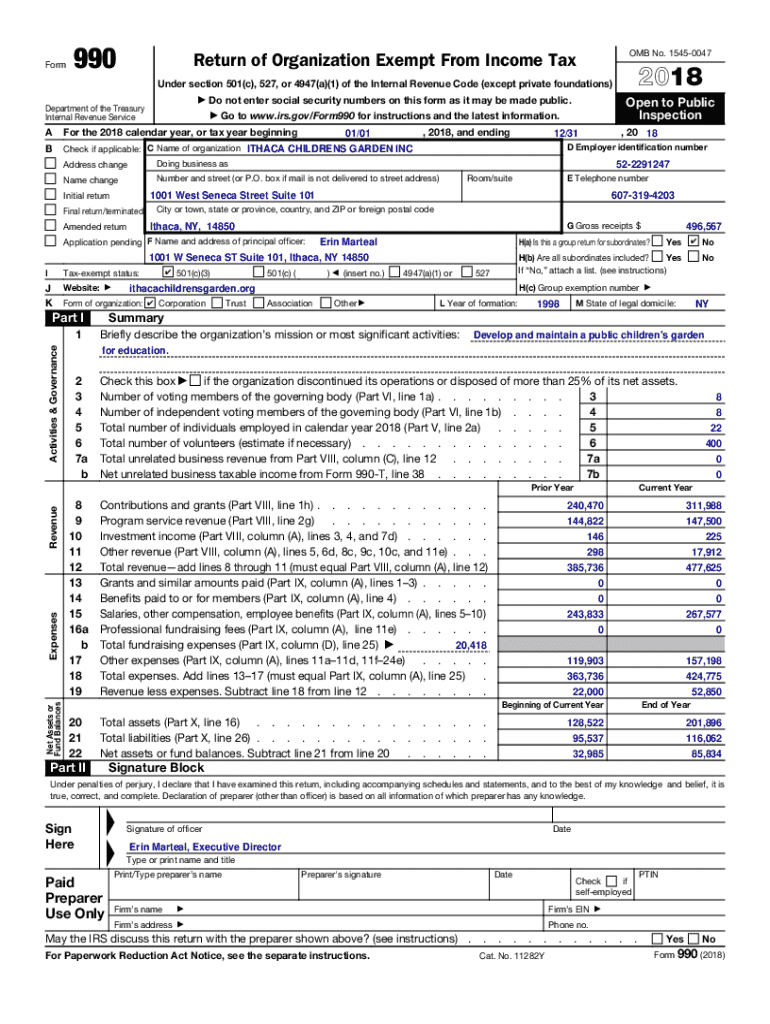

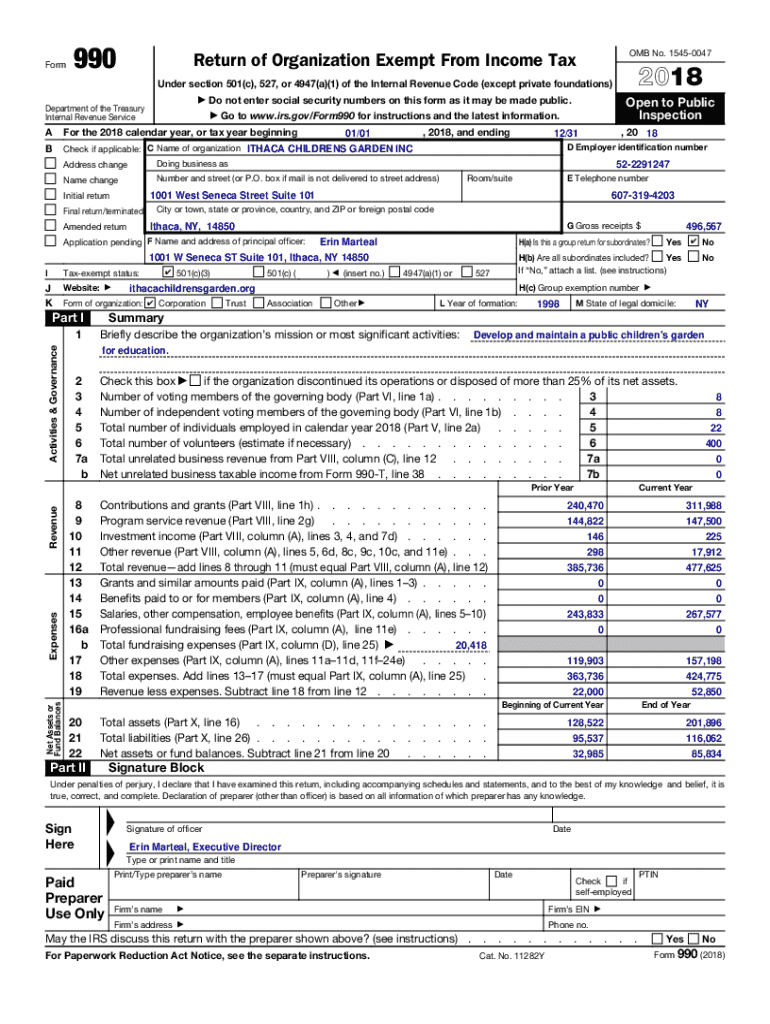

Get the free Check if applicable: C Name of organization ITHACA CHILDRENS GARDEN INC

Get, Create, Make and Sign check if applicable c

How to edit check if applicable c online

Uncompromising security for your PDF editing and eSignature needs

How to fill out check if applicable c

How to fill out check if applicable c

Who needs check if applicable c?

Check if applicable form: A comprehensive guide to understanding your requirements

Understanding the applicable form

The Applicable C Form is a critical document associated with the Affordable Care Act (ACA), designed to report information about health coverage offered to employees. This form, more formally known as IRS Form 1095-C, is essential for employers to comply with ACA regulations. Its primary purpose is to verify that adequate health insurance is provided, thereby ensuring that individuals fulfill their mandate under the ACA.

