Council Tax Reductions and Form: A Comprehensive Guide

Understanding council tax reductions

Council Tax Reduction is a financial assistance scheme available to help individuals and families who may struggle to pay their council tax bills. This is particularly pertinent for those on low incomes or facing specific personal circumstances. By reducing the amount of council tax that individuals are required to pay, the scheme aims to alleviate financial pressure and ensure that essential services can continue to be funded sustainably.

To qualify for council tax reductions, applicants must meet certain eligibility criteria. Factors such as household income, the number of people living within the home, and individual situations like disability or education status can influence eligibility. Understanding these criteria is crucial for anyone seeking to reduce their council tax liability.

Basic income level: Applicants must demonstrate a low-income status or reliance on benefits.

Personal circumstances: Certain groups, including people with disabilities, students, and carers, may qualify for additional support.

Exemptions: Specific situations, such as owning an empty property or living in a care home, can provide eligibility for reductions.

The importance of council tax reductions cannot be underestimated as they provide essential support to those in need, allowing them to allocate their limited resources towards other vital areas such as food and housing.

Types of council tax discounts and reductions

There are several types of discounts and reductions available under the council tax reduction scheme. Understanding these options ensures that individuals can maximize their potential savings on council tax bills.

Available to households with only one adult occupant, this discount provides a 25% reduction on the council tax bill.

This scheme offers additional discounts for properties that require substantial adaptations due to a disabled resident.

Full-time students are completely exempt from paying council tax, which helps them manage their finances while studying.

Individuals who provide care for someone under age 18 or someone with a disability may be eligible for a discount.

Properties that are unoccupied and unfurnished may receive a reduction for a specified time.

Those who are severely mentally impaired may qualify for a complete council tax reduction.

Various discounts are available for specific groups such as care leavers, apprentices, and those who are in prison.

Refugees from Ukraine and their families are entitled to council tax reductions, reflecting the ongoing support for those affected by the conflict.

Each of these reductions has specific eligibility criteria and application processes, making it essential for applicants to research their options thoroughly.

Applying for council tax reduction

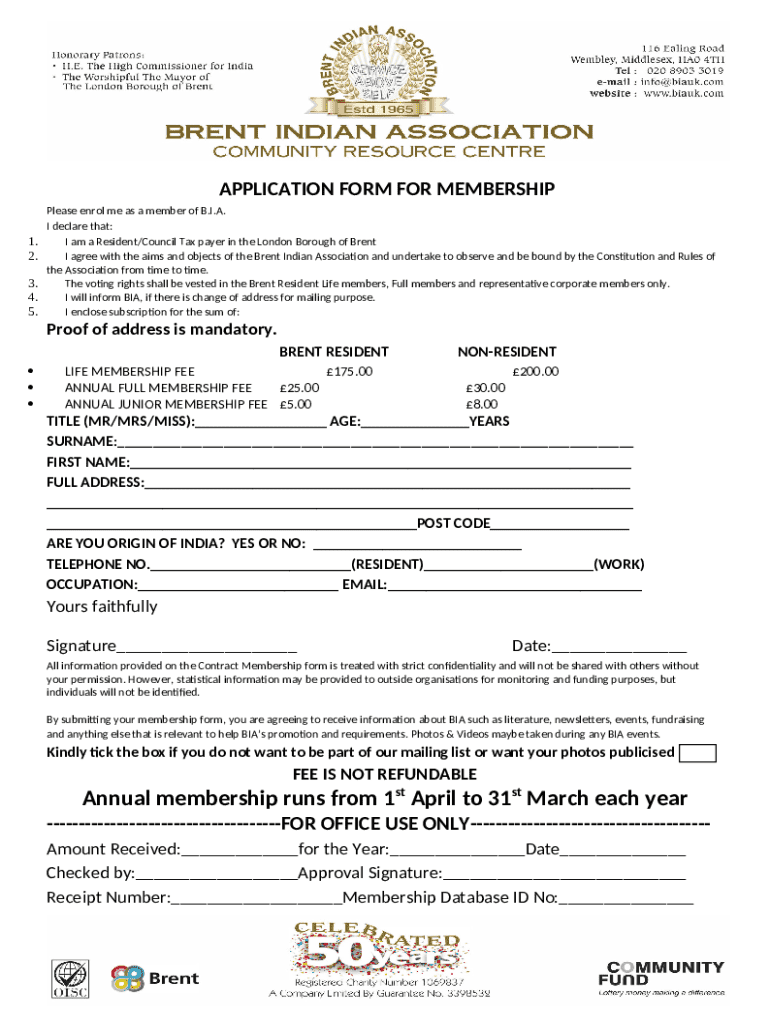

Applying for council tax reduction can be a straightforward process if approached methodically. To ensure the application is successful, start by gathering all necessary documents. This includes identification (like a passport or driver's license), income details (such as pay stubs or benefit statements), and any supporting documents that highlight your eligibility.

