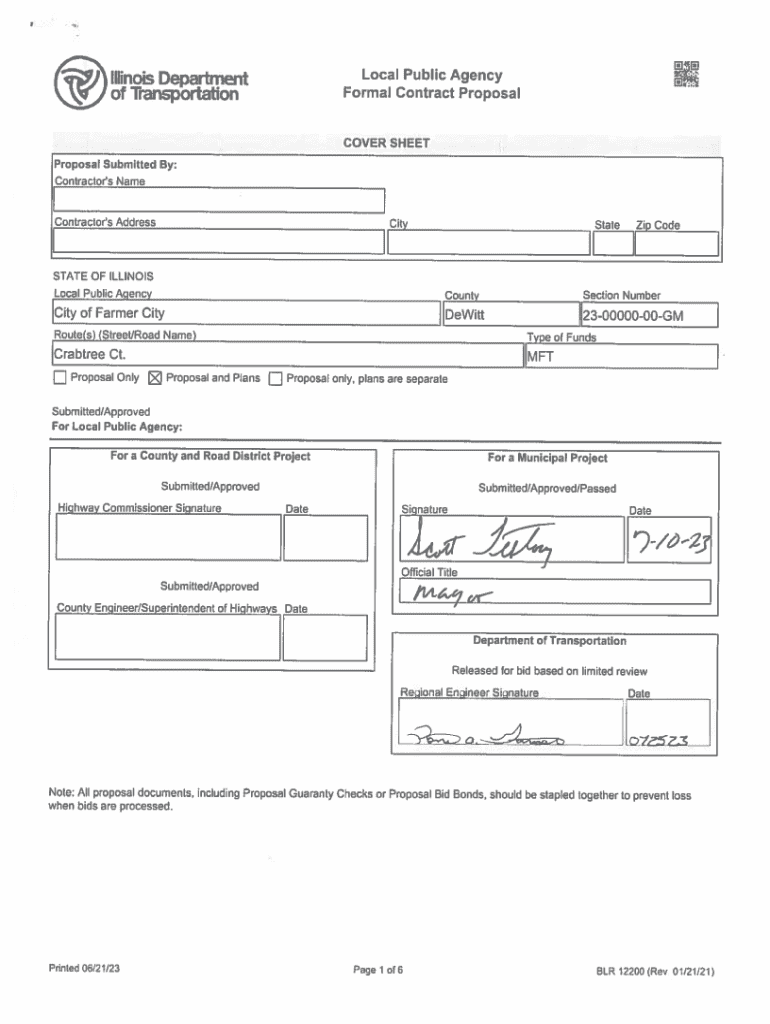

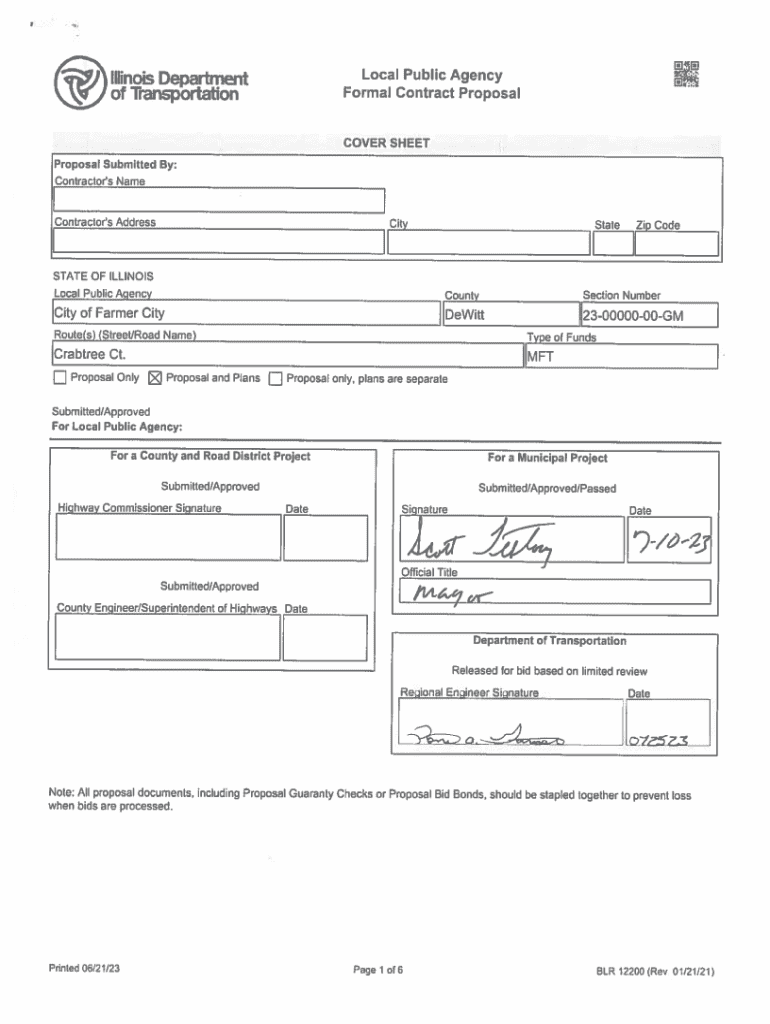

Get the free Crabtree Ct

Get, Create, Make and Sign crabtree ct

How to edit crabtree ct online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crabtree ct

How to fill out crabtree ct

Who needs crabtree ct?

Your Comprehensive Guide to the Crabtree CT Form

Understanding the Crabtree CT Form

The Crabtree CT Form serves as a crucial document used in various administrative and regulatory contexts. Primarily designed for reporting financial statistics related to real estate or local tax assessments, this form captures essential information that officials rely on for fair evaluation and taxation. Its proper completion is vital for ensuring compliance with municipal regulations governing property taxes.

Common applications of the Crabtree CT Form include tax assessments during property sales, annual reporting for local tax authorities, and adjustments in property valuations. Each of these uses hinges on the accurate reporting of financial and personal information that can impact property taxes or assessments significantly.

Importance of the Crabtree CT Form

Correctly filling out the Crabtree CT Form can have far-reaching implications. Errors or omissions may not only delay processing but can also result in financial penalties or inaccuracies in property tax assessments, leading to either overpayment or underpayment of taxes. Hence, the importance of meticulous detail cannot be overstated.

Beyond financial ramifications, there are legal implications as well. Inaccuracies on this form can lead to audits or investigations by tax authorities, necessitating further scrutiny of one’s financial activities. Adhering to regulations is essential to avoid such complications, thereby reinforcing the need for clear understanding and correct completion of the Crabtree CT Form.

Preparing to fill out the Crabtree CT form

Preparation is key when it comes to completing the Crabtree CT Form. Before diving into filling out the form, gather all necessary information. This can include personal details like your name, address, and contact information, as well as financial details, including income statements and records of relevant expenses.

Organizing this information ahead of time is crucial. Ensure that all documents are readily accessible, and verify that the information is accurate to streamline the filing process. Utilize checklists or notes to maintain clarity on what is needed, making it easier to complete the form without delay.

Using pdfFiller to streamline your preparation

pdfFiller offers an excellent solution to simplify the document collection process. With its cloud-based platform, users can access necessary documents from virtually anywhere. This accessibility enables individuals and teams to gather and organize information efficiently, saving valuable time.

Moreover, pdfFiller’s intuitive interface allows users to upload documents seamlessly, contributing to a more organized workflow. By centralizing all information in one place, you can enhance your preparation efforts, making the completion of the Crabtree CT Form less daunting.

Step-by-step guide to completing the Crabtree CT form

Filling out the Crabtree CT Form requires close attention to detail, as each section provides critical data that authorities will review. Begin with the personal information section, where you will detail your name, address, and contact details. Ensure spellings are correct and that your information aligns with official documents.

