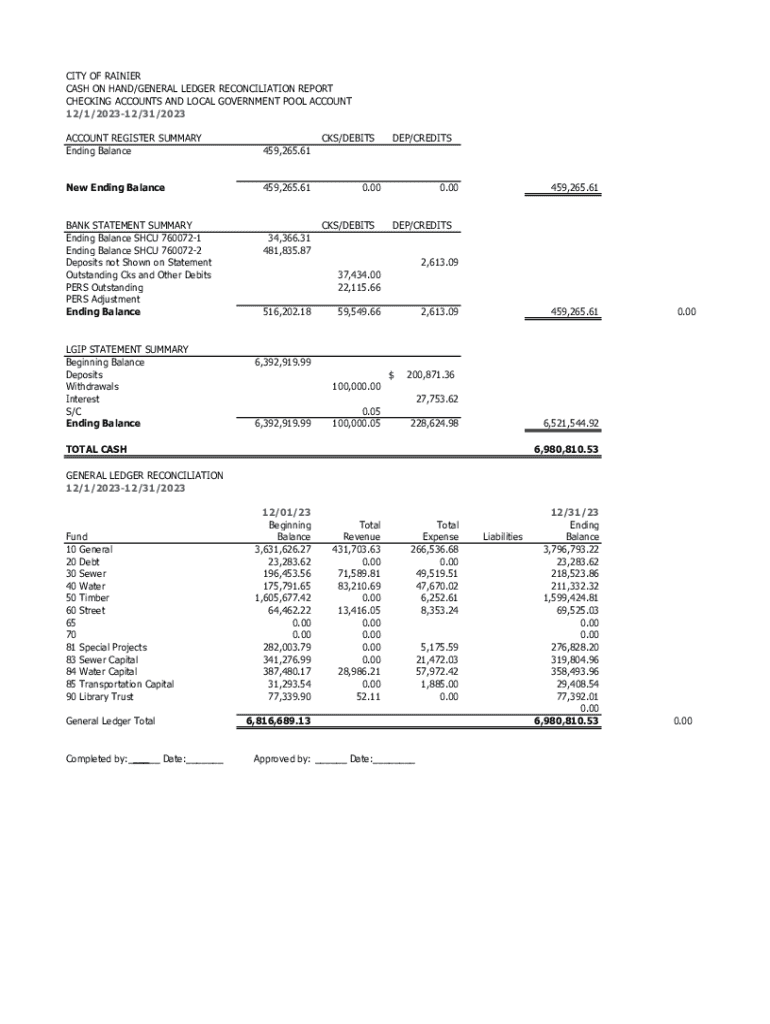

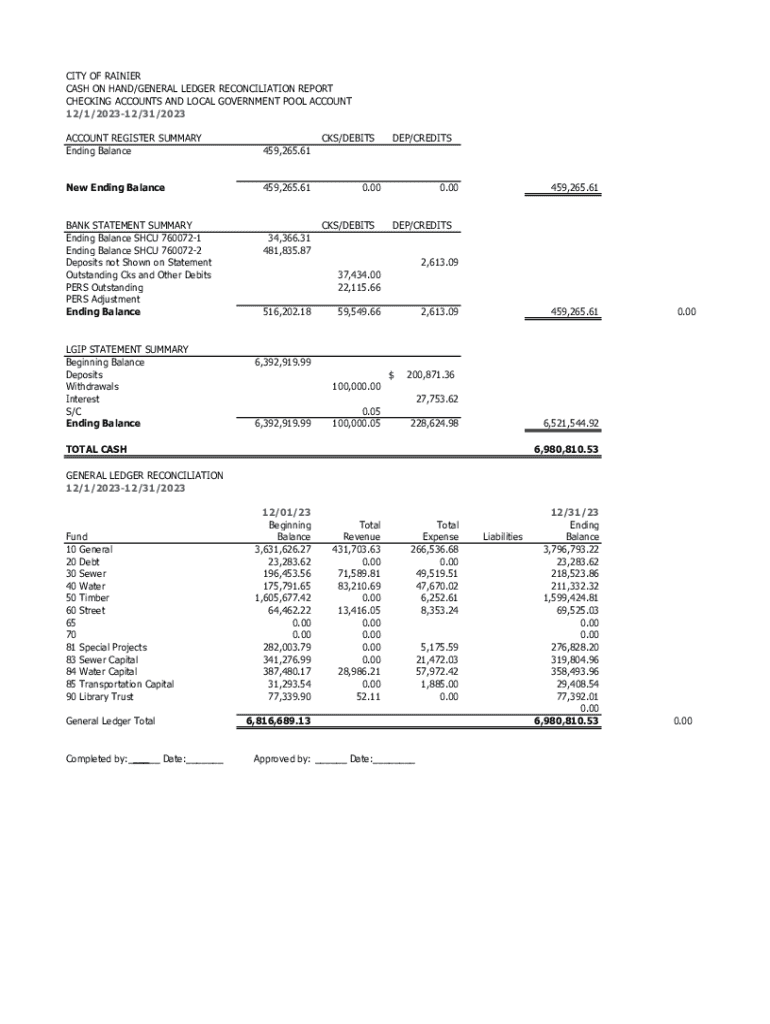

Get the free CASH ON HAND/GENERAL LEDGER RECONCILIATION REPORT

Get, Create, Make and Sign cash on handgeneral ledger

Editing cash on handgeneral ledger online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash on handgeneral ledger

How to fill out cash on handgeneral ledger

Who needs cash on handgeneral ledger?

Cash on hand general ledger form: A detailed guide to cash management

Understanding cash on hand

Cash on hand refers to the physical currency or liquidity that a business maintains for immediate operational needs. This includes coins, notes, and any other cash equivalents readily available at the business’s location. The importance of cash on hand cannot be overstated; it allows businesses to handle everyday transactions, unexpected costs, or emergencies without the delay that often accompanies bank transactions. Unlike cash at the bank, which can take time to access due to withdrawal processes, cash on hand is instantly usable.

Businesses must distinguish between cash on hand and cash at bank. Cash at bank involves funds held in checking or savings accounts, which, while easily accessible, may not provide the immediate liquidity required for daily operations. Cash on hand ensures that a company can operate smoothly and respond quickly to fluctuations in its cash flow.

The role of the general ledger

The general ledger is the heart of any accounting system, where all financial transactions are systematically recorded and organized. It offers a comprehensive overview of a business’s finances, detailing specific accounts and their balances. Cash on hand is recorded as a distinct account within the general ledger, tracking all cash inflows and outflows. The accuracy of these entries is critical, as it ensures that a business maintains an accurate depiction of its financial position.

An accurate general ledger is foundational for decision-making and financial reporting. If cash on hand entries are incorrect, it can lead to overestimating or underestimating available liquidity, potentially resulting in misinformed business decisions. Thus, ensuring that every transaction involving cash on hand is recorded correctly is paramount for any organization.

