Get the free CT-1, Initial Registration Form and Instructions. CT-1, Initial Registration Form an...

Get, Create, Make and Sign ct-1 initial registration form

How to edit ct-1 initial registration form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1 initial registration form

How to fill out ct-1 initial registration form

Who needs ct-1 initial registration form?

CT-1 Initial Registration Form: A Comprehensive Guide

Understanding the CT-1 initial registration form

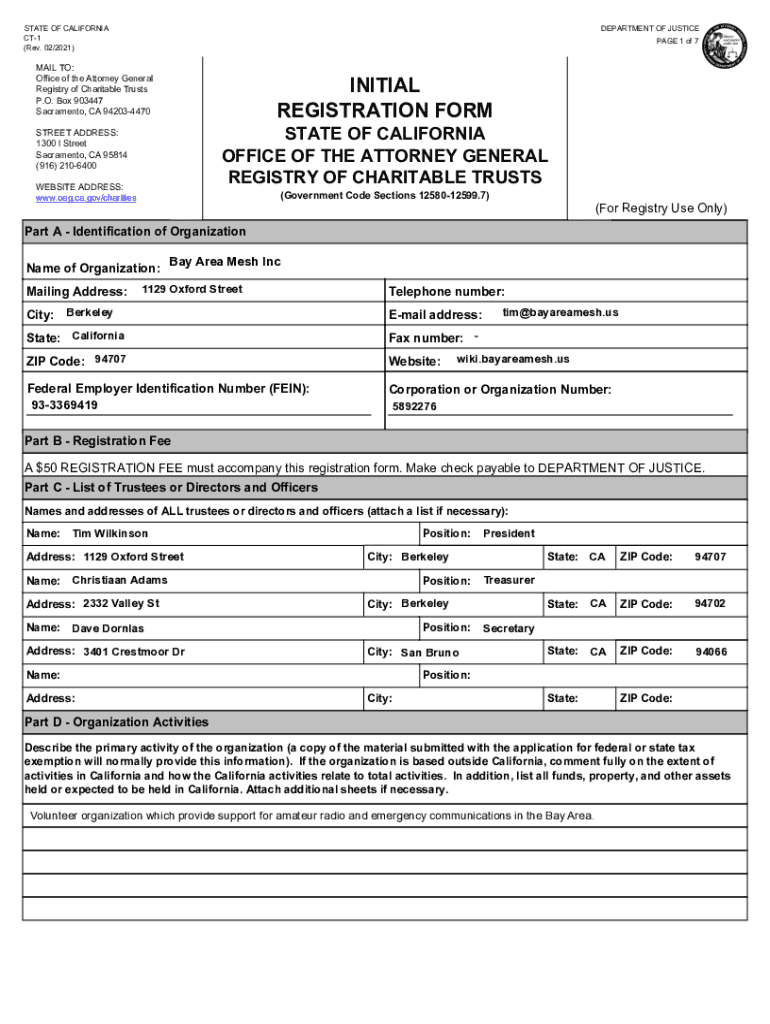

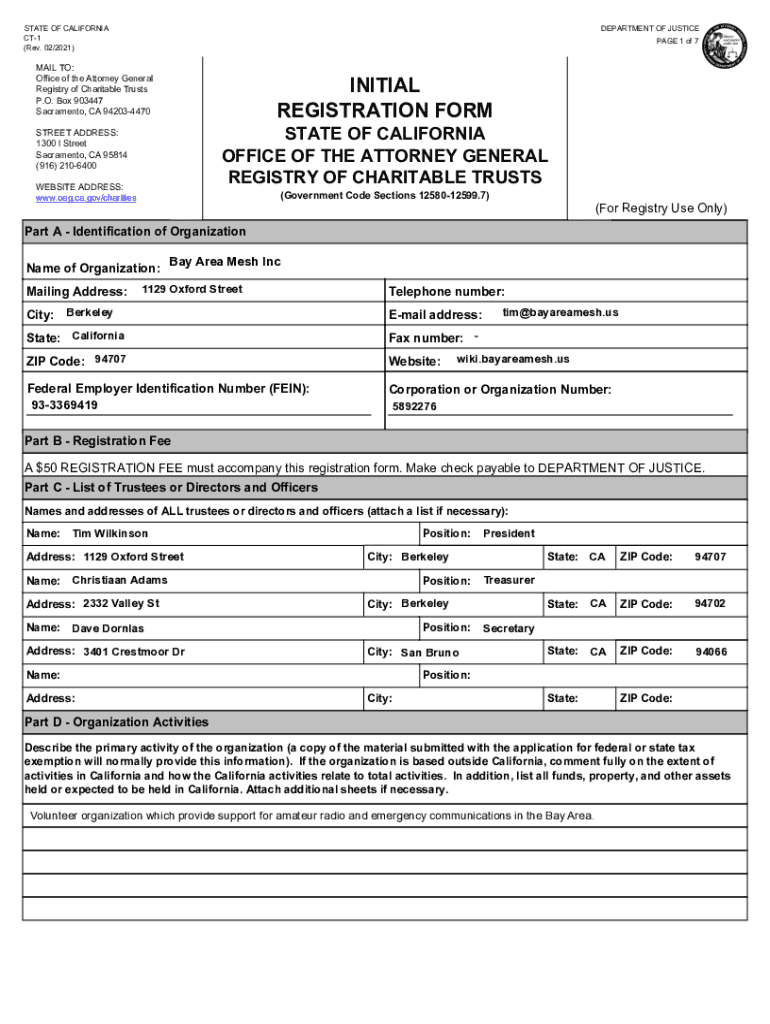

The CT-1 Initial Registration Form is a pivotal document for nonprofit organizations operating in California. It serves as the initial step for registering with the California Secretary of State, allowing nonprofits to establish their existence legally. This form provides essential information about the organization, including its mission, governance structure, and financial outlook, facilitating transparency and compliance with state regulations.

Initial registration is critical for nonprofits as it ensures they can operate legally, access funding, and engage with the community effectively. Filing the CT-1 form is not merely a bureaucratic requirement; it is an opportunity for nonprofits to outline their goals and secure a formal recognition that aids in attracting donors and volunteers.

Who needs to file the CT-1 form?

Various types of organizations are mandated to submit the CT-1 form, specifically those seeking to incorporate as nonprofit entities in California. This includes charitable organizations, educational institutions, and foundations that intend to operate for public benefit. Meeting eligibility criteria involves confirming that the organization complies with California nonprofit laws and aligns with the IRS guidelines for tax-exempt status.

Preparing to complete the CT-1 initial registration form

Before diving into the CT-1 form, gather all necessary information and documents. This preparation stage is essential for a smooth filing process. You'll need crucial details such as the organization’s legal name, mission statement, leadership structure, and Employer Identification Number (EIN), among others.

To avoid common pitfalls during this data-gathering phase, ensure that all documents are current and accurately reflect the organization’s purpose and governance structure. Misrepresentations or outdated information can lead to delays or complications during the registration process.

Tips for accurate & efficient filling

When filling out the CT-1 form, accuracy is paramount. Ensure that you enter all data carefully, paying attention to detail and double-checking for typos. Adhering to best practices, such as maintaining a consistent format for dates and using official titles for organizational members, helps streamline the review process.

Step-by-step instructions for filling out the CT-1 form

Completing the CT-1 form involves several specific sections, each requiring distinct information.

Section 1: Organization details

In this section, provide the organization's official name, address, and contact information. Additionally, articulate the mission and objectives succinctly, as this sets the tone for the organization’s intent.

Section 2: Leadership information

Detail the members of the board and key officers in this part, including their respective titles and contact information. Transparency in this area fosters trust and accountability, which are essential for nonprofit success.

