Get the free charitable organization initial registration & annual report ...

Get, Create, Make and Sign charitable organization initial registration

Editing charitable organization initial registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable organization initial registration

How to fill out charitable organization initial registration

Who needs charitable organization initial registration?

Comprehensive Guide to Charitable Organization Initial Registration Form

Understanding charitable organizations

Charitable organizations are entities established to pursue social, educational, religious, or public benefit missions. These organizations typically aim to aid the public by addressing issues such as poverty, education, health care, and environment among others. They can operate as nonprofits, charitable trusts, or through the efforts of professional fundraisers.

Initial registration serves as the foundational step for establishing a legal identity for these organizations. It not only legitimizes their existence but also enables them to garner public trust and access essential funding sources. Registration is vital for compliance with local, state, and federal regulations.

Preparing for initial registration

Preparation for the initial registration of a charitable organization is crucial. First, it’s essential to determine whether your organization meets the eligibility criteria set by local laws. Understanding the unique structure and mission of your organization can streamline this process significantly.

Gathering the required documentation is the next important step. Key documents include your organization’s bylaws, an IRS determination letter confirming tax-exempt status, and thorough financial statements outlining projected revenues and expenses.

Additionally, understanding registration fees and other costs associated with filing can help avoid unexpected financial strains during the process.

Step-by-step guide to completing the initial registration form

Begin the process by accessing the charitable organization initial registration form accessible through pdfFiller. This platform provides intuitive tools for editing and completing the document seamlessly.

