Get the free Complete Return for 334160

Get, Create, Make and Sign complete return for 334160

Editing complete return for 334160 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out complete return for 334160

How to fill out complete return for 334160

Who needs complete return for 334160?

Complete Return for 334160 Form: A Comprehensive Guide

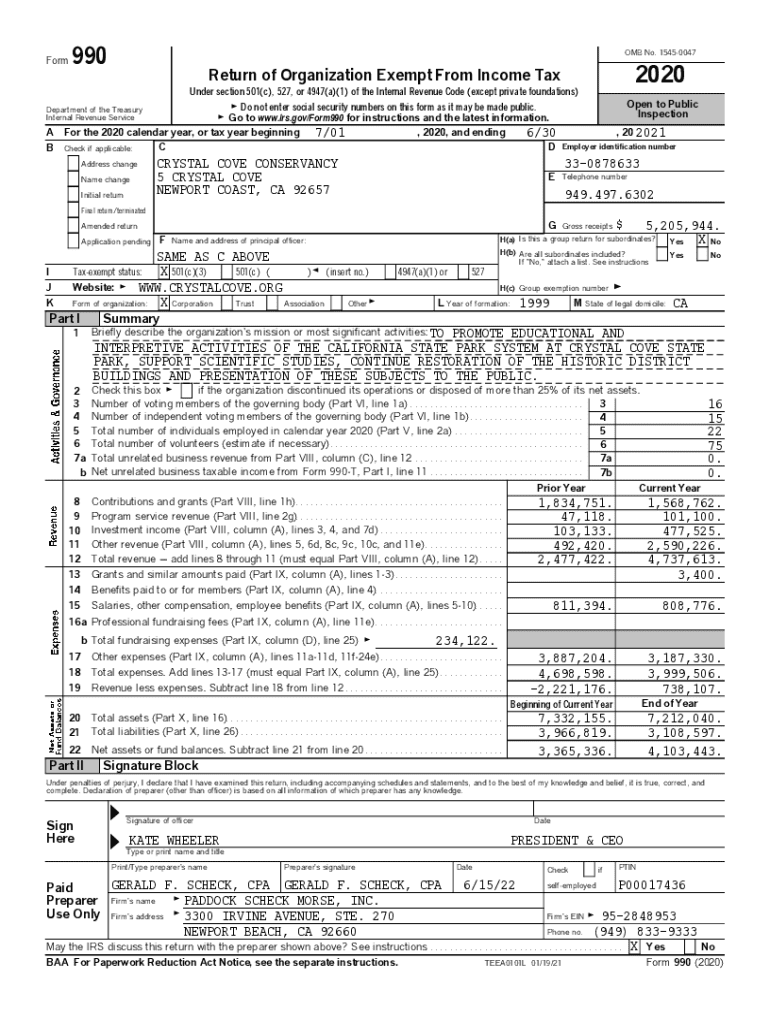

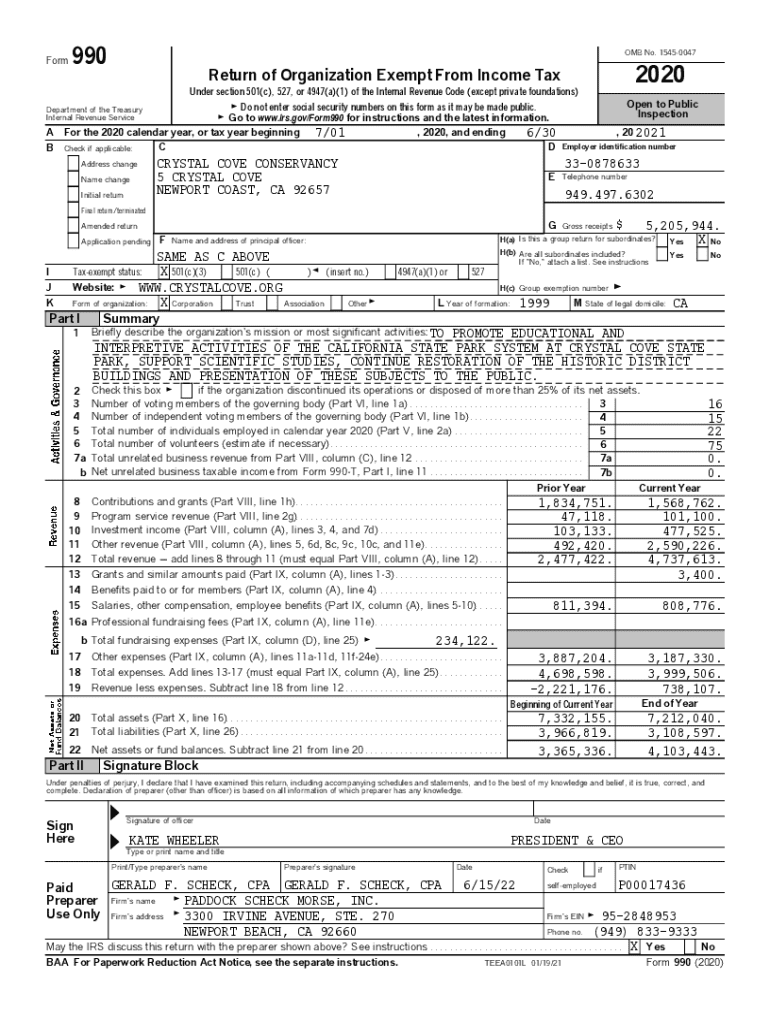

Understanding the 334160 form

The 334160 form plays a pivotal role in financial reporting, serving as a key document utilized by both individuals and organizations to communicate their financial status. Its primary purpose is to ensure transparency and accountability, making it crucial for compliance with regulatory standards.

