Get the free Condensed Interim Balance Sheet (Un-audited) As at 30 ...

Get, Create, Make and Sign condensed interim balance sheet

Editing condensed interim balance sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out condensed interim balance sheet

How to fill out condensed interim balance sheet

Who needs condensed interim balance sheet?

Condensed Interim Balance Sheet Form: A Comprehensive Guide

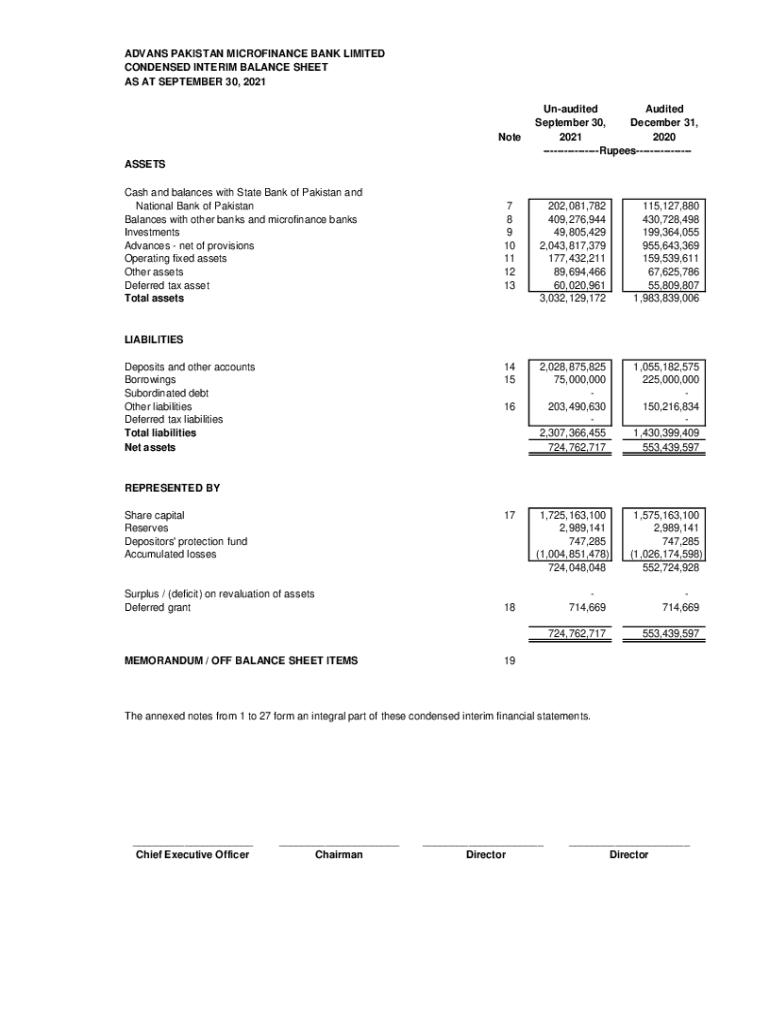

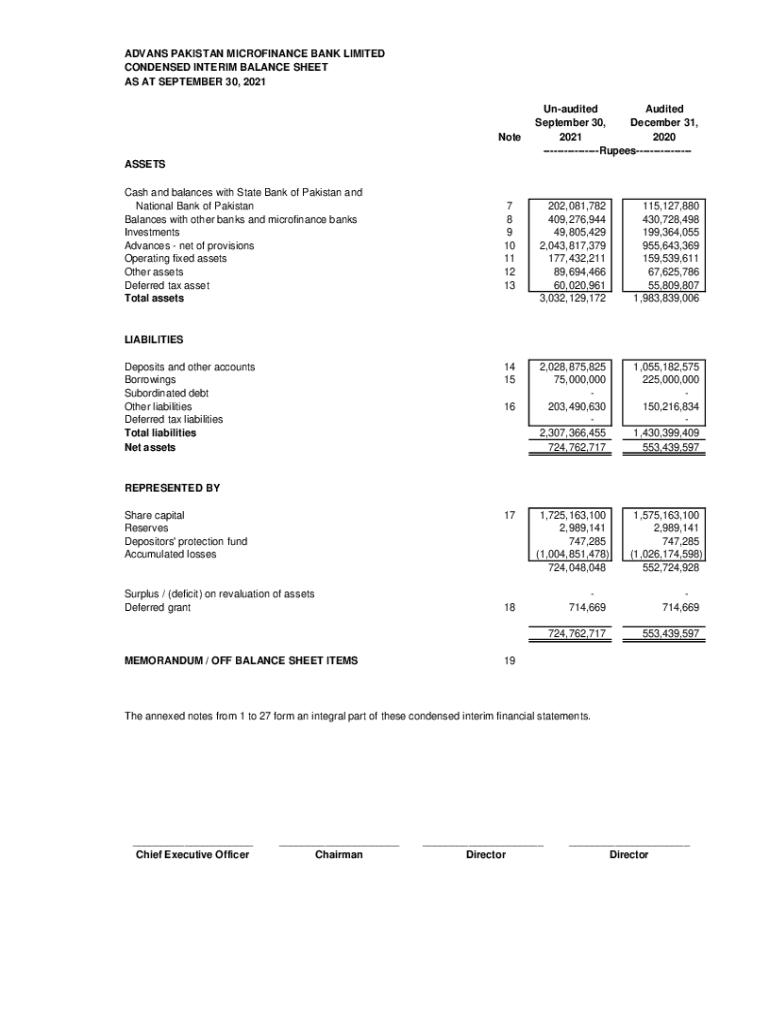

Understanding the condensed interim balance sheet

A condensed interim balance sheet is a streamlined snapshot of a company's financial position at a specific point in time, typically prepared for interim reporting periods less than a full financial year. Its primary purpose is to provide stakeholders with timely and relevant information without the extensive detail found in annual reports. This form is particularly beneficial for investors, creditors, and internal management who require a quick assessment of a company's financial health.

Accurate interim financial reporting is crucial because it ensures transparency and trust in the company's financial dealings. Unlike annual reports, which often include a wealth of information, condensed balance sheets focus on key data that reflect the company's current state. Understanding the differences between full and condensed financial statements is essential — while full statements offer comprehensive disclosures, condensed statements prioritize brevity and clarity.

Key components of the condensed interim balance sheet

A condensed interim balance sheet consists of three main components: assets, liabilities, and equity. Each of these categories plays a vital role in providing a clear picture of the company’s financial standing.

Delving into the components further, assets are categorized into current assets, such as cash and cash equivalents, accounts receivable, and inventory, and non-current assets, including property, plant, equipment, and intangible assets. Liabilities are divided into current liabilities, like accounts payable and short-term debt, and non-current liabilities, which might encompass long-term debt and deferred tax obligations. Lastly, equity consists of share capital, retained earnings, and any other equity components, giving insight into the company's net worth.

