Get the free CASH AND RSP (BROKER)

Get, Create, Make and Sign cash and rsp broker

Editing cash and rsp broker online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash and rsp broker

How to fill out cash and rsp broker

Who needs cash and rsp broker?

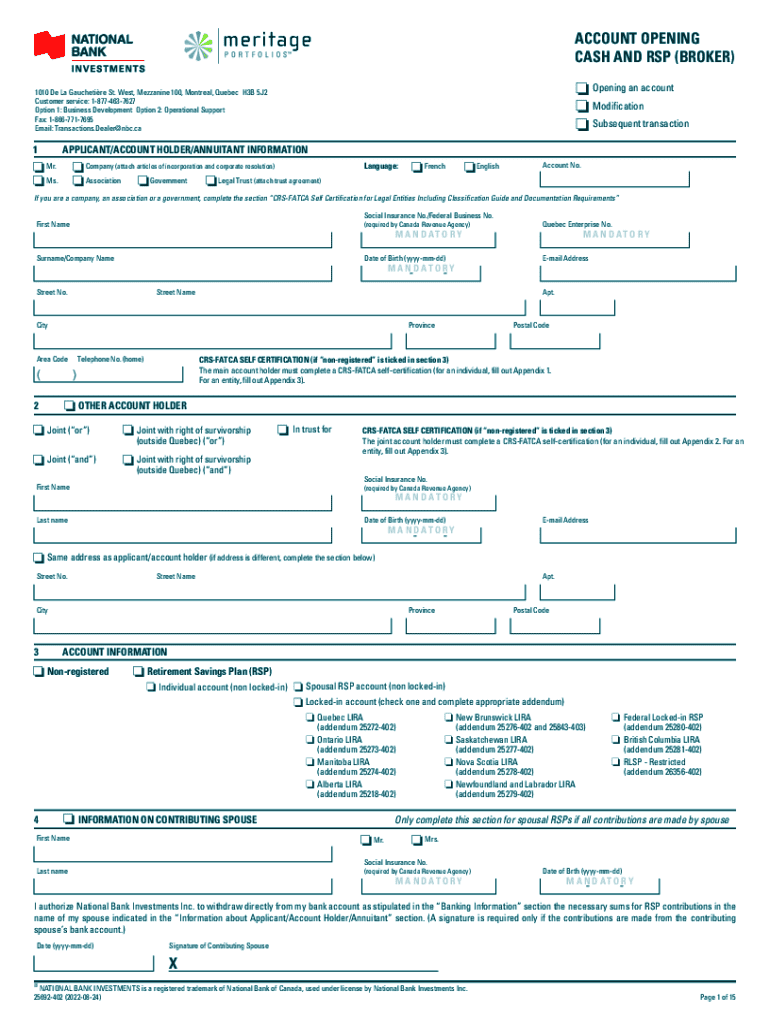

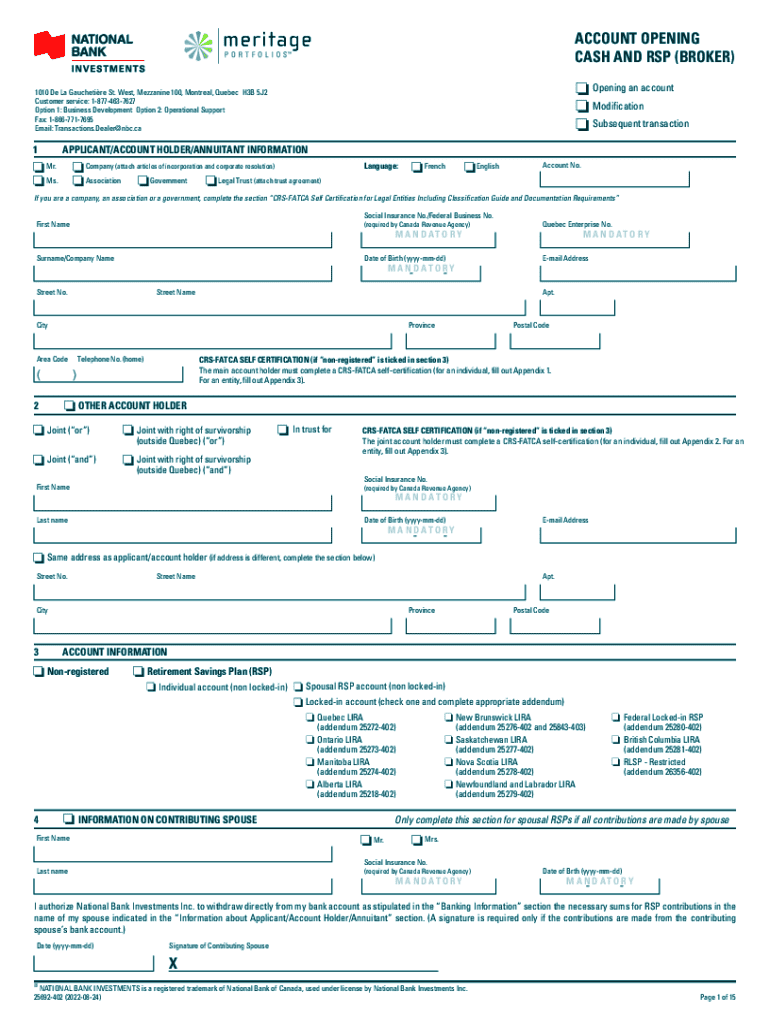

Comprehensive Guide to the Cash and RSP Broker Form

Understanding the cash and RSP broker form

The Cash and RSP Broker Form is an essential document for investors looking to manage their cash and Registered Savings Plans (RSPs) effectively. This form facilitates the process of opening a brokerage account, allowing individuals to invest in various financial products such as stocks, bonds, and mutual funds.

Understanding this form is crucial as it directly impacts how your investments are structured and managed. A clean, accurate submission can lead to a smoother investment experience and better financial outcomes.

Navigating the cash and RSP broker process

Initiating the Cash and RSP brokerage process requires attention to detail and careful preparation. The first step involves gathering personal data and relevant financial documents. Accurate completion of the form is vital since discrepancies can delay the process or even result in application denial.

Many applicants overlook minor details, leading to common pitfalls such as discrepancies in personal information or misreported income. It's critical to double-check entries and ensure they align with supporting documentation.

Detailed breakdown of the cash and RSP broker form

The Cash and RSP Broker Form is structured into several key sections, each crucial for establishing your investment account. Understanding these sections will help you navigate the form more effectively.

The Personal Information section requires your name, address, contact number, and optionally, information that can help your broker facilitate effective communication. The Financial Information section verifies your income and financial stability, crucial for risk assessment.

Filling out the cash and RSP broker form

Filling out the Cash and RSP Broker Form correctly requires methodical preparation and attention to detail. Start by gathering the necessary documents, such as identification and proof of income. This will help ensure that all required information is available at your fingertips.

Furthermore, consider whether you'll submit the form online or offline. Online submission offers speed and convenience, but ensure you have reliable internet access. Conversely, offline submission might take longer due to postal delays, yet it allows for a more personal touch.

Managing your investment account

Upon submitting your Cash and RSP Broker Form, the initial setup of your investment account will commence. You may need to set up online account features to track your investments efficiently. This includes accessing your investment portfolio and understanding account statements.

Investors must also engage in ongoing management of their portfolios. Regular reviews are essential to adjust strategies based on market conditions and changes in personal financial goals. This proactive approach ensures that your investments align with your evolving life circumstances.

