Get the free Carmen Chu, San Francisco Assessor-Recorder

Get, Create, Make and Sign carmen chu san francisco

Editing carmen chu san francisco online

Uncompromising security for your PDF editing and eSignature needs

How to fill out carmen chu san francisco

How to fill out carmen chu san francisco

Who needs carmen chu san francisco?

Carmen Chu San Francisco Form - How-to Guide

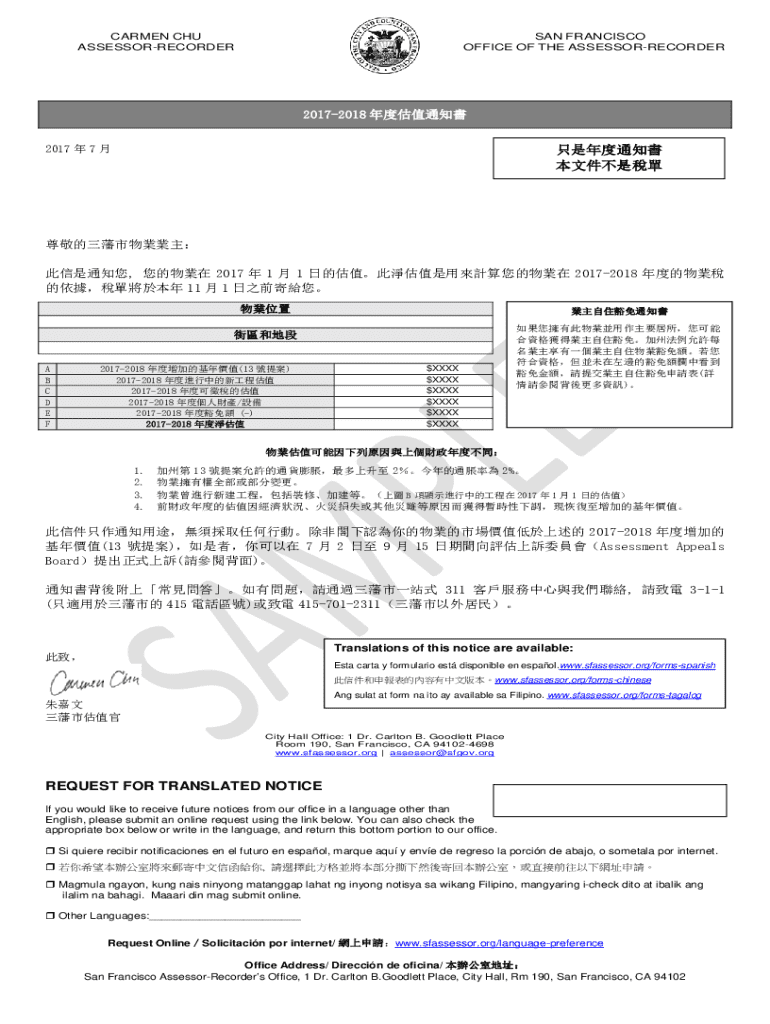

Overview of the Carmen Chu San Francisco Form

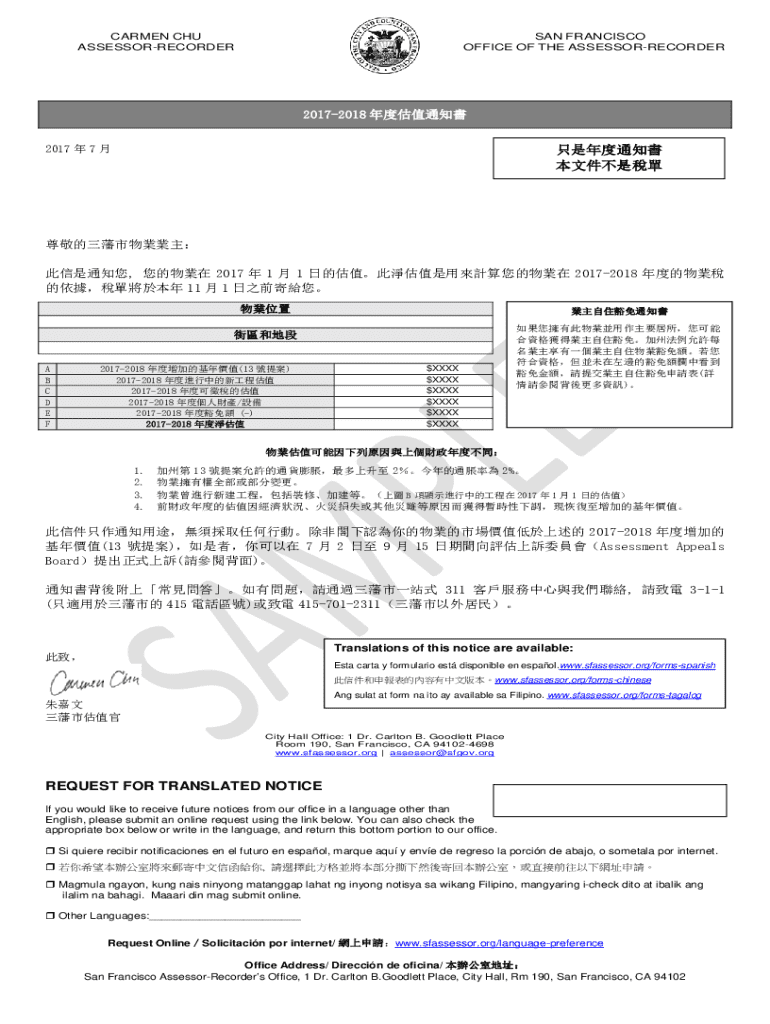

The Carmen Chu San Francisco Form is a vital document for residents and property owners in San Francisco. This form is specifically designed to facilitate various assessments and administrative processes handled by the city's Assessor-Recorder's Office. Understanding the purpose of this form is crucial for ensuring proper compliance with local regulations and requirements.

Filling out the form accurately is important, as mistakes or incomplete information can lead to delays or complications in processing. Whether you are filing for property tax exemptions or making changes to property records, ensuring that you follow the correct procedures enhances the efficiency of your submission.

Accessing the Carmen Chu Form

Finding the Carmen Chu form on the San Francisco government website is straightforward. The form is typically hosted on the Assessor-Recorder's Office page, where residents can access various documents related to property assessments. If you're looking for the specific form you need, you can start by visiting the official San Francisco government site.

Additionally, pdfFiller offers you the ability to access the Carmen Chu form conveniently, allowing for easy editing and completion right from your browser. With pdfFiller, you can upload the form, edit it, and fill it out without having to print it, making the process much more efficient.

Detailed instructions for filling out the form

Completing the Carmen Chu San Francisco form properly requires careful attention to detail. Below is a step-by-step guide on how to fill out the various sections of the form:

Common issues, such as missing signatures or incorrect property details, can lead to delays in processing. By double-checking your information before submission, you can help ensure that your form is processed promptly.

Tips for editing and collaborating on the form

Collaborating on the Carmen Chu form can be made significantly easier through tools like pdfFiller. Not only does pdfFiller allow for real-time collaboration, but it also provides options for comments and annotations to ensure clarity and alignment among all parties involved.

These collaborative features can drastically streamline the process, especially for teams handling multiple submissions or complex forms.

eSigning the Carmen Chu form

Digital signatures have become increasingly important in maintaining the efficiency and legality of document submissions. The Carmen Chu form can be electronically signed using pdfFiller's eSignature feature, providing you with a secure and fast way to finalize your form.