Filling out the condensed interim balance sheet form

Completing a condensed interim balance sheet form involves several important steps. Accurate and thorough data collection is essential to ensure reliability in reporting. First, gather all necessary financial data, including information from accounting systems and relevant financial documentation. This foundational step sets the stage for accurate reporting.

Next, input asset information, making sure to evaluate both current and non-current assets carefully. This requires a clear understanding of how each asset contributes to the overall financial picture. When recording liabilities, ensure accuracy in documenting both short-term and long-term obligations, as misreporting can lead to significant discrepancies in financial assessment.

Finally, calculate the equity position derived from the evaluated figures of assets and liabilities. A critical part of this process is understanding how to derive equity correctly — typically, equity is calculated by subtracting total liabilities from total assets. Following these steps minimizes the likelihood of errors, allowing for a well-constructed balance sheet.

It’s important to identify common pitfalls in data entry, such as failing to update numbers or mistakenly including outdated information. Best practices include double-checking figures and maintaining thorough documentation of assumptions and estimates used during the reporting process.

Reviewing and editing the condensed interim balance sheet

Before finalizing your condensed interim balance sheet, diligence in reviewing plays a crucial role in ensuring accuracy. This review process must incorporate several key checkpoints, allowing you to confirm that the balance sheet adheres to accounting standards and accurately presents the financial position.