Section 3: Financial information

Here, outline the organization’s current financial standing and projected income and expenses. Clearly detailing expected funding sources, such as donations, grants, or fundraising activities, is crucial for the assessment of your nonprofit's viability.

Section 4: Submission process

Once completed, the CT-1 form can be submitted either online or by mail, depending on your preference. For online submissions, ensure you have a reliable internet connection and follow the prompts provided on the Secretary of State's website. After submission, keep proof of your filing and check for confirmation. Tracking your application status can help you stay informed about any updates or requirements.

What comes after filing the CT-1 form?

Once you have submitted the CT-1 form, anticipation of confirmation is next. Typically, organizations receive acknowledgment from the California Secretary of State within a specified timeframe, allowing you to plan your next steps effectively.

Initial registration confirmation

Upon confirmation, review the acknowledgment letter for details on follow-up actions or additional requirements. Being proactive in responding to any inquiries or requests for further information will facilitate smooth processing.

Next steps for nonprofit compliance

Filing the Statement of Information (Form SI-100) is often the next critical step after your CT-1 has been accepted. Organizations should also prepare for federal tax exemption by filing IRS Form 1023, ensuring that they are aligned with both state and federal regulations.

Frequently asked questions (FAQs) about the CT-1 initial registration form

What happens if file my CT-1 form late?

Filing the CT-1 form late can lead to penalties, including fines or delays in obtaining necessary certifications. It is crucial for organizations to adhere to deadlines to maintain their legal status and operational continuity.

Can changes be made to the CT-1 after submission?

Yes, amendments can be made to the CT-1 form after it has been submitted. Organizations must follow the prescribed amendment process through the California Secretary of State’s office, providing updated information as necessary.

Are there resources for further support?

Various resources, including the California Secretary of State’s website, nonprofit associations, and legal aid organizations, offer assistance and guidance when completing the CT-1 form. Utilizing these resources can provide additional clarity and support throughout the registration process.

Using pdfFiller for document management

Features to enhance your CT-1 completion experience

pdfFiller offers an array of features designed to simplify the CT-1 completion process. With cloud-based editing capabilities, users can fill out and edit the CT-1 form from anywhere with internet access. eSignature functionalities enable easy sign-off on documents, while collaboration tools facilitate seamless teamwork in preparing submissions.

Advantages of managing your forms on pdfFiller

Managing your CT-1 form and other documents through pdfFiller enhances accessibility. Users can securely store sensitive documents while enjoying the flexibility of accessing forms on any device. This cloud-based solution ensures efficient document management and minimizes the risk of lost paperwork.

Real-life examples and success stories

Case studies of successful nonprofit registrations

Numerous organizations have leveraged the CT-1 form successfully to establish themselves in California. Testimonials from these organizations often highlight how the clear structure and information requirements not only facilitated their registration but also helped them articulate their mission more clearly to stakeholders.

How pdfFiller has helped other organizations

pdfFiller has played a transformative role for several nonprofits navigating the registration landscape. Feedback from users indicates that the platform streamlined their document handling processes, allowing them to focus more on their missions rather than the intricacies of form management.

Explore other related forms & templates available on pdfFiller

Additional forms for nonprofits

In addition to the CT-1 form, pdfFiller offers a variety of other templates tailored for California nonprofits. Forms such as the Statement of Information (Form SI-100) and IRS Form 1023 are accessible, ensuring that organizations can find all their registration and compliance needs in one place.

Upcoming changes in nonprofit registration requirements

Stay informed about potential regulatory changes in nonprofit registration to ensure your organization remains compliant. Monitoring updates from the California Secretary of State and relevant federal agencies prepares your organization for any shifts in requirements and practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ct-1 initial registration form in Chrome?

How can I edit ct-1 initial registration form on a smartphone?

How do I fill out ct-1 initial registration form on an Android device?

What is ct-1 initial registration form?

Who is required to file ct-1 initial registration form?

How to fill out ct-1 initial registration form?

What is the purpose of ct-1 initial registration form?

What information must be reported on ct-1 initial registration form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.