How to create a cash on hand general ledger form

Creating a cash on hand general ledger form requires understanding its essential components. Each entry needs to capture key information to ensure clarity and accuracy. The primary elements of the form include:

Filling out the cash on hand general ledger form involves a simple, step-by-step process:

Filling out the cash on hand general ledger form effectively

Effectively filling out the cash on hand general ledger form requires some best practices. First, ensure that all cash transactions are recorded promptly; delaying entries can lead to forgotten transactions, resulting in inaccuracies. Additionally, always double-check amounts to avoid costly mistakes. Maintaining consistency in how descriptions are written will also help anyone reviewing the ledger to understand the nature of each transaction quickly.

It's crucial to avoid common mistakes, such as failing to account for petty cash withdrawals or miscategorizing expenses. To enhance accuracy and consistency, regularly review and reconcile the cash on hand ledger with daily cash sheets and bank statements. This routine can help ensure that discrepancies are promptly identified and resolved.

Integrating with accounting software

Many businesses now utilize accounting software to streamline financial management processes. Popular solutions such as QuickBooks, Xero, and FreshBooks offer features that facilitate the seamless integration of cash on hand data. These platforms often allow users to import existing cash ledgers directly into the system, saving time and minimizing manual entry errors.

Additionally, automating cash on hand tracking can provide real-time visibility into liquidity. With notifications and alerts set for unusual changes in cash levels, managers can respond quickly to potential cash flow issues. By incorporating these software solutions, businesses can enhance their cash management strategies, ensuring that they maintain optimal liquidity levels.