Next, you'll need to fill out the council tax reduction form accurately. The form often requires information about your personal circumstances, household income, and any dependents. Accessing the form online through pdfFiller streamlines this process significantly.

Gather necessary documents: Ensure you have all identification and income details on hand.

Visit pdfFiller to access the Council Tax Reduction form and utilize its interactive tools for easy form completion.

Fill out the form accurately, providing required details and ensuring all information reflects your current situation.

Submit your application through the online platform or follow the submission process as outlined by your local council.

Utilizing pdfFiller's platform not only facilitates the filling out of forms but also provides editing options, e-signing capabilities, and cloud-based document management. This allows users to manage their applications from anywhere with an internet connection.

Managing your council tax reduction

Once your application for council tax reduction is submitted, ongoing management is essential. This includes keeping track of all documents related to your application. Using pdfFiller’s platform can assist you with editing and storing your application materials securely. It’s advisable to establish a document management system where you can keep track of submitted forms and any communication with your local council.

To check the status of your application, contact your local council directly, or access their online portal if available. If you have not received a response in a reasonable timeframe, reaching out proactively can help clarify any issues and expedite the process.

Document management: Use pdfFiller to maintain organized records of all applications and communications.

Track the status: Regularly check in with your local council to ascertain the progress of your application.

Follow up promptly: If there are delays, take the initiative to reach out and ensure your application is being processed.

Troubleshooting council tax reduction issues

Issues arising during the application or management of council tax reductions can be frustrating. Common problems include denied applications and changes in circumstances that need to be reported. In cases where an application is denied, understanding how to appeal can be crucial. The appeals process requires a clear documentation trail and an effective communication strategy with the council.

Changes in your financial situation or household composition must be reported as these may affect your eligibility. Regularly reviewing your council tax circumstances can prevent misunderstandings and ensure compliance with local regulations.

Denied applications: If denied, familiarize yourself with the appeals process, ensuring all documentation is complete.

Report changes promptly: Notify your council of any changes in your circumstances that could affect your eligibility.

Navigate misunderstandings: Keep a clear record of all communications with your council and use pdfFiller to manage documentation.

Important considerations

If you find yourself needing assistance during the application process for council tax reductions, it is essential to know that numerous local resources and organizations are available to help. Many areas have charitable organizations offering support, as well as government services designed to assist those navigating financial difficulties.

For those who do not have access to the internet or a computer, local libraries often provide free internet access, and community centers may offer assistance in filling out forms. Balancing your council tax reduction with other financial responsibilities is crucial; consider budget planning tools or consultation with a financial advisor for tailored assistance.

Explore local resources: Research support services available in your area for assistance preventing financial strain.

Library access: Utilize local libraries for free internet and potential assistance with forms.

Seek financial advice: Consider budgeting tools or consultations to effectively manage your expenses.

Additional resources and support

Numerous government resources and helplines are available for those considering or currently applying for council tax reductions. Familiarizing yourself with the local council's website can provide essential information on available discounts and reductions, while helplines offer personalized assistance to clarify any doubts.

Benefits calculators can also be useful tools for assessing your eligibility more accurately. They can help identify not only council tax reductions but various other financial assists you may qualify for. Reading further on related topics through reputable sources can expand your understanding and empower you to make informed decisions.

Government resources: Utilize online tools and helplines for direct assistance regarding council tax reductions.

Local council support: Engage with local council services to better understand discounts applicable to your situation.

Benefits calculators: Use online calculators to check for additional financial aids you may be missing.

Frequently asked questions

Council tax reductions often come with many questions regarding eligibility, application processes, and maximizing benefits. Common misconceptions may cloud the understanding of who can apply or what documentation is required. Clear communication and accurate information can dispel these myths.

Frequently asked questions include inquiries about specific eligibility scenarios, necessary documentation, and how to navigate the application process effectively. It is essential to remain informed and proactive, ensuring you understand each aspect of your council tax reduction application.

Eligibility inquiries: Get clarity on who can apply and the necessary criteria.

Documentation: Understand what documents are required for successful applications.

Application strategies: Learn effective methods for maximizing eligibility and ensuring completeness.

For further help, individuals should contact their local council directly or access resources available through pdfFiller, which offers tools for managing and submitting the necessary forms online.

Appendices

In addition to the information provided in this guide, it may be useful to reference a glossary of terms related to council tax and reductions. This can help individuals better navigate the complexities of council tax language.

Sample filled-out forms accessible through pdfFiller's platform are also available. These can serve as useful references for applicants to ensure their documentation meets the required standards.