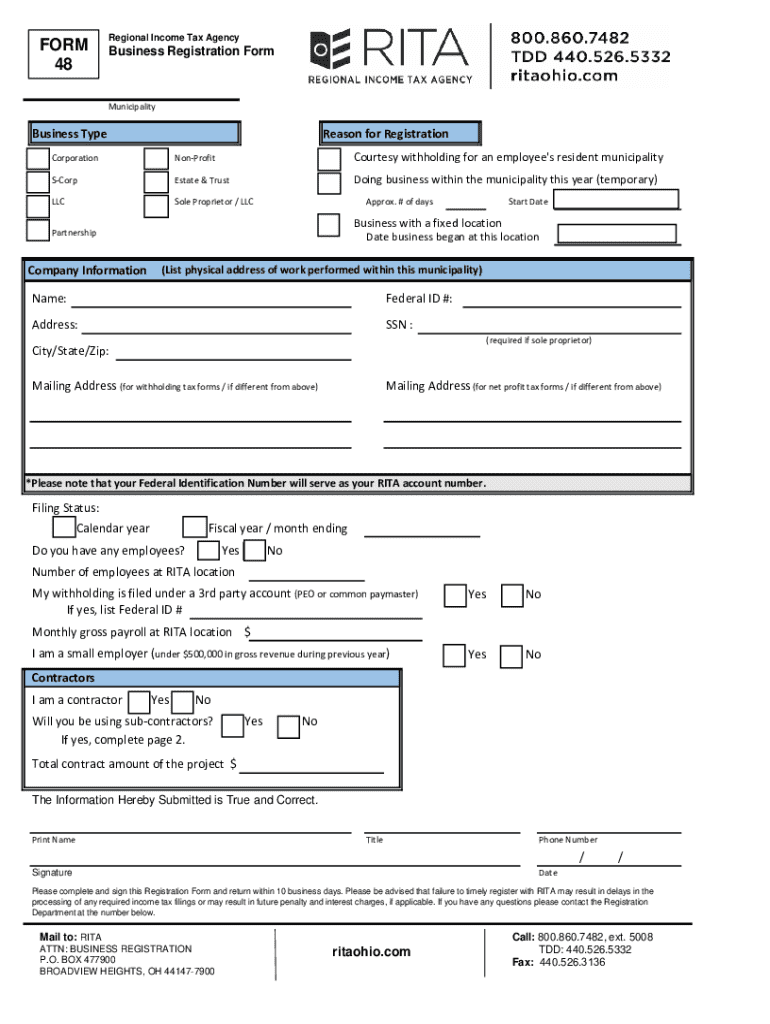

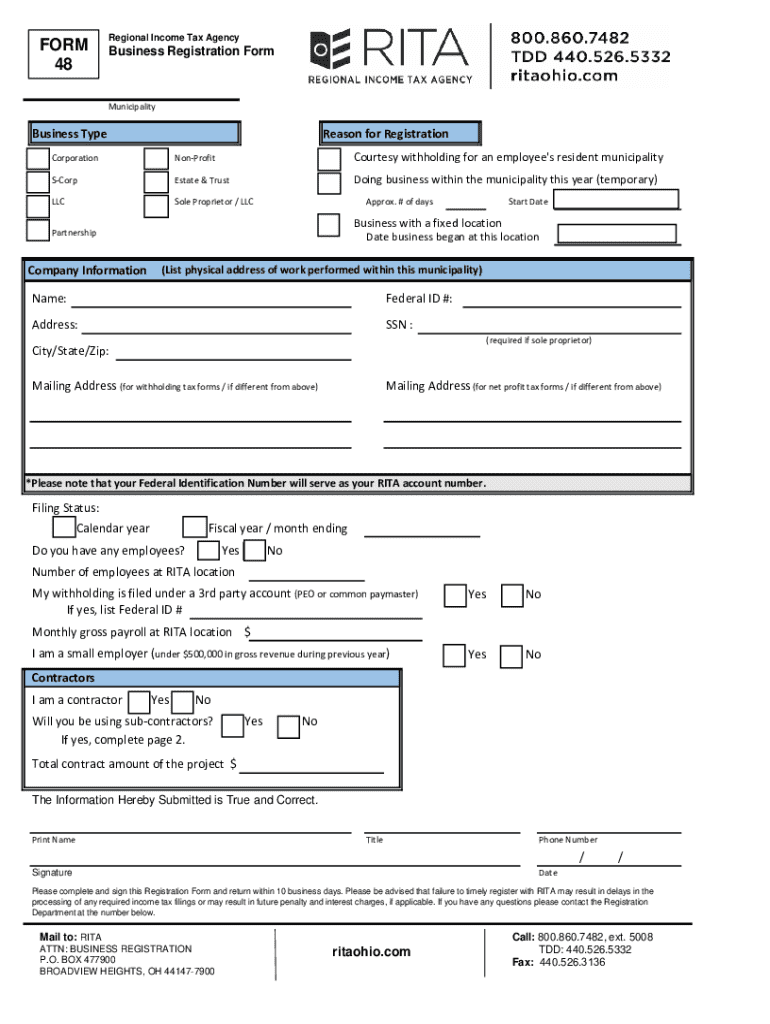

Get the free Courtesy withholding for an employee's resident municipality

Get, Create, Make and Sign courtesy withholding for an

Editing courtesy withholding for an online

Uncompromising security for your PDF editing and eSignature needs

How to fill out courtesy withholding for an

How to fill out courtesy withholding for an

Who needs courtesy withholding for an?

