Get the free crs individual tax residency self-certification form - Untitled SLC

Get, Create, Make and Sign crs individual tax residency

How to edit crs individual tax residency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs individual tax residency

How to fill out crs individual tax residency

Who needs crs individual tax residency?

How to Complete the CRS Individual Tax Residency Form

Understanding the CRS Individual Tax Residency Form

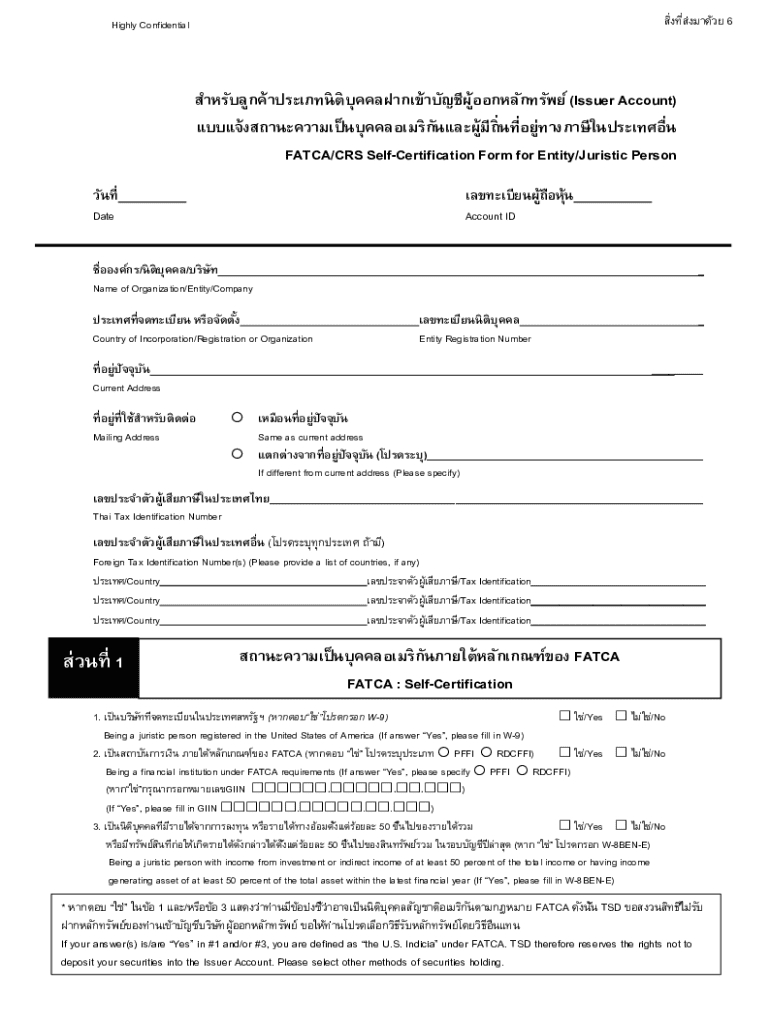

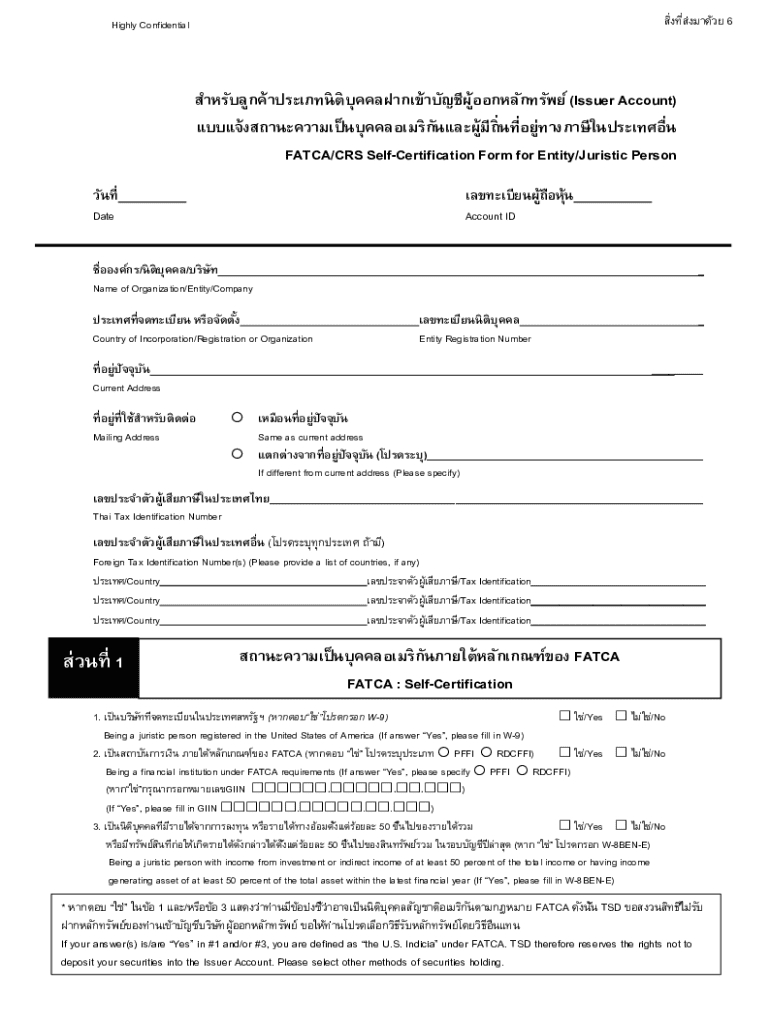

The CRS Individual Tax Residency Form is a crucial document for individuals with international financial interests. It serves to determine an individual's tax residency status according to the Common Reporting Standard (CRS), an initiative by the OECD aimed at combating tax evasion. This form requires detailed personal and residency information, making it indispensable for compliance with tax authorities in various jurisdictions.

Completing the CRS Individual Tax Residency Form is essential for those possessing foreign bank accounts, income sources, or investments. Accurate completion ensures that individuals remain compliant with tax regulations, potentially avoiding hefty penalties later.

Who needs to complete the form?

Generally, any individual subject to the CRS must complete this form. This encompasses individuals who are tax residents in jurisdictions participating in the CRS framework—currently over 100 jurisdictions worldwide. Additionally, anyone with financial accounts in these jurisdictions, even if not a tax resident, may have reporting obligations.

However, there are exemptions. Certain low-income earners, minors, or individuals in specific circumstances related to international treaties may be eligible for exclusion. It is vital to understand your unique situation and determine whether completion of the CRS form is necessary.

Key components of the CRS Individual Tax Residency Form

The CRS Individual Tax Residency Form consists of several key sections designed to collect pertinent information about the individual’s identity and tax residency. These components are essential for accurate processing by financial institutions.

Step-by-step instructions for completing the form