Understanding fees and charges

Investing through a Cash and RSP brokerage account comes with various fees that can affect your returns. It's essential to understand these costs, such as maintenance fees and transaction fees associated with buying or selling investments.

Maintenance fees can accumulate over time, reducing your investment's growth. Choosing the right broker with a transparent fee structure allows you to manage your costs effectively and maximize net returns.

Leveraging interactive tools within pdfFiller

pdfFiller offers a range of features designed to streamline the management of forms. With real-time collaboration tools, teams can work together on the Cash and RSP Broker Form, ensuring that expert insight and compliance is readily available.

Additionally, pdfFiller's cloud-based solutions enable easy document storage and organization. Accessing your forms from any device ensures that your investment management is seamless, regardless of location.

Tools for enhancing your investment knowledge

Deepening your understanding of investment strategies, particularly regarding RSPs, is vital for financial success. Explore online courses, webinars, and recommended books centered around RSP strategies to equip yourself with knowledge.

Staying current with financial news platforms will help you keep up with trends and learn from experts in the field. Use these resources to inform your investment decisions and guide your portfolio management strategies.

Customer support and assistance

When encountering difficulties while filling out the Cash and RSP Broker Form, accessing customer service can resolve issues promptly. Brokers often provide multiple channels for support, including phone, chat, and email, ensuring that assistance is readily available.

Common queries about forms or account processes can often be resolved through FAQs provided by the broker. Don't hesitate to seek assistance; having clarity on your investments is essential for maintaining financial health.

Future of cash and RSP management with technology

Technological advancements are continuously reshaping the landscape of investment management. Innovations in digital brokerage solutions streamline the documentation process, providing enhanced user experiences. Looking ahead, expect an increased emphasis on cloud-based platforms that offer easy access and functionality for users managing their investments.

As investment management evolves, embracing user-friendly platforms like pdfFiller will ensure that individuals can navigate their RSP and cash management with ease and efficiency. Understanding how to leverage these tools will be key to future investment success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in cash and rsp broker without leaving Chrome?

Can I create an electronic signature for signing my cash and rsp broker in Gmail?

Can I edit cash and rsp broker on an iOS device?

What is cash and rsp broker?

Who is required to file cash and rsp broker?

How to fill out cash and rsp broker?

What is the purpose of cash and rsp broker?

What information must be reported on cash and rsp broker?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.