Next, move to the financial information section. This is where accuracy is paramount. Report your income and any relevant expenses accurately, as this section impacts your tax assessments significantly. It’s advisable to have supporting documents at hand, such as pay stubs or expense receipts.

Additionally, some forms may require supplementary data such as signatures or notarization details. Double-check to ensure all sections that pertain to your situation have been completed. Missing a signature or crucial detail can lead to issues down the line.

Tips for accurate fill-out

To avoid common pitfalls when completing the Crabtree CT Form, consider the following tips: ensure all fields are filled accurately, double-check your figures, and confirm that all necessary documentation is included with the submission.

Using pdfFiller's features

pdfFiller is equipped with various interactive tools for form filling, including text editing capabilities and customizable checkboxes. These features allow you to navigate through the Crabtree CT Form swiftly, making necessary adjustments easily. The platform also offers an eSignature feature, which facilitates timely approvals by providing a simple method for everyone involved to sign the document electronically.

Editing and modifying the Crabtree CT form

After completing the Crabtree CT Form, you may find that some information needs editing. pdfFiller enables easy editing of already completed forms. To modify your Crabtree CT Form, simply upload the document back into the platform, and use the editing tools to make the necessary changes.

Additionally, pdfFiller includes tracking features that allow you to monitor versions of the document. This means you can refer back to any modifications and analyze the changes made, which is especially useful for organizations that require approval from multiple parties.

Collaborative editing options

For teams needing to collaborate on the Crabtree CT Form, pdfFiller provides robust collaborative editing options. Team members can work together in real-time, making it easy to share feedback and suggestions without losing track of who has contributed what. The comment feature and various feedback tools within the platform enhance communication, ensuring that everyone is on the same page.

Finalizing and signing the Crabtree CT form

Before submitting your Crabtree CT Form, conduct a thorough review to ensure all information is accurate and complete. A common checklist for final review should include verifying that all sections are filled, checking that calculations are correct, and confirming that all necessary signatures are obtained.

Signing the form can be accomplished using pdfFiller’s eSignature feature. Electronic signatures hold the same legal weight as traditional signatures, making them a reliable option for documentation. To sign the Crabtree CT Form electronically, simply complete the designated eSignature steps outlined within the platform.

Submitting the Crabtree CT form

Once the Crabtree CT Form is complete and signed, the next step is to submit it to the relevant authority. Depending on your location and jurisdiction, the submission may vary. Forms are typically submitted either online or via traditional mail, so ensure you know the proper channels.

Keep in mind, there may be specific deadlines for submission. Tracking the submission is also crucial to ensure that your form was received. By using pdfFiller's tracking tools, users can confirm receipt and processing, alleviating any potential concerns regarding submission status.

Frequently asked questions (FAQ)

Many users have similar inquiries regarding the Crabtree CT Form, often centered around common concerns related to filling and submitting the form correctly. Topics may include when to file the form, how to address potential discrepancies, or understanding required documentation.

Additionally, users may need troubleshooting tips in case they encounter issues. For instance, should you mistakenly submit an incorrect form, consult the guidelines on proper channels for amendments. Familiarizing oneself with these frequently encountered scenarios can save time and minimize frustration.

Conclusion and next steps

Completing the Crabtree CT Form is just one piece of the puzzle in managing real estate or financial matters. Following submission, it’s important to stay informed regarding the status of your form and be prepared for any subsequent processes. Additional forms or documentation may be necessary based on your unique situation.

Engaging with pdfFiller further allows you to explore other document management solutions available within the platform. As a versatile tool, pdfFiller empowers users to efficiently manage future forms and documents, streamlining your administrative tasks and enhancing productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send crabtree ct to be eSigned by others?

How do I edit crabtree ct in Chrome?

How can I fill out crabtree ct on an iOS device?

What is crabtree ct?

Who is required to file crabtree ct?

How to fill out crabtree ct?

What is the purpose of crabtree ct?

What information must be reported on crabtree ct?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.