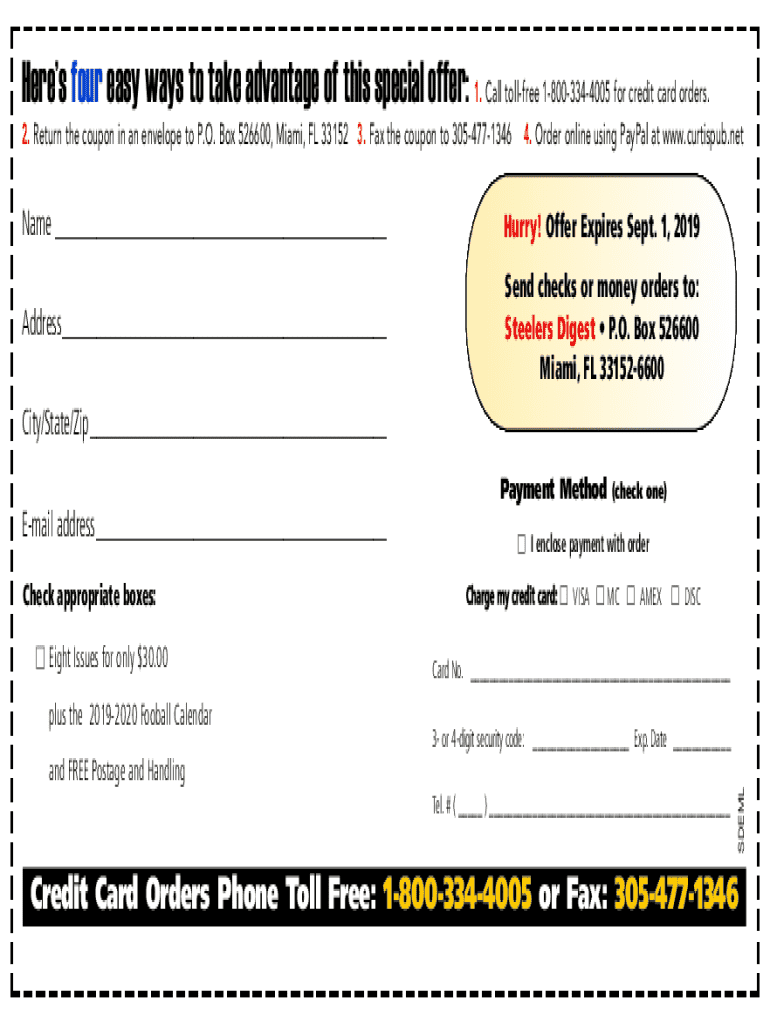

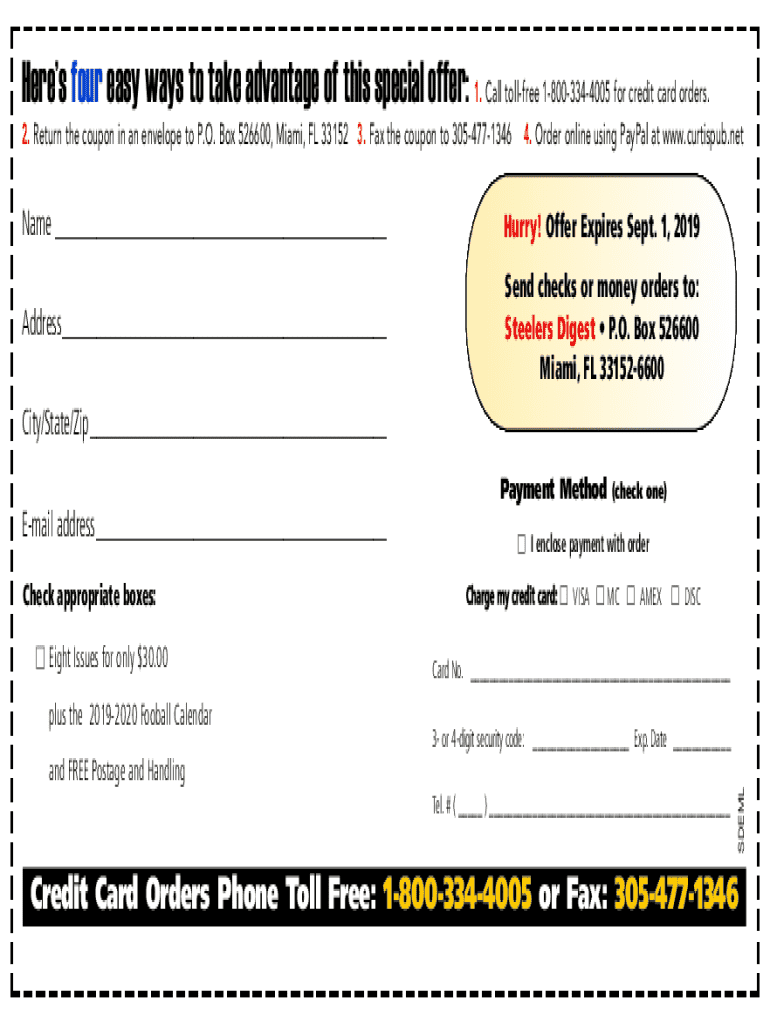

Get the free Credit Card Orders Phone Toll Free: 1-800-334-4005 or Fax

Get, Create, Make and Sign credit card orders phone

How to edit credit card orders phone online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card orders phone

How to fill out credit card orders phone

Who needs credit card orders phone?

Understanding and Utilizing Credit Card Orders Phone Forms

Understanding credit card orders phone forms

A credit card orders phone form is a document used to capture payment details during a telephonic transaction. This type of form allows businesses to securely gather and process credit card information from customers who wish to make payments over the phone instead of using an online or in-person payment method. The use of these forms has become increasingly vital in various industries, particularly where remote transactions are common.

Accurate documentation is paramount in payment processing, as errors can lead to discrepancies, delayed payments, or even chargebacks. Businesses benefit from having a standardized method for collecting payment information, which ensures consistent practices and helps maintain customer trust.

Integrating credit card orders phone forms into business operations streamlines the payment process, enhancing customer experience while allowing companies to maintain organized records and adhere to necessary compliance measures.

Advantages of using credit card orders phone forms

Utilizing credit card orders phone forms offers several key advantages for businesses and their customers alike. Primarily, they streamline the payment authorization process, significantly reducing transaction times and enhancing customer convenience. Customers can provide their payment details quickly and securely, which can lead to increased sales and satisfaction.

Improved record keeping and organization are additional benefits of using these forms. Centralized documentation allows businesses to track transactions more efficiently, making it easier to resolve disputes or manage financial records.

