or potential non-compliance related to the taxanes being audited. Clearly state the findings, including any errors or discrepancies identified during the audit process.

06

Provide a detailed explanation of your audit methodology and any specific audit procedures followed during the examination. This helps to establish the credibility and thoroughness of the audit report.

07

Assemble all supporting documents, such as copies of relevant financial records, calculations, and any correspondence with the taxpayer. These documents will serve as evidence to support your findings and conclusions.

08

Summarize your findings and conclusions in a clear and concise manner. Explain any adjustments made and, if applicable, provide recommendations for corrective measures that should be taken.

09

Review and proofread the audit report to ensure accuracy and clarity. Double-check all calculations, references, and supporting documentation before submitting the report.

Who needs a taxanes audit report?

01

Tax authorities: The primary audience for a taxanes audit report is the tax authority responsible for administering and enforcing tax laws. They require this report to assess the accuracy and compliance of the taxpayer's tax filing related to taxanes.

02

Taxpayer: The taxpayer themselves may also need a taxanes audit report for their own records and to understand the results of the audit. It helps them identify any potential issues or discrepancies and allows them to take appropriate corrective actions.

03

Third parties: In certain situations, third parties such as financial institutions, investors, or business partners may require a taxanes audit report to evaluate the financial health and compliance of the taxpayer. This report can provide assurance that the tax filing related to taxanes is accurate and reliable.

Overall, the taxanes audit report serves as a crucial document for both the tax authorities and the taxpayer, ensuring transparency, accuracy, and compliance with tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is taxanes audit report?

Taxanes audit report is a report that provides an overview of the financial transactions and records related to taxanes.

Who is required to file taxanes audit report?

Companies and individuals who use taxanes in their business operations are required to file taxanes audit report.

How to fill out taxanes audit report?

Taxanes audit report must be filled out accurately and completely, including detailed information about the use of taxanes and financial transactions related to them.

What is the purpose of taxanes audit report?

The purpose of taxanes audit report is to ensure transparency and compliance with tax regulations in relation to the use of taxanes.

What information must be reported on taxanes audit report?

Information such as the quantity of taxanes used, the source of taxanes, financial transactions related to taxanes, and any discrepancies or issues must be reported on taxanes audit report.

When is the deadline to file taxanes audit report in 2023?

The deadline to file taxanes audit report in 2023 is December 31st.

What is the penalty for the late filing of taxanes audit report?

The penalty for late filing of taxanes audit report is a fine of $500 per day up to a maximum of $10,000.

How do I edit taxanes audit report online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your taxanes audit report and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit taxanes audit report on an Android device?

You can make any changes to PDF files, such as taxanes audit report, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete taxanes audit report on an Android device?

Use the pdfFiller mobile app and complete your taxanes audit report and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your taxanes audit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.