Courtesy withholding for an form: Your comprehensive how-to guide

Understanding courtesy withholding

Courtesy withholding refers to the practice where employers withhold state income tax for an employee who works in a different state than their resident state. This process simplifies the tax obligations for employees who might otherwise need to file taxes in multiple states. The main purpose of courtesy withholding is to prevent employees from facing double taxation while also ensuring compliance with state tax laws.

Legally, various states have enacted laws requiring or allowing courtesy withholding, particularly for employees who engage in remote work or often travel for business. Knowing these regulations can help employers navigate the complexities associated with multi-state employment.

The importance of courtesy withholding

Implementing courtesy withholding offers numerous benefits to both employees and employers. For employees, it simplifies tax obligations, enabling them to have their state tax withheld by their employer without needing to file multiple returns. For employers, courtesy withholding reduces administrative burdens and mitigates compliance risks related to multiple state tax regulations.

Common scenarios requiring courtesy withholding often arise in various industries, such as trucking and consulting, where employees frequently work in different states. For instance, a truck driver based in Ohio working in Michigan could benefit from courtesy withholding, preventing complications with state income taxes.

Implementing courtesy withholding: Step-by-step process

Implementing courtesy withholding can streamline payroll procedures. The following steps will guide you through the process:

Step 1: Assessing your obligations

Begin by determining the residency status of your employees. Understanding whether your employee is a resident of a state that imposes their local income tax is crucial. Next, identify the state tax withholding requirements that apply to your business operations.

Step 2: Setting up your payroll system

Choose the right payroll software that can manage courtesy withholding efficiently. Look for solutions that allow for automatic updates to tax rates and support various state forms. pdfFiller, for example, provides tools that integrate seamlessly with payroll and tax systems.

Step 3: Managing paperwork and compliance

Ensure all essential forms are readily available. You will need state-specific forms along with the usual W-4 forms. Utilizing pdfFiller can ease the process of generating, e-signing, and securely storing these documents for compliance.

Challenges with courtesy withholding

While courtesy withholding simplifies many aspects, it comes with its challenges. Misclassifying employees can lead to trouble down the line. Employers may also face challenges with errors in withholding calculations and payments, which can result in penalties.

Navigating the different regulations among states adds another layer of complexity. A clear understanding of the differences between tax reciprocity and courtesy withholding is vital, especially for businesses employing a workforce spread across multiple states.

Simplifying your courtesy withholding process with technology

Leveraging technology can greatly enhance the courtesy withholding process. pdfFiller offers solutions that streamline documentation tasks involved in tax form management. With interactive tools, employers can easily fill out, sign, and collaborate on necessary forms.

Additionally, automated reminders for tax filing deadlines and performance tracking related to courtesy withholding can ensure no important date is missed, further enhancing compliance.

Staying updated on courtesy withholding regulations

In the dynamic landscape of tax law, staying updated is paramount. Employers should invest in regular training and updates about payroll changes affecting courtesy withholding. Consulting with tax professionals ensures that any changes in legislation are identified and addressed promptly.

Utilizing alerts and announcements from official state websites can help keep employers informed about the latest requirements. This knowledge is crucial for compliance and minimizing risks associated with payroll management.

Practical FAQs related to courtesy withholding

Common queries surrounding courtesy withholding often arise due to its complexity. For instance, employers might wonder what to do if no withholding tax needs to be reported. In such cases, adhere to the state's guidelines, as situations can vary widely. Additionally, addressing correcting overpayments or underpayments is crucial to maintaining compliance.

Businesses employing individuals across state lines should understand how to transfer obligations correctly. Addressing unique circumstances like remote work and independent contractors can require further scrutiny, ensuring legal obligations are met while facilitating smooth operations.

Future of courtesy withholding

The future of courtesy withholding is shaped by evolving practices and technology. Legislative changes may introduce new requirements or clarify existing regulations, particularly in response to the remote work trend that has increased the number of employees working across state lines dramatically.

As technology advances, tools for document management in payroll will likely grow more sophisticated. pdfFiller, for example, continues to refine its capabilities, enabling users to manage forms efficiently in a cloud-based environment, which is essential for modern workforce management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit courtesy withholding for an on a smartphone?

How do I fill out courtesy withholding for an using my mobile device?

Can I edit courtesy withholding for an on an iOS device?

What is courtesy withholding for an?

Who is required to file courtesy withholding for an?

How to fill out courtesy withholding for an?

What is the purpose of courtesy withholding for an?

What information must be reported on courtesy withholding for an?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.