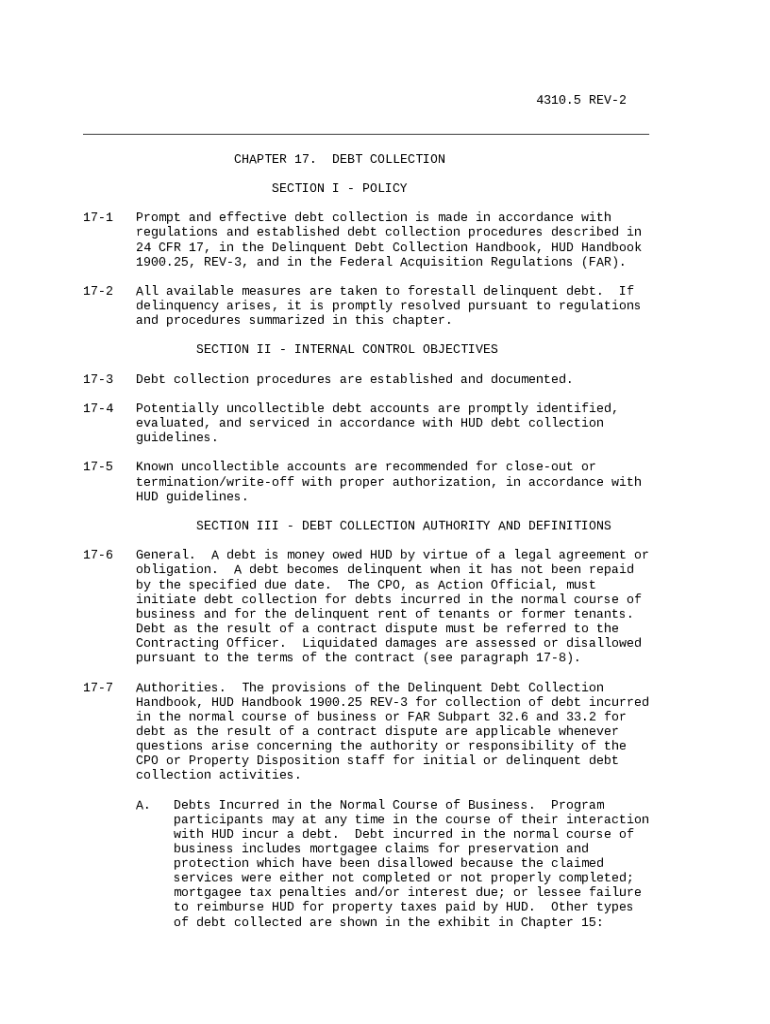

Chapter 17 Debt Collection Form: A Comprehensive Guide

Understanding debt collection forms

Debt collection forms serve a critical role in legal and financial frameworks. They are documents used by creditors or debt collectors to detail the specifics of outstanding debts and to communicate effectively with debtors. These forms ensure that the debt collection process adheres to regulatory guidelines while keeping all parties informed and accountable.

Proper documentation is essential in debt collection as it secures the rights of creditors and provides necessary protections for debtors. Without well-maintained records, the collection process can become muddled, leading to legal disputes and potential losses. Creating and maintaining accurate debt collection forms is not merely good practice; it's integral to effective financial management.

Types of debt collection forms

Several types of debt collection forms exist, each tailored to specific purposes within the collection process. Understanding these forms can aid creditors in choosing the right approach for their situation.

Demand Letters: These are formal requests for payment that outline the amount owed and the deadline for repayment.

Settlement Offers: These forms propose reduced payment amounts to settle the outstanding debt, often used when the debtor is in financial distress.

Repayment Agreements: These documents establish a payment plan that allows the debtor to pay off their debt over time, helping both parties avoid more severe collection actions.

Sample templates and letters for debt collection

Having access to well-structured templates can streamline the debt collection process, saving time and confusion. Below are key templates that can be easily adapted for individual needs.

Sample debt collection demand letter

A demand letter is often the first formal step in collection. It should include key components such as the debtor's account number, the amount due, and a specified payment due date.

Personalization tips include using the debtor's name, mentioning previous communication, and offering clear instructions on how the debtor can make the payment.

Request for further information letter

This letter is useful when debtors request verification of the debt or need more details. An effective letter should clearly state the request and contain a polite but firm tone.

Offer of settlement template

Crafting an offer of settlement involves outlining the proposed payment terms, the reason for the offer, and a request for a written response. Clarity and empathy can encourage a positive response.

Deed of settlement

A deed of settlement formalizes an agreement reached between the creditor and debtor. It should include all terms previously discussed and be signed by both parties to ensure enforceability.