Maintaining daily cash sheets

Daily cash monitoring is a practice that should not be overlooked. Maintaining daily cash sheets allows businesses to track their cash inflows and outflows in real time. By linking the general ledger form to daily cash sheets, a business can ensure that all entries are in sync, promoting accuracy and efficient cash management.

Utilizing tools for managing cash flow, such as cloud-based solutions, can further enhance accuracy and accessibility of cash data. These tools often allow multiple users to access and edit cash sheets from anywhere, promoting collaboration among team members and ensuring that cash management is a shared responsibility.

Preparing a bank reconciliation

A bank reconciliation involves the process of comparing a business's cash on hand records with its bank statements. This step is crucial for identifying any discrepancies that may arise due to timing issues or errors in recording transactions. The steps to reconcile cash on hand with bank statements include:

Regular reconciliations not only help prevent fraud but also support accurate financial reporting, which is vital for maintaining investor and stakeholder confidence.

Managing petty cash funds

Petty cash is a small amount of cash kept on hand for minor business expenses that do not warrant a check or credit card transaction. Managing petty cash effectively involves setting a defined limit, documenting all transactions, and reconciling the petty cash fund regularly. Guidelines for tracking petty cash transactions include keeping receipts for all purchases and recording each withdrawal in the cash on hand general ledger.

Recording petty cash properly in the general ledger ensures that all cash movements are visible and accounted for. Any discrepancies in the petty cash fund can lead to larger issues if not handled promptly, making it essential to adhere to a strict management process.

Handling accounts receivable and payable

The cash on hand balance is profoundly influenced by accounts receivable and accounts payable. When a business extends credit to customers, the amount due influences cash flow; delays in collections from accounts receivable can significantly impact available cash. In contrast, timely payments of accounts payable ensure that cash does not remain unnecessarily tied up. Recording these transactions accurately in the general ledger helps maintain a clear understanding of cash flow dynamics.

Incorporating accounts payable and receivable updates regularly into the cash on hand general ledger allows businesses to make informed decisions about managing their cash flow effectively. This transparency is crucial for overall financial health.

Advanced considerations

Utilizing cash flow statements can provide deeper insights into a business’s liquidity over time, revealing trends and patterns that might not be immediately evident in day-to-day cash monitoring. Understanding how cash flow affects operational sustainability is essential for business leaders, as it influences growth strategies, capital investments, and risk management.

Furthermore, implementing strategies for improving cash management practices, such as establishing an efficient revenue collection process or optimizing payables, can enhance overall financial stability. By paying attention to these advanced considerations, businesses can ensure better cash flow health and prepare for unexpected financial challenges.

Interactive tools for document management

pdfFiller offers an impressive array of features designed to enhance the creation and management of documents, including cash on hand general ledger forms. Users can easily edit PDF forms and have access to eSigning capabilities, which streamlines the approval process for cash transactions.

The collaboration tools within pdfFiller empower teams to work together efficiently on cash management tasks. By using pdfFiller, businesses can create a cohesive process for managing cash on hand records, ensuring all stakeholders have access to the most recent data, and promoting accuracy throughout. This cloud-based platform truly empowers users with a seamless document management experience.

Frequently asked questions (FAQs)

Common inquiries about the cash on hand general ledger form often relate to its purpose, usage, and troubleshooting issues. One frequent question is how often a business should review its cash on hand ledger. The best practice is to evaluate it daily, especially for businesses with significant cash flow activities. Another common concern arises when discrepancies appear. In such cases, reviewing transaction history and supporting documentation is essential for accuracy.

For further assistance, companies can find resources available through accounting profession associations or consult accounting software support teams. Staying informed about best practices and leveraging available resources ensures effective cash management.

Related topics to explore

To further enhance cash management strategies, businesses should consider keeping abreast of upcoming financial regulations affecting liquidity management. Understanding best practices in liquidity management ensures organizations adapt to changes in financial environments. Moreover, the importance of stress testing in cash management cannot be overlooked. By periodically analyzing the potential impacts of various scenarios, businesses can prepare for unexpected shocks and maintain robust cash flow management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute cash on handgeneral ledger online?

Can I create an electronic signature for the cash on handgeneral ledger in Chrome?

How do I fill out cash on handgeneral ledger using my mobile device?

What is cash on hand general ledger?

Who is required to file cash on hand general ledger?

How to fill out cash on hand general ledger?

What is the purpose of cash on hand general ledger?

What information must be reported on cash on hand general ledger?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.