Security is also a major consideration. Well-designed credit card orders phone forms include measures to protect sensitive customer data, thereby reducing chargeback risks and safeguarding against fraudulent activities. By implementing these forms, businesses can build trust with their customers, assuring them that their payment information is handled responsibly.

Key components of a credit card orders phone form

A well-structured credit card orders phone form contains several essential components that ensure the thorough and secure collection of payment information. First and foremost, the form should include customer details such as name, address, and phone number. This information is crucial for identification and verification purposes.

Next, the form must capture credit card information accurately, including the card number, expiration date, and CVV. Additionally, a clear authorization statement should be included, where the customer gives consent for the charge. Optional but beneficial components include contact information for customer queries and any relevant payment terms and conditions, providing clarity to both parties.

To further refine the utility of the credit card orders phone form, businesses can include custom fields tailored to their specific needs or industry requirements, ensuring that the forms are truly reflective of their operational functions.

How to fill out a credit card orders phone form (step-by-step)

Filling out a credit card orders phone form is a straightforward process when approached methodically. First, identify who is responsible for completing the form, typically a company representative handling customer transactions. This person should be trained in best practices for data handling and security when dealing with sensitive information.

The next step is to input the customer's basic information accurately. Following this, credit card details must be entered. It's essential to advise your team on secure data entry practices to ensure the information stays protected, utilizing encrypted channels when necessary.

After all information has been entered, verification is crucial. Double-checking all details helps prevent errors that could lead to payment issues. Finally, a signature is typically required to finalize the authorization, and completed forms should be safeguarded in a secure, compliant manner to prevent unauthorized access.