One of the first checkpoints is to confirm the fundamental balance equation: Assets = Liabilities + Equity. This equation underpins proper financial statement preparation and is essential in validating the accuracy of reported figures. Furthermore, being compliant with relevant accounting standards—such as GAAP or IFRS—is critical in ensuring that your reporting maintains professionalism and integrity.

For those utilizing pdfFiller, the platform offers an array of editing tools that enhance the review process. Interactive features allow for quick corrections, ensuring your interim balance sheet is as refined and accurate as it should be.

eSigning and securing your condensed interim balance sheet

The eSigning process is an important step in legitimizing your condensed interim balance sheet. Utilizing eSignatures ensures that all parties are in agreement with the figures presented and that the document holds legal validity. This can save time compared to traditional signing methods and simplifies the approval chain.

It's crucial to understand the legal standing of eSignatures on financial statements. Most jurisdictions recognize electronic signatures as valid under electronic signature laws, helping streamline processes. Additionally, ensuring document security is paramount; utilize encrypted storage solutions to maintain confidentiality and protect sensitive financial data.

Collaborating on your condensed interim balance sheet

Effective collaboration is pivotal for teams working on a condensed interim balance sheet. Sharing the document with team members ensures that everyone involved is on the same page regarding financial reporting. With pdfFiller, collaborative elements such as document sharing and real-time updates facilitate teamwork, enhancing productivity and effectiveness.

While working collaboratively, tracking changes becomes essential to understand the evolution of the document. pdfFiller’s capabilities allow users to view revision histories and update financial data seamlessly. Such tools promote accountability and clarity among team members, ensuring that the financial narrative remains accurate and reflective of current realities.

Managing your condensed interim balance sheet

Once your condensed interim balance sheet has been completed and submitted, effective management is crucial for maintaining efficient workflows. Organizing files for easy access not only enhances productivity but also ensures that relevant documents are readily available for future reference. Utilize a systematic naming convention and structure to categorize files by date, type, and importance.

Additionally, archiving previous interim reports helps maintain a clear record while freeing up digital space. Cloud-based management features provided by pdfFiller allow users to store and retrieve documents efficiently, ensuring that financial records can be easily accessed when required and simplifying compliance with audits and reviews.

Frequently asked questions about the condensed interim balance sheet

As with any complex financial form, individuals often encounter questions during the preparation and submission of a condensed interim balance sheet. Common inquiries include clarifications on regulatory compliance, particularly regarding the accounting standards that govern interim financial statements. It’s also important to address the timelines and frequency at which these statements must be prepared to maintain investor trust and regulatory adherence.

Understanding each of these aspects is vital, as any lapse in regulatory compliance can lead to significant ramifications for a company. Consequently, companies and accountants must remain abreast of updates to financial reporting requirements, ensuring that all interim reports are constructed with the utmost accuracy.

Practical examples of condensed interim balance sheets

Seeing examples of condensed interim balance sheets can significantly enhance comprehension and application. Different industries may have unique formats that suit their specific reporting needs and regulatory environments. Individuals preparing these documents can often compare successful vs. poorly constructed interim balance sheets to identify best practices.

For instance, a tech start-up might focus heavily on intangible assets due to its reliance on patents and software development, while a manufacturing company’s balance sheet may show significant property and equipment holdings. Understanding these nuances aids in tailoring your approach to effectively representing your financial position within your industry.

Connecting with financial advisors

While preparing a condensed interim balance sheet can certainly be undertaken independently, there are circumstances where professional assistance may prove invaluable. A financial advisor can offer insights that not only optimize balance sheet preparation but also enhance overall financial strategy. This partnership may yield benefits such as identifying untapped assets, streamlining reporting processes, or ensuring compliance with the latest regulations.

Whether you are a small business owner or part of a larger financial team, knowing when to seek professional help can make a significant difference. Financial advisors can provide tailored solutions that address specific challenges and support long-term financial objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in condensed interim balance sheet without leaving Chrome?

Can I create an electronic signature for the condensed interim balance sheet in Chrome?

Can I create an electronic signature for signing my condensed interim balance sheet in Gmail?

What is condensed interim balance sheet?

Who is required to file condensed interim balance sheet?

How to fill out condensed interim balance sheet?

What is the purpose of condensed interim balance sheet?

What information must be reported on condensed interim balance sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.