The Applicable C Form is crucial because it supports compliance with ACA requirements. Inaccuracies or omissions can lead to significant penalties for employers. Furthermore, it helps the IRS gauge whether beneficiaries have qualifying health coverage, ultimately ensuring that public health initiatives are met effectively. Understanding this form ahead of time is vital for both employers and employees.

Who needs to use the applicable form?

Employers who offer health insurance to their employees are the primary users of the Applicable C Form. Specifically, large employers, defined as those with 50 or more full-time equivalent employees, must file this form to report health coverage provided to their employees. Key criteria for determining applicability include the number of employees and whether health coverage was offered during the tax year.

Additionally, applicable employees include full-time employees provided with health coverage for at least one month during the calendar year. Part-time employees may also be affected if their hours collectively meet full-time equivalency thresholds. Assessing eligibility isn't just about employee count; it requires delving into the specifics of health benefits offered.

Compliance with ACA regulations

Employers are responsible for accurately filing the Applicable C Form as part of their obligations under the ACA. This form must be submitted annually to report health coverage for all full-time employees. If an employer fails to file the form, they not only risk fines but also contribute to confusion regarding employee health coverage and eligibility.

Filing the Applicable C Form is mandatory for large employers, and while smaller employers may not be required to file, many still opt to do so voluntarily. Instances requiring mandatory filing typically arise when employers offer minimum essential coverage, which should be reported accurately on the form.

Penalties for failing to submit the Applicable C Form can be severe, ranging from civil penalties that can accrue daily to the revocation of tax credits. The IRS imposes a penalty for each instance of non-compliance, suggesting that employers should take the completing and submission process seriously.

Filling out the applicable form: A step-by-step guide

Gathering required information before filling out the Applicable C Form is essential for a smooth submission process. Employers should compile significant documentation including employee Social Security Numbers (SSNs), health coverage start and end dates, as well as family coverage details. Accurate data collection is crucial to avoid mistakes that could lead to compliance issues.

Following is a step-by-step approach for successfully completing the Applicable C Form to ensure all required information is correctly reported:

Common mistakes to avoid include skipping required fields, entering incorrect SSNs, and failing to report status changes like employment termination or changes in health coverage. Taking the time to review the form thoroughly before submission is key.

Special considerations

Understanding when the Applicable C Form is due is an important aspect of the filing process. Typically, employers are required to submit this form to the IRS by the end of February for paper submissions or by March 31st for electronic submissions. However, employers should prepare well in advance to gather the necessary information to meet these deadlines.

For employees, their copies of the form must be provided by their employer by January 31st of the following year, ensuring employees have the necessary information for their tax filing. Adhering to these deadlines is not just a matter of compliance but also fosters trust in the employer-employee relationship.

Correcting errors on the applicable form

If errors are discovered after submission, filing a corrected Applicable C Form is paramount. Employers should promptly notify the IRS and issue a corrected form to minimize potential repercussions. Ignoring inaccuracies can lead to complications ranging from incorrect employee tax assessments to increased penalties.

Guidelines for issuing a correction include explicitly marking the form as corrected and ensuring that all relevant fields are updated accurately. Communicating with affected employees regarding these corrections is also a best practice that can help maintain transparency during the process.

Navigating ACA compliance

Maintaining accurate records related to the Applicable C Form is an essential practice for employers. These records not only support compliance but also provide a buffer against potential audits by the IRS. Recommended practices for effective compliance audits include keeping employee work hours, coverage details and the dates when coverage began and ended.

Proper recordkeeping allows for quick correction of errors if they occur and demonstrates good faith compliance efforts. Digital tools can simplify this process, making it easy to store, access, and organize necessary documentation as needed.

Resources and tools

Utilizing interactive tools for form filling can significantly streamline the process of completing the Applicable C Form. Platforms like pdfFiller provide user-friendly interfaces for editing, signing, and collaborating on the document. These features allow users to manage their documents effectively, ensuring compliance with ACA regulations while saving time.

Staying informed about ACA compliance is crucial for employers and employees alike. Various resources, including webinars, training sessions, and updates from the IRS, can help users remain updated on regulatory changes that may affect their obligations and entitlements concerning health coverage.

Understanding applicable codes

IRS Form 1095-C incorporates specific codes that provide essential information regarding coverage offered. Each code corresponds to coverage levels, employee status, and certain exemptions. Understanding these codes is vital for accurate reporting. For example, code 1A indicates that minimum essential coverage was offered; comprehending when to use each code can significantly impact compliance.

Practical applications of these codes include selecting the correct one that aligns with the health benefits offered during the relevant period. Employers should educate themselves and their staff about these codes to avoid mistakes that could result in non-compliance with ACA requirements.

FAQs and common queries

Employees and employers alike may have questions regarding the Applicable C Form. Understanding common concerns can enhance clarity throughout the filing process. For instance, a frequently asked question involves how to correct an error after submission, while others may center on reporting dependents or filing exceptions. Therefore, explicit explanations for common queries can assist users in navigating the complexities of the ACA.

Other common inquiries concern the necessity of providing coverage details for dependents, how to interpret codes, and timelines relevant to both employees and employers. Sharing insights from both professionals and community experiences can also prove valuable, ensuring that users are prepared for varied situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send check if applicable c to be eSigned by others?

How do I edit check if applicable c straight from my smartphone?

How do I fill out check if applicable c on an Android device?

What is check if applicable c?

Who is required to file check if applicable c?

How to fill out check if applicable c?

What is the purpose of check if applicable c?

What information must be reported on check if applicable c?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.