Common mistakes to avoid when using credit card orders phone forms

While credit card orders phone forms are highly effective, certain pitfalls can undermine their effectiveness. One common mistake is incorrect data entry, which can occur when distracted or inexperienced staff hastily fill out the forms. Always emphasize the importance of careful information gathering.

Another critical error is failing to obtain proper authorization from the customer. For a transaction to be valid, the customer must clearly indicate their consent. Not providing clear terms of service can also lead to misunderstandings and disputes, so including this information is essential.

Additionally, ignoring necessary security measures can leave sensitive data vulnerable, potentially resulting in data breaches. Lastly, neglecting document management practices can hinder future business operations, such as audits or financial assessments.

Ensuring compliance with payment processing regulations

Incorporating credit card orders phone forms into business processes requires adherence to various payment processing regulations. Understanding relevant laws and paying close attention to standards governing payments is crucial to mitigate legal risks. This includes recognizing requirements from both federal and state regulations, as well as any industry-specific guidelines.

A significant aspect of compliance is ensuring PCI (Payment Card Industry) compliance. This set of security standards is essential for organizations that handle credit card information. Staying abreast of changes and updates to these regulations is imperative for mitigating risks associated with data breaches and maintaining customer trust.

Frequently asked questions (FAQs)

In this section, we address some common queries related to credit card orders phone forms. What happens if I lose one of these forms? It's crucial to implement a secure document management process to minimize the risk of loss. If a form is lost, take immediate steps to inform affected customers and monitor for unauthorized charges.

Can customers revoke authorization after submitting the form? Yes, they can usually contact you to cancel the transaction, although policies may vary. Businesses should maintain clear terms regarding cancellations to avoid confusion.

How should businesses maintain records of these forms? Keeping organized and secure records is fundamental for tracking transactions and legal compliance. Utilize cloud-based solutions like pdfFiller to enhance document management.

What security measures should be in place for handling these forms? Implementing encryption, secure storage solutions, and staff training on data privacy are necessary steps to protect customer information.

Best practices for implementing credit card orders phone forms

To maximize the efficacy of credit card orders phone forms, it's essential to establish best practices. Start by training staff on proper use and the importance of handling sensitive data carefully. Empowering your team with knowledge helps in maintaining compliance and preventing errors.

Utilizing digital solutions for enhanced management can streamline processes and improve security. Leveraging tools like pdfFiller offers numerous benefits, including easy access to templates, secure document handling capabilities, and a cloud-based platform for real-time collaboration.

Regularly updating template forms to reflect changing business policies or regulations is another critical best practice. Keeping forms fresh ensures compliance and reduces the risk of operational errors.

Troubleshooting common issues with credit card orders phone forms

Addressing customer concerns during the filling of a credit card orders phone form is essential for ensuring a positive experience. Be prepared to guide customers through the process, answering questions and providing clarity on any part of the form that may seem confusing.

Resolving errors in submitted forms is equally important. Should a customer submit an incorrect form, promptly follow up to rectify the situation, whether by re-confirming details or issuing new forms as necessary. The follow-up steps after form submission include confirming the processing status and providing the customer with updates on their transaction.

Resources for further assistance

For those looking to streamline their operations, pdfFiller provides a wealth of resources for creating and managing credit card orders phone forms. From customizable templates tailored to various industries to access to professional guidance, users can find the necessary tools to ensure secure and efficient document processing.

Additionally, educational materials on secure payment processing can enhance understanding and compliance, empowering businesses to effectively navigate the complexities of credit card transactions.

pdfFiller remains committed to financial security and document management excellence. By exploring more of their tools, businesses and teams can elevate their document creation and management practices, ensuring adherence to industry standards while enhancing customer experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit card orders phone online?

How do I fill out credit card orders phone using my mobile device?

How can I fill out credit card orders phone on an iOS device?

What is credit card orders phone?

Who is required to file credit card orders phone?

How to fill out credit card orders phone?

What is the purpose of credit card orders phone?

What information must be reported on credit card orders phone?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.