Get the free Cashless Health Insurance: 4 Steps Claim Process

Get, Create, Make and Sign cashless health insurance 4

How to edit cashless health insurance 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cashless health insurance 4

How to fill out cashless health insurance 4

Who needs cashless health insurance 4?

Understanding Cashless Health Insurance: A How-to Guide

Understanding cashless health insurance

Cashless health insurance is a modern approach that allows policyholders to receive medical treatment without having to make upfront payments. Instead of paying bills and seeking reimbursement later, hospitals and healthcare providers can directly settle costs with the insurance provider, streamlining the payment process. This model eliminates financial barriers during emergencies, ensuring timely access to medical care.

The importance of cashless transactions in healthcare cannot be overstated. Medical emergencies can be stressful, and complications can arise from financial concerns. Cashless health insurance addresses this issue, allowing patients to focus on their recovery rather than their expenses. Furthermore, cashless mechanisms enhance healthcare accessibility, leading to improved patient outcomes.

Understanding how cashless health insurance works involves grasping the ecosystem of network hospitals, pre-authorization processes, and the role of documentation. Hospitals partnered with insurance companies facilitate cashless transactions for treatments, making it vital to check whether your healthcare provider participates in these networks.

Key features of cashless health insurance

One of the standout features of cashless health insurance is seamless access to a network of hospitals. When policyholders seek treatment, they can do so at recognized facilities without initial payment, provided the hospital is within the insurer's network.

Utilizing a pre-authorization process is crucial in cashless claims. Before treatment, the hospital usually contacts the insurer to get approval for services, ensuring that necessary coverage is confirmed beforehand. This helps streamline the service and guarantees that patients receive the expected care.

Cashless health insurance typically covers various medical services, including inpatient treatments, surgeries, and critical illness care. However, personalizing coverage to suit individual or family needs is vital, thus selecting the correct plan becomes essential.

Types of cashless health insurance plans

Cashless health insurance comes in various formats, catering to distinct individual needs. The most common types include individual health insurance, family floater plans, senior citizen policies, and specific disease coverage plans.

Individual health insurance plans are tailored for those seeking coverage for personal medical needs. Family floater plans, on the other hand, allow a single sum insured to cover multiple family members under one policy, making it convenient and cost-effective.

For older adults, senior citizen policies offer tailored features like coverage for age-related conditions. Specific disease coverage plans focus on particular illnesses, providing comprehensive treatment options for those requiring targeted care. Choosing the right plan means evaluating your healthcare needs, financial capabilities, and family dynamics.