Common use cases for the 334160 form include annual financial statements and tax declarations, where accurate data entry is vital. Understanding how to complete the form correctly is essential for individuals filing taxes or businesses submitting reports to stakeholders.

Importance of completing the 334160 form accurately

Completing the 334160 form accurately is paramount for ensuring compliance with financial regulations. Inaccurate submissions can lead to severe penalties, including fines or legal consequences. Correctly filled forms reflect honesty and can contribute to a smoother review process.

Furthermore, errors can result in financial misrepresentation, adversely impacting decision-making for both individuals and organizations. Adhering to the specific guidelines when completing this form can safeguard against such issues.

Step-by-step guide to completing the 334160 form

Completing the 334160 form requires careful preparation and organization. The first step is gathering the necessary information. Key documents include previous tax returns, financial statements, and any relevant tax deduction receipts.

The next step involves organizing this information systematically. Create a checklist to ensure you have everything at hand before starting on the form.

Navigating the sections of the form

Once you have all required documents ready, it's essential to understand how to navigate the sections of the 334160 form. Each section has its purpose, from reporting income to disclosing deductions.

Focus on providing precise details, as missing or incorrect information can lead to delays or rejections. Common pitfalls to avoid include failing to fill in required fields and providing inconsistent figures across different sections.

Filling out the form online vs. offline

Choosing between online or offline completion depends on personal preference and accessibility. Using platforms like pdfFiller for digital submissions offers several advantages, including ease of editing and convenience, allowing for immediate corrections.

On the other hand, filling out a physical form may be more comfortable for some; however, it can be less efficient in terms of making updates or corrections. Whichever method you choose, ensure that your information is accurately reflected.

Utilizing pdfFiller for your 334160 form

pdfFiller provides an interactive platform designed to simplify the form completion process. Its user-friendly interface lets you easily navigate all the features needed for filling out the 334160 form, including templates that reduce repetitive tasks.

Utilizing pre-filled options can also save considerable time, especially if you frequently submit similar information. pdfFiller empowers users to seamlessly edit PDFs, eSign, and collaborate from anywhere.

Editing and collaborating on your form

One of the standout features of pdfFiller is its editing capability. Whether you need to make minor adjustments or significant changes to your 334160 form, the editing tools within pdfFiller are robust yet straightforward to use.

Additionally, collaboration features allow multiple users to contribute to the form completion process, ensuring efficiency and accuracy. This is particularly advantageous for teams that need to work together on financial documents.

eSigning your 334160 form

The importance of e-signatures cannot be overstated, as they authenticate the document and signify consent. pdfFiller makes signing your completed 334160 form a seamless process, allowing users to add their signatures digitally with just a few clicks.

This feature not only saves time but also reduces the need for printing and scanning, making the entire process more eco-friendly and efficient.

Submitting your completed 334160 form

After filling out your 334160 form, it's crucial to conduct a final review. Create a checklist to ensure all data is accurate and complete. Common mistakes include omitting required signatures or failing to attach necessary documentation.

Once you’ve ensured everything is correct, you can submit your completed form through various methods. pdfFiller streamlines this process, allowing for electronic submissions that eliminate postal delays.

Troubleshooting common issues

If your 334160 form is not accepted, identifying the reason can save time in resubmission. Common reasons for rejection include missing signatures, incorrect financial figures, or not following submission guidelines.

To address these issues, carefully review your form against error-checking criteria before submission. Additional resources are often available to help you troubleshoot specific errors.

FAQs related to the 334160 form

Understanding common questions about the 334160 form can help alleviate confusion during completion and submission. Frequently asked questions include queries about deadlines, required attachments, and submission frequencies.

By familiarizing yourself with these topics, you can prepare adequately and reduce the likelihood of encountering problems during the completion process.

Managing your documentation post-submission

Tracking your submission status is crucial for ensuring your 334160 form has been processed correctly. Many platforms, including pdfFiller, offer tracking options that allow you to confirm receipt and processing of your submitted forms.

Additionally, maintaining organized digital storage of your documents helps you access them efficiently in the future. By utilizing pdfFiller’s cloud-based storage, you can ensure that your completed form is safe and accessible from anywhere.

Contacting support for assistance

If you encounter difficulties while completing the 334160 form, reaching out for assistance can be beneficial. pdfFiller provides support options that include live chat and a dedicated resource center.

These options ensure that you can get immediate help or find comprehensive guides and tutorials that can assist you in completing your documentation accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my complete return for 334160 in Gmail?

Where do I find complete return for 334160?

How do I edit complete return for 334160 online?

What is complete return for 334160?

Who is required to file complete return for 334160?

How to fill out complete return for 334160?

What is the purpose of complete return for 334160?

What information must be reported on complete return for 334160?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.