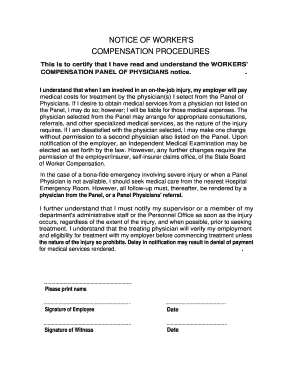

Get the free Corporate Compliance Plan For Behavioral Healthcare, Inc.

Get, Create, Make and Sign corporate compliance plan for

Editing corporate compliance plan for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate compliance plan for

How to fill out corporate compliance plan for

Who needs corporate compliance plan for?

Corporate compliance plan for form: A comprehensive guide

Understanding corporate compliance: An overview

Corporate compliance refers to an organization's adherence to laws, regulations, policies, and procedures relevant to its business operations. This is not merely about avoiding fines or legal issues; it encompasses the ethical standards an organization commits to uphold. Corporate compliance encompasses a broad spectrum, from financial regulations to employment laws, ensuring that businesses operate within legally sound frameworks.

An effective compliance plan is crucial in today’s business environment where data breaches, fraud, and regulatory penalties can severely impact an organization’s reputation and financial standing. Additionally, a well-structured compliance plan plays a pivotal role in risk management by identifying and mitigating potential risks before they escalate into significant issues.

The essentials of a corporate compliance plan

Creating a corporate compliance plan requires more than just adhering to regulations; it necessitates the establishment of a comprehensive framework that encompasses several key components. To effectively safeguard the organization, a compliance framework must be developed, which sets the foundation for compliance policies and procedures. Here are the essential components of an effective compliance plan:

Moreover, customization is vital for tailoring the compliance plan to the specific needs of the organization. Factors such as industry standards, company size, and operational scope must be considered when developing a personalized compliance strategy.

Setting the stage: Conducting a risk assessment

A fundamental step in crafting an effective corporate compliance plan for form is conducting a thorough risk assessment. This process begins with the identification of potential compliance risks that the organization might face. Compliance risks can manifest in various forms, such as legal, financial, or operational risks.

There are various tools and techniques for assessing these risks, including surveys, interviews, and data analysis. Prioritizing identified risks is crucial; organizations should focus on high-impact areas to allocate resources effectively.

Crafting policies and procedures

Effective corporate compliance policies must be clear and concise to ensure that all employees understand their responsibilities. A sample policy structure might include an introduction, a statement of purpose, and detailed sections outlining the specific compliance responsibilities and procedures relevant to each department.

The importance of using clear language cannot be overstated; ambiguity can lead to misinterpretations and non-compliance. Once policies are developed, clear procedures for implementation should be established, including step-by-step protocols for employees to follow.

Training employees: Ensuring awareness and adherence

Employee training is a cornerstone of a successful corporate compliance plan for form. Training not only informs staff about their compliance obligations but also fosters a culture of integrity and responsibility. To ensure effectiveness, various types of training programs can be used, including online modules, in-person workshops, and continuous education programs.

Assessing the effectiveness of training programs is vital. This can be done through tools and metrics such as quizzes, feedback forms, and follow-up interviews to gauge understanding and retention of compliance concepts.

Monitoring and auditing for compliance

Setting up a robust monitoring framework is essential for ensuring ongoing compliance. Organizations must decide on the types of monitoring to implement—whether real-time or periodic assessments. Utilizing Key Performance Indicators (KPIs) can aid in measuring compliance effectiveness and identifying areas for improvement.

Auditing processes further verify compliance, with both internal and external audits playing critical roles. Establishing a clear schedule for audits—perhaps quarterly or bi-annually—ensures that compliance remains a priority.

Establishing reporting and investigating processes

Creating a whistleblower policy is a fundamental aspect of a corporate compliance plan, ensuring that employees feel safe reporting concerns. A successful whistleblower policy emphasizes anonymity and protection for individuals who report violations.

Establishing clear investigation protocols allows for timely and thorough inquiries into compliance violations, leading to appropriate outcomes and disciplinary actions where necessary.

Utilizing technology for compliance management

Incorporating technology into compliance management significantly enhances document handling processes. Document management solutions, like those offered by pdfFiller, provide robust capabilities for managing compliance documents efficiently. Cloud-based platforms offer considerable benefits, including accessibility, capacity for eSignatures, and document tracking, which simplify compliance administration.

These technologies empower organizations to maintain compliance more effectively, addressing needs from documentation to tracking and reporting.

Maintaining compliance: An ongoing process

Compliance is not a one-time initiative but an ongoing process demanding continuous improvement. Regularly reviewing and updating compliance policies ensures they align with evolving regulations and internal changes. Organizations should engage employees in dialogue surrounding compliance to foster a culture of commitment and accountability.

Maintaining a strong compliance environment requires vigilance and adaptation to new challenges that may arise.

Case studies: Lessons from successful corporate compliance plans

Examining real-world examples can provide valuable insights into effective corporate compliance plans. For instance, Company A successfully implemented a comprehensive compliance program that not only met legal requirements but also integrated a proactive risk management approach, resulting in a significant reduction in compliance-related issues.

Conversely, Company B faced challenges in their compliance program due to inadequate employee training and ambiguous policies. However, by re-evaluating their strategies and focusing on employee engagement, they were able to turn their compliance efforts around, achieving better adherence to their compliance obligations.

Conclusion: The path to effective corporate compliance

In summary, a corporate compliance plan for form is a multi-faceted framework that requires careful consideration and ongoing attention. By understanding the foundational elements, conducting thorough risk assessments, and implementing effective training and monitoring mechanisms, organizations can foster a culture of compliance that not only meets regulatory requirements but builds long-term integrity.

Engaging proactively with compliance initiatives equips organizations to navigate the complexities of regulatory landscapes while also reinforcing a commitment to ethical business practices. As organizations invest in their compliance plans, they will not only protect their interests but also enhance their reputations in the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate compliance plan for for eSignature?

Where do I find corporate compliance plan for?

Can I sign the corporate compliance plan for electronically in Chrome?

What is corporate compliance plan for?

Who is required to file corporate compliance plan for?

How to fill out corporate compliance plan for?

What is the purpose of corporate compliance plan for?

What information must be reported on corporate compliance plan for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.