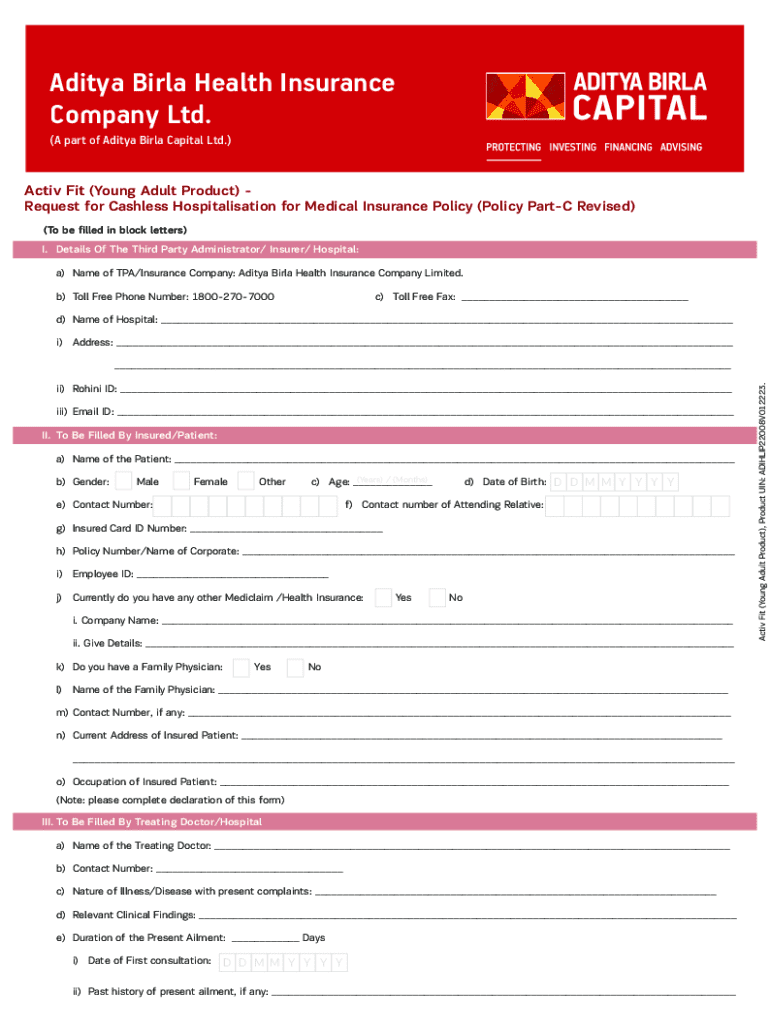

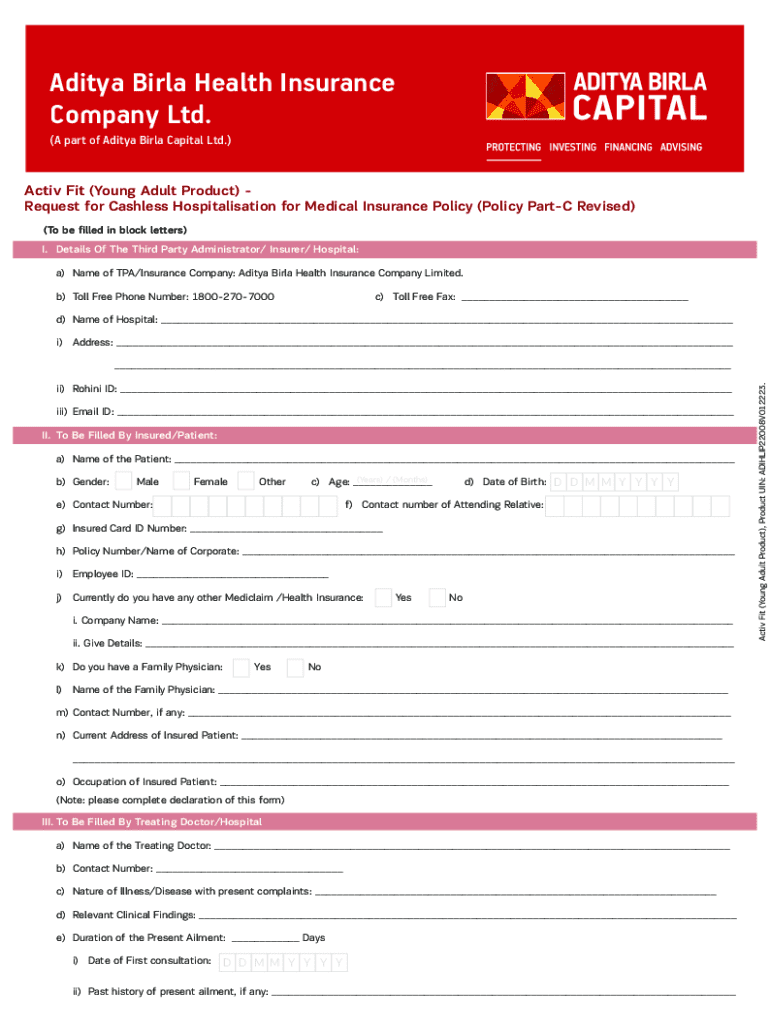

Cashless claim process: A step-by-step guide

Navigating the cashless claim process may seem daunting, but breaking it into steps can simplify understanding. Here’s a thorough guide:

Common issues and challenges in cashless health insurance claims

Despite the advantages of cashless health insurance, challenges occasionally arise during the claim process. Common issues include claim rejections due to insufficient documentation, non-disclosure of pre-existing conditions, or violations of policy terms.