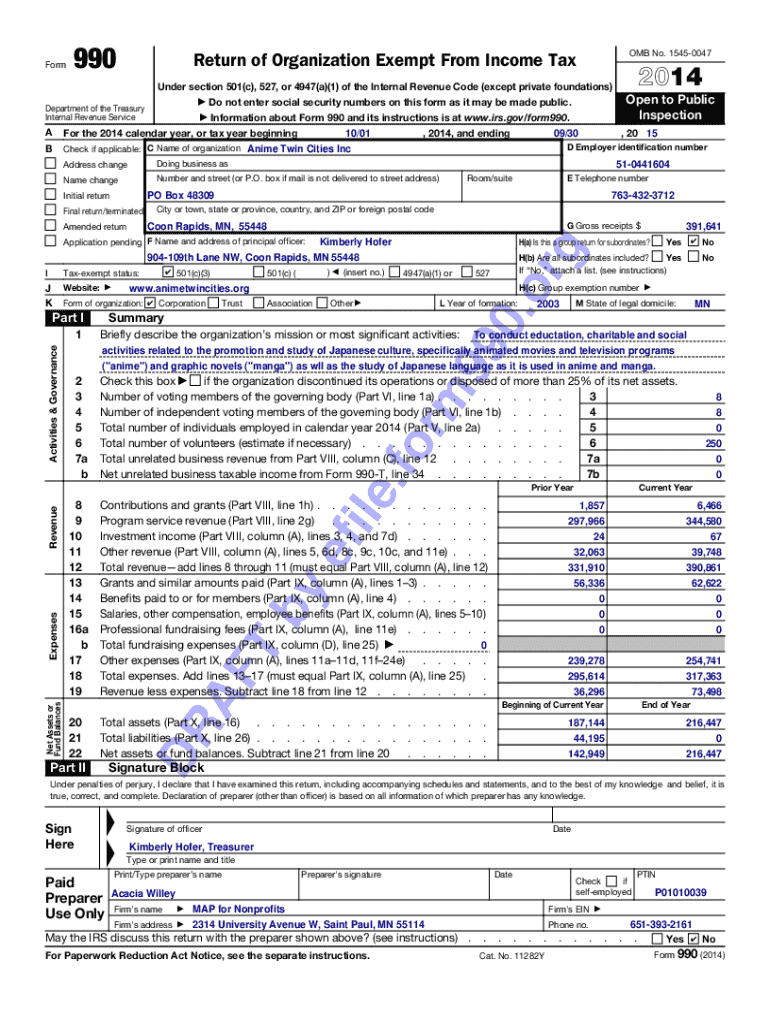

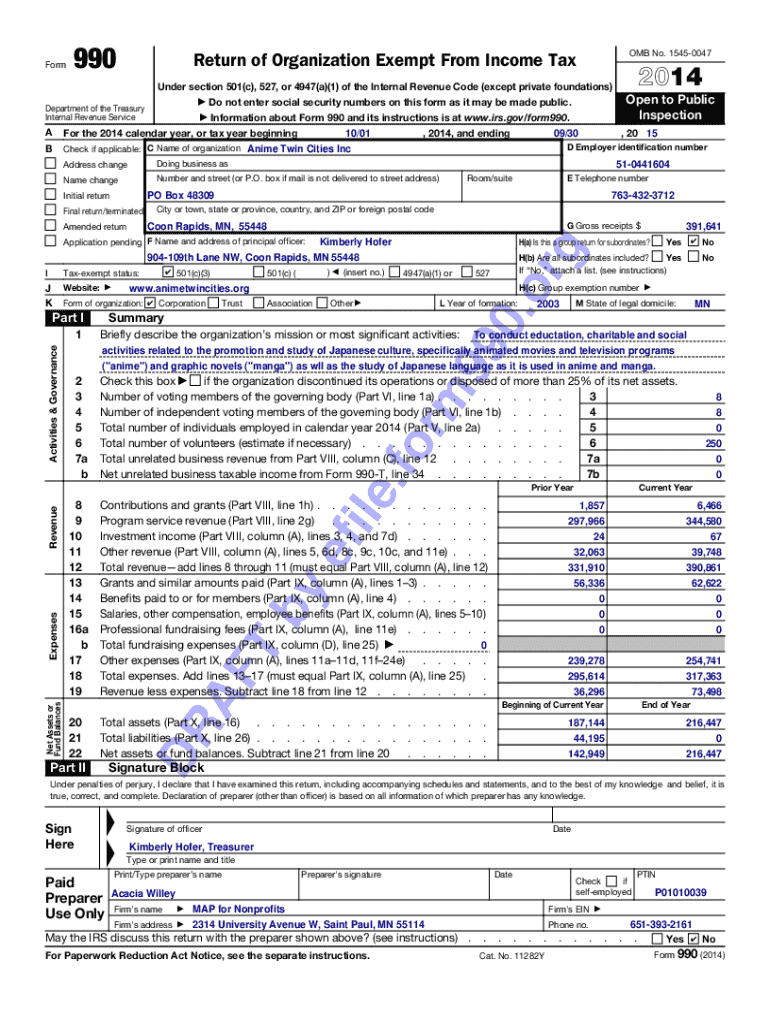

The form comprises several sections that must be accurately filled out. The basic information section requires details such as the organization name, contact information, and a clear mission statement, while the financial information section asks for projected income and expenses along with identified funding sources.

Furthermore, the governance section necessitates information about board members, including their backgrounds and any potential conflicts of interest to promote transparency.

Once the form is filled out, utilize pdfFiller’s tools to review and edit the document for accuracy. After finalizing the content, ensure to sign and submit the form electronically to maintain an effective workflow.

Common mistakes to avoid in initial registration

Completing the initial registration form for a charitable organization can be daunting. Avoiding common pitfalls will ensure a smoother registration process. A frequent mistake is leaving information incomplete or providing unclear details, which can lead to unnecessary delays.

Moreover, misunderstanding the eligibility requirements can set back progress, so it's crucial to familiarize yourself with all criteria early on. Charitable organizations must also stay vigilant to update information regularly, as failure to do so can result in complications in maintaining your registered status.

Post-registration expectations

After submitting your initial registration form, managing your charitable organization's registration status is vital. Make it a priority to stay informed about renewals and necessary updates to comply with the latest regulations.

Knowing your reporting obligations is equally essential, as many jurisdictions require periodic financial statements, updates on activities, and compliance with fundraising regulations. Engaging in regular oversight helps maintain the integrity and effectiveness of your organization.

Tools and resources for successful registration

Leveraging tools like pdfFiller for document management can significantly enhance the registration process. The platform offers interactive features for editing, signing, and collaborating on documents, making it an invaluable resource for organizations.

Additionally, utilizing cloud storage can ensure your documents remain secure and accessible from anywhere. Participating in webinars focused on charitable organization registration can provide deeper insights into navigating the complexities of the process.

Lastly, exploring frequently asked questions (FAQs) related to the registration process can provide clarity and help answer immediate concerns.

Related information and next steps

Getting familiar with state-specific registration requirements is crucial for compliance. Charitable trusts and fundraisers might need separate considerations and pathways when completing their registration, and best practices should be employed when choosing fundraising platforms.

Identifying resources for further assistance can alleviate challenges. Establishing connections with local nonprofits or attending informational workshops can yield fruitful networking opportunities.

Additional insights on the nonprofit sector

Understanding current trends in charitable organizations is vital for sustained engagement with your audience and stakeholders. Nonprofits are experiencing a shift towards digital transformation, emphasizing online donations and virtual events, which should be reflected in organizational strategies.

Regulations impacting nonprofits continue to evolve, making it critical for organizations to remain adaptable. Engaging in community outreach and fostering networking can provide additional visibility and support for missions, enhancing the overall impact of your charitable efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the charitable organization initial registration in Gmail?

How do I edit charitable organization initial registration straight from my smartphone?

Can I edit charitable organization initial registration on an Android device?

What is charitable organization initial registration?

Who is required to file charitable organization initial registration?

How to fill out charitable organization initial registration?

What is the purpose of charitable organization initial registration?

What information must be reported on charitable organization initial registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.