To fill out the CRS Individual Tax Residency Form effectively, you must follow a structured approach. Here's a simplified step-by-step guide:

Common mistakes and how to avoid them

Filling out the CRS Individual Tax Residency Form can be complex, and individuals commonly make several errors during the process. Awareness and understanding of these mistakes can help in avoiding them.

To mitigate the risks of errors, establish a checklist of crucial items to verify before submission, including ensuring all information is correct and up-to-date and confirming that required documentation is attached.

Interactive tools and resources

Leveraging technology can significantly simplify the process of completing the CRS Individual Tax Residency Form. pdfFiller offers several interactive tools to enhance your experience.

Submitting your CRS Individual Tax Residency Form

Once the CRS Individual Tax Residency Form is completed, you need to submit it according to the instructions provided by your financial institution or relevant tax authority. Understanding your submission options ensures a seamless process.

Managing your tax documents post-submission

Proper management of tax documents after submitting the CRS Individual Tax Residency Form is imperative for future reference and inquiries. Keeping organized records helps avoid complications with tax authorities.

FAQs about the CRS Individual Tax Residency Form

The CRS Individual Tax Residency Form can prompt several questions from users. Understanding the most frequently asked questions can demystify the form’s requirements.

Additionally, seeking insights from professionals can offer best practices for successfully navigating the form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send crs individual tax residency to be eSigned by others?

Where do I find crs individual tax residency?

How do I complete crs individual tax residency on an iOS device?

What is crs individual tax residency?

Who is required to file crs individual tax residency?

How to fill out crs individual tax residency?

What is the purpose of crs individual tax residency?

What information must be reported on crs individual tax residency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.