Get the free Rev. Proc. 73-29

Get, Create, Make and Sign rev proc 73-29

How to edit rev proc 73-29 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rev proc 73-29

How to fill out rev proc 73-29

Who needs rev proc 73-29?

Rev Proc 73-29 Form: Your Comprehensive Guide

Understanding Rev Proc 73-29: An overview

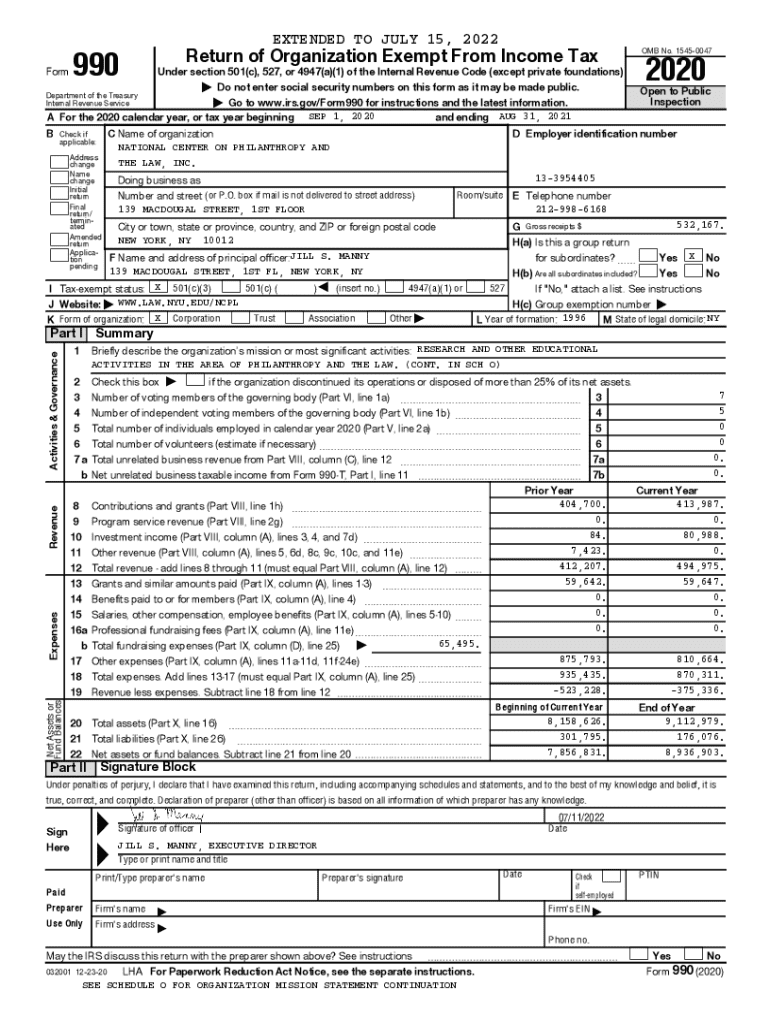

Rev Proc 73-29, officially known as Revenue Procedure 73-29, is a crucial document utilized in the realm of federal income tax. It serves as a guideline for taxpayers who are keen on understanding their responsibilities when it comes to reporting certain types of income. This form originated in the early 1970s in response to the evolving complexities of the tax code, providing a structured approach for individuals and businesses to follow. The significance of this document cannot be overstated, as it offers clarity and a standardized process that undoubtedly assists in easing the often daunting task of tax compliance.

By providing clear definitions and guidelines, Rev Proc 73-29 ensures that taxpayers can effectively assess their obligations, thereby minimizing the risk of penalties or unnecessary litigation. The form has since evolved, adapting to changes within the IRS and the broader tax landscape, ensuring its relevance and utility for today’s taxpayers.

Who needs to use the Rev Proc 73-29 form?

The Rev Proc 73-29 form caters to a diverse range of users, from individual taxpayers to large corporate entities. Individuals who receive a specific type of income—such as self-employment income—should familiarize themselves with this form, as it provides essential guidance on how to report that income accurately. On the other hand, teams managing financial portfolios or accounting departments in companies can benefit significantly, as the form aids in compliance with federal regulations and offers clarity on tax obligations.