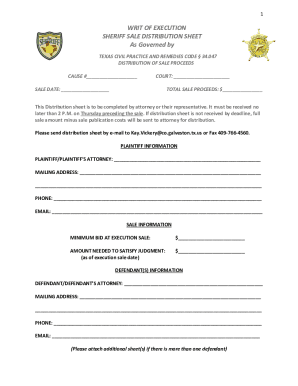

Steps to complete a debt collection form

Completing a debt collection form accurately is vital for a successful collection process. Here are the essential steps to consider.

Evaluating your situation

Start by assessing the debt amounts. Make a list of all debts, ensuring you're not overlooking any legal aspects like interest rates or fees. Understanding your rights is equally important; research the Fair Debt Collection Practices Act (FDCPA) to ensure compliance.

Filling out the form

When filling out the form, ensure all sections are complete. Avoid common mistakes such as leaving out necessary signatures or failing to label forms accurately. Consistency is key; use the same terminology throughout your paperwork.

Signing and submitting the form

When the form is complete, consider using eSigning options available through pdfFiller for convenience and security. Best practices for submission include following up to confirm receipt by the intended party.

Managing debt collection communications

Effective communication with debtors is crucial in establishing rapport and facilitating timely payments.

Responding to debt collection agencies

Engaging with debt collection agencies requires clarity and directness. Express your position succinctly while maintaining a professional tone. Use templates to ensure that you don’t miss any important points in the discussion.

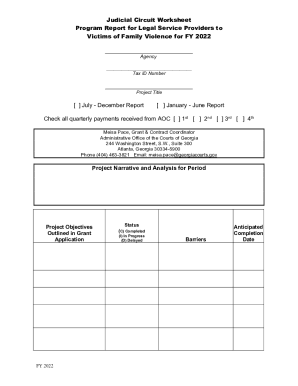

Documenting interactions

Keeping thorough records of all communications is critical. Utilize a recommended log format to track conversations, letters sent, and payment receipts. This documentation can protect you in case of disputes.

Handling allegations of harassment

If allegations of harassment arise, it’s essential to understand your rights. Review the FDCPA and consider how to respond effectively. A well-crafted response can clarify misunderstandings and maintain professional integrity.

Legal considerations in debt collection

Navigating the legal landscape of debt collection can be complicated. Familiarity with applicable laws is essential.

Overview of relevant laws

The Fair Debt Collection Practices Act (FDCPA) governs how debt collectors can conduct their activities. This includes stipulations about communication times, the language used, and the rights of consumers.

Knowing when to seek legal help

Recognizing signs of potential abuse or unfair practices is critical. If you suspect illegal behavior, consulting with a legal professional is advisable to protect your interests.

Troubleshooting common issues

The debt collection process can present numerous challenges. Understanding how to address these issues promptly can improve outcomes.

When the debtor does not respond

If there’s no response from the debtor, consider sending a follow-up letter. This should include a clear summary of previous communications and a new deadline for action.

Disputing incorrect information

If incorrect information appears on your debt collection form, it's crucial to file a dispute. Specify the errors clearly in your communication and maintain copies of all correspondence.

Extending payment deadlines

Negotiating payment deadlines can foster goodwill. Use templates to propose new terms that are mutually acceptable while ensuring you document all agreements for clarity.

Case studies in debt collection

Analyzing real-life scenarios provides valuable insights into effective debt collection strategies.

Real-life examples of successful collection strategies

Case Study 1: A company utilized clear and direct communication in their initial demand letters, resulting in a 70% repayment rate. Their success stemmed from personalized outreach, which created a positive rapport with debtors.

Case Study 2: A law firm faced challenges with aggressive debt collection practices; however, they learned from mistakes by ensuring compliance with the FDCPA, which improved their reputation and relationship with clients.

Lessons learned from failed attempts

An analysis of missteps in debt collection reveals that unclear communications and failure to follow legal guidelines often lead to failure. Key takeaways emphasize the importance of professionalism and adherence to legal standards.

Interactive tools and features

Leveraging interactive tools can significantly enhance the efficiency of debt collection efforts.

Utilizing pdfFiller features

pdfFiller provides a user-friendly platform for managing debt collection forms, offering benefits such as enhanced editing capabilities, secure eSigning options, and easy collaboration tools for teams.

Tips for effortless document management

Utilize templates offered by pdfFiller to streamline document creation. Ensure all team members are trained on utilizing the platform’s features for maximum efficiency.

Conclusion and best practices for ongoing management

To ensure effective debt collection, continuously monitor processes and communications. Regular reviews can help identify areas for improvement and prevent potential issues.

Establishing a follow-up system is also crucial. By scheduling reminders and utilizing automated tools within pdfFiller, you can maintain organized records and keep the collection process on track.

Feedback and user experience

Encouraging feedback on form usability helps improve user experience. Actively seeking input allows the development team at pdfFiller to enhance features based on user input.

Regular updates and enhancements based on feedback keep pdfFiller at the forefront of document management, ensuring that users have access to the best tools for efficient debt collection.