Using digital signatures not only expedites the process but also preserves the integrity of your documents. Ensure all parties involved are comfortable with eSigning technology to avoid confusion.

Submitting the form to the Assessor-Recorder's Office

Once your Carmen Chu form has been completed and signed, the next step is submission. You have several options for submitting your form to the Assessor-Recorder's Office. The two main methods are online submission and in-person delivery.

After submitting your form, you should receive a confirmation of submission. This confirmation is important as it serves as proof that you have completed your filing.

Managing your form after submission

After submission, it's essential to track the progress of your form and make any necessary corrections promptly. You can usually check the status of your submission via the Assessor-Recorder's website or contact their office directly.

Managing your form proactively can save you time and ensure that your requests are handled efficiently.

Frequently asked questions about the Carmen Chu form

It’s common for users to have many questions about the Carmen Chu San Francisco form. Here are some common queries that can help clarify the process:

These FAQs serve as a guide to help you navigate the submission process with confidence.

Related forms and resources

In addition to the Carmen Chu form, San Francisco residents may need to access other relevant forms depending on their circumstances. Here are some important links to consider:

These resources are designed to assist you in navigating the landscape of form submissions in San Francisco.

Engaging with local governance

Filling out the Carmen Chu form isn’t just about paperwork; it’s a crucial way for residents to engage with local governance. The information collected helps shape local policies and ensures accurate records are maintained.

Being active participants in this process can lead to improved facilities and services for everyone in the community.

Technology and innovation in document management

Utilizing platforms like pdfFiller enhances your document management capabilities, making it easier to handle the Carmen Chu form and other necessary documents. The shift towards cloud-based solutions simplifies the process of accessing and managing forms from anywhere.

These innovations not only simplify form management but also promote secure and efficient handling of important documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute carmen chu san francisco online?

How do I edit carmen chu san francisco in Chrome?

Can I create an electronic signature for signing my carmen chu san francisco in Gmail?

What is carmen chu san francisco?

Who is required to file carmen chu san francisco?

How to fill out carmen chu san francisco?

What is the purpose of carmen chu san francisco?

What information must be reported on carmen chu san francisco?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.