Understanding eligibility requirements is paramount. Generally, anyone who falls within particular income thresholds or involved in specific tax scenarios may need to utilize the form. Special cases, such as those accounting for foreign income or specific tax deductions, might also necessitate the use of Rev Proc 73-29. It’s highly recommended to evaluate your income sources and any related tax situations to gain a better understanding of whether this form applies to you.

Step-by-step guide to completing the Rev Proc 73-29 form

Filling out the Rev Proc 73-29 form requires careful preparation to ensure accuracy and compliance. Start by gathering required documents, such as previous tax returns, any relevant income statements, and receipts for deductible expenses. Familiarizing yourself with these documents before you start will significantly streamline the process. It’s also advisable to set aside quiet time to focus on completing the form without interruptions.

Now, let’s go through detailed instructions for each section of the form:

Common mistakes to avoid

Many taxpayers make common errors when filling out the Rev Proc 73-29 form, which can have significant consequences. One of the most typical mistakes involves inaccurate reporting of personal information which can lead to processing delays and misunderstandings with tax authorities. Additionally, failing to report all income sources or neglecting potential deductions can prevent you from achieving the maximum allowable tax benefits.

To avoid these pitfalls, consider implementing a checklist approach to ensure every section is thoroughly reviewed and completed:

Interactive tools and resources

Utilizing pdfFiller can enhance your experience when dealing with the Rev Proc 73-29 form. The platform offers a range of tools that streamline document management—making it easier to fill out, edit, and sign forms electronically. You can easily upload your Rev Proc 73-29 and utilize features such as form fields, checkboxes, and text boxes to populate data efficiently.

For e-signatures, pdfFiller complies with legal e-signature standards, ensuring that your submission is legitimate and recognized by tax authorities. Here’s how to add your electronic signature in pdfFiller:

Managing your document post-submission

After you submit the Rev Proc 73-29 form, it’s essential to understand what happens next. The tax authorities will review your submission, a process that may take several weeks depending on their backlog and the complexity of your case. Keeping track of your submission status is critical, as it ensures you can promptly address any queries or additional requirements they may have.

Organizing and storing your submitted form is equally crucial. With pdfFiller, you can utilize secure storage options for your documents, allowing easy access to your records whenever required. Best practices for future reference include:

FAQs about the Rev Proc 73-29 form

Frequently asked questions surrounding the Rev Proc 73-29 form often pertain to common issues faced post-submission. One typical inquiry is, 'What if I make a mistake after submitting the form?' Generally, the IRS allows amendments, but specifics vary based on the nature of the error and timing of the amendment.

Another key question is, 'How does this form affect my overall tax situation?' Keeping accurate records and understanding your filing status can influence your tax outcomes significantly. Taxpayers should also consider whether their filing necessitates other forms or schedules, making it essential to review tax obligations comprehensively.

Real-life applications and case studies

Success stories abound regarding the effective use of the Rev Proc 73-29 form. For instance, an individual entrepreneur who utilized this form successfully reported additional income from a side business, ensuring compliance and avoiding penalties. The correct documentation helped to navigate IRS scrutiny seamlessly, ultimately resulting in a favorable resolution to their tax situation.

Another example involves a small business team that used the Rev Proc 73-29 form to appropriately claim deductions on operational expenses. By taking the time to complete the form accurately, they achieved significant tax savings that directly contributed to the financial health of their business. Analysis of such successful cases illustrates the importance of understanding and utilizing the Rev Proc 73-29 form effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit rev proc 73-29 straight from my smartphone?

How do I fill out rev proc 73-29 using my mobile device?

How do I fill out rev proc 73-29 on an Android device?

What is rev proc 73-29?

Who is required to file rev proc 73-29?

How to fill out rev proc 73-29?

What is the purpose of rev proc 73-29?

What information must be reported on rev proc 73-29?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.