To avoid these pitfalls, it’s crucial to familiarize yourself with your policy and gather all necessary documents before proceeding with claims. Ensure you have accurate and honest information on your claim forms, as discrepancies can lead to delays or approvals.

Inclusions and exclusions in cashless health insurance

Knowing what is included in your cashless health insurance plan is essential for managing expectations. Most policies include standard medical conditions, surgeries, and emergency treatments.

However, some exclusions are also crucial to understand, like cosmetic surgeries or alternative treatments, which are generally not covered. Specific pre-existing illnesses may also fall outside the coverage limit, making reading through policy documents critical.

Benefits of cashless health insurance

Cashless health insurance provides numerous advantages that improve the overall healthcare experience. One of the primary benefits is the convenience and efficiency it offers during medical emergencies. Patients can receive immediate care without worrying about proving funds at critical moments.

Cashless treatment brings financial predictability as no upfront costs are involved, ensuring patients are not burdened with unexpected expenses. Overall, this leads to an enhanced patient experience within hospitals, allowing for a focus solely on recovery and health rather than financial matters.

Navigating the cashless claim during hospitalization

While undergoing medical treatments, hospitals often deal with cashless claims for both planned and emergency hospitalizations. Understanding the procedures for filing a cashless claim during emergencies is essential for efficient healthcare management.

For planned hospitalizations, ensure you acquire pre-authorization well in advance. In emergencies, hospitals typically handle all claims directly, yet knowing which documents to present—even in emergencies—can streamline processes and help in securing necessary treatment without delays.

Using pdfFiller for managing essential documents can help streamline the process, ensuring you have the right papers ready for both situations.

The role of electronic document management in cashless health insurance

With the rise of digital solutions, managing cashless health insurance documents has never been easier. pdfFiller offers a robust platform that simplifies document handling for cashless claims, ensuring users can rapidly fill out, edit, and submit necessary forms.

Additionally, cloud-based document storage ensures that individuals can access their necessary paperwork from anywhere, facilitating real-time collaboration with healthcare providers. This not only speeds up claim processes but ensures ongoing engagement throughout treatment.

Frequently asked questions (FAQs) about cashless health insurance

Understanding the nuances around cashless health insurance can lead to many questions. Some of the most common queries include the fundamental differences between cashless and reimbursement plans, steps to take if a cashless claim is denied, and ways to check if your hospital is part of a cashless network.

It’s also helpful to know what actions can resolve disputes regarding cashless claims. Such proactive learning ensures policyholders remain informed and empowered regarding their healthcare choices.

Future trends in cashless health insurance

As health insurance technology continues to evolve, cashless health insurance is poised for significant transformation. Future innovations may include enhanced digital platforms that streamline the claim process even further, utilizing artificial intelligence for quicker approvals.

The role of digital platforms will likely increase in facilitating healthcare access, offering users real-time updates on their claims, tracking service levels, and enhancing overall satisfaction with healthcare services.

Using online tools for cashless health insurance management

In the contemporary digital landscape, utilizing online tools for managing cashless health insurance documents is vital. Platforms like pdfFiller allow users to securely manage their documents anytime, from anywhere, eliminating the stress of manual paperwork.

Interactive tools for filling out forms efficiently save time and reduce errors, ensuring that documents submitted for claims are accurate and complete, thus enhancing the overall cashless health insurance experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in cashless health insurance 4?

How do I edit cashless health insurance 4 in Chrome?

How do I complete cashless health insurance 4 on an Android device?

What is cashless health insurance 4?

Who is required to file cashless health insurance 4?

How to fill out cashless health insurance 4?

What is the purpose of cashless health insurance 4?

What information must be reported